Is Gold bullish again? [Video]

![Is Gold bullish again? [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/hand-full-of-gold-nuggets-53773200_XtraLarge.jpg)

Gold was a safety hedge in an uncertain world. There is no surprise we saw a massive sell-off with Covid vaccines being announced. Both vaccines are still waiting on final FDA approval. The real game-changer however could be Johnson & Johnson's vaccine which only requires one shot and no special refrigeration outside that already widely required for current vaccines. Johnson & Johnson are expected to have interim data on its vaccine sometime in January which could mean emergency use authorization as soon as February.

So overall the vaccine news is still very promising. However, the damage to the economy is already done and it will take years to recover after COVID. Despite massive stimulus key economic data is very weak.

Middle-term setup

Gold was unable to rally even with a weak dollar. It seems last week metal finally rebuilt its correlation with the greenback. MA200 turned out to be a buyers zone. But is it a jerk reaction or gold is trying to start a new wave to the upside?

Formation of higher low or kind of base formation is needed to have confidence in buying gold. However, we already can identify a bullish setup:

- Cycles point we are close to the bottom and new rally.

- The seasonal indicator is turning to the upside.

- Valuation model shows gold is undervalued.

Technical analysis

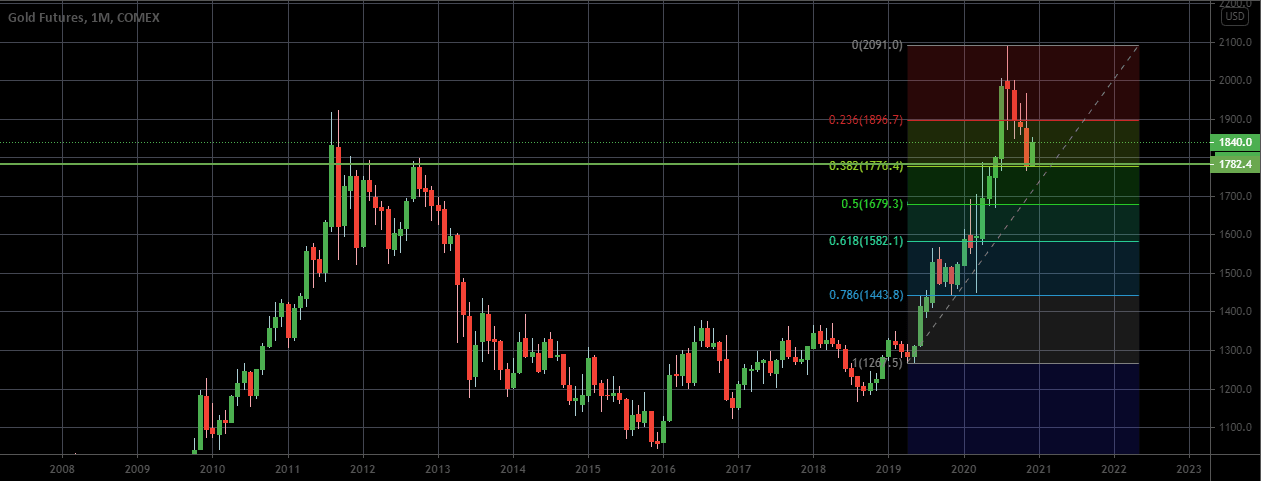

With that in mind let's have a look at the technical picture. Gold used to follow flagging formations. We had three similar patterns on the weekly chart during the last two years and it played very well. There are early signs gold is getting ready for the next wave up with another flagging formation.

The metal reached the Fibo retrace zone that is also near MA200 along with the 2012 bounce highs as support. Technically till gold holds above this zone, there are chances to test 2400 and 3000 in extension given enough time. This is not something that will happen in a few weeks – this trend will likely take place over months, and even years. Breaking below mentioned range is a trend change.

Will Gold rally if the Dollar goes up?

Let's not forget the huge government debt and potential asset bubble. Gold and Dollar are both means of safe haven. Definitely, under certain circumstances (like mentioned above) they can move in one direction.

Author

Inna Rosputnia

Managed Accounts IR

Inna Rosputnia is a stock and futures trader, portfolio manager and financial analyst that has been in the trading industry for the last 12 years.