Iron Ore Elliott Wave technical analysis [Video]

![Iron Ore Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/metal-shavings-gm137352689-11106793_XtraLarge.jpg)

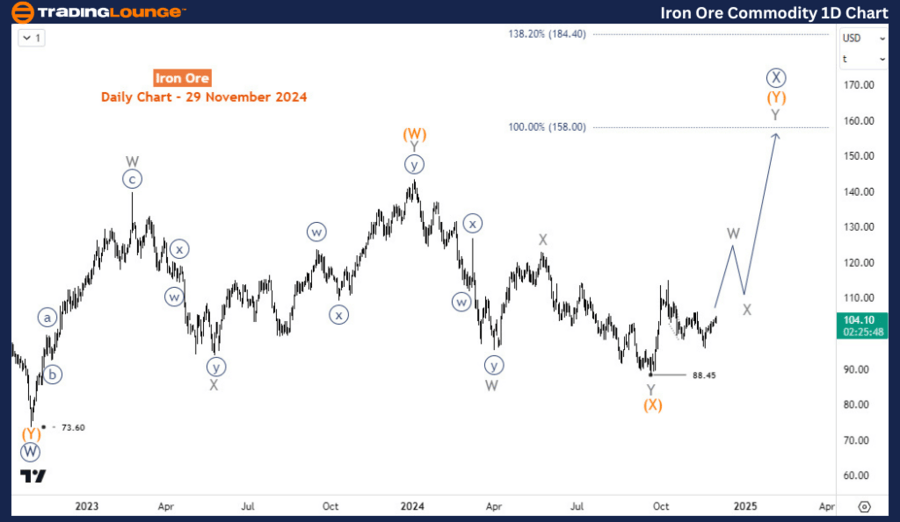

Iron Ore Elliott Wave analysis

The SGX TSI Iron Ore Index serves as a critical benchmark for stakeholders in the iron ore market, including traders, miners, and steelmakers who rely on it for contract settlements and managing price risk. The index, derived from real-time transactions in the spot market, is widely viewed as a trustworthy reflection of market dynamics.

The index saw an unprecedented high of approximately $233 per dry metric ton in May 2021, driven by China's strong demand and supply disruptions. However, this peak marked the beginning of a significant correction, with the index tumbling over 68% to $73 by October 2022. A rebound followed, lifting the index to $143.5 by December 2023. Yet, in 2024, the recovery stalled, with the index dropping nearly 50% before showing signs of resurgence in September but about half of that was shed in October gain.

Daily chart analysis

Technically, a double zigzag structure is emerging from the low of October 2022. Wave (W) and (X) finished in January 2024 and September 2024 respectively. Thus, wave (Y) started at 88.45 and could extend up to 158 in the coming weeks or months.

Four-hour chart analysis

On the H4 chart, the price had a 5-wave rally to complete wave ((a)) of W of (Y) and then a pullback followed to 95.85 to complete wave ((b)). Wave ((c)) of W has started and could extend to 122.6. While pullbacks end above 95.85, the upside should extend in the coming days.

Iron Ore Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.

.thumb.png.71f644cb76ef1e8c11b992e6418fc0d3.png&w=1536&q=95)