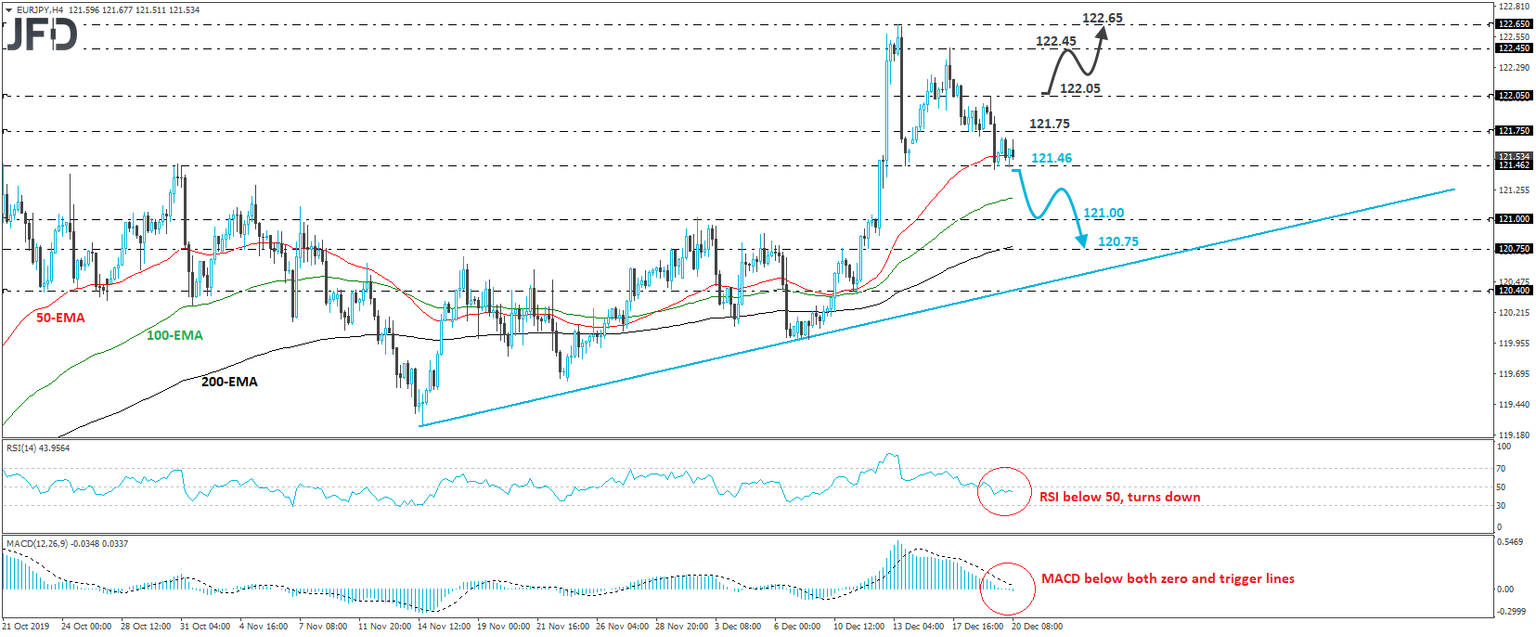

Is EUR/JPY Set to Correct Lower?

EUR/JPY traded in a consolidative manner today, staying between the 121.46 support and the resistance of 121.75. Although the pair continues to trade above the tentative upside support line drawn from the low of November 14th, the December 12th rally has distanced the rate from that line and thus, on the 13th, the pair has entered a downside corrective mode. Given that there is still decent space between the rate and the aforementioned upside line, we would expect the current correction to continue for a while more.

If the bears are strong enough to overcome the 121.46 barrier, we may see them driving the battle towards the 121.00 zone, which is near the inside swing high of December 2nd. If they are not willing to stop there, then a break lower may extend the retreat towards the 120.75 obstacle, marked by the inside swing high of December 10th, or even the pre-mentioned upside support line.

Taking a look at our short-term oscillators, we see that the RSI stands slightly below its 50 line and has just turned down, while the MACD, already below its trigger line, has just obtained a negative sign. Both indicators detect negative momentum and support the notion for this exchange rate to continue drifting south for a while more.

On the upside, we would like to see a strong rebound back above 122.05 before we start considering that the current corrective phase is over. Such a move may encourage the bulls to aim for the high of December 17th, at around 122.45, the break of which could allow extensions towards the 122.65 territory, marked by the high of December 13th.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD