IPO’s: Hot or not?

“Initial Public Offerings” – or IPO for short, have been the most popular way for businesses to raise capital for their business. However, as of late, they have been used as an exit strategy for early venture capital investors. The question becomes – should you spend your hard-earned money on stocks that have recently IPO’d?

The purpose of an IPO have changed – however; you’ll have to read between the lines to see it

Bill Gates, the founder of Microsoft, is one of the wealthiest people in the world. However, his IPO did not immediately send him into the stratospheric amounts of wealth he has today.

Microsoft took one round of venture capital funding and stated that they did not need the money – they wanted the investors. Come IPO, Bill Gates, Paul Allen, Steve Balmer, and the Venture Capitalist, David F Marquardt, sold 17% of their shares on the open market. They raised over USD 61 Million (Around $140 Million in 2020) for the company, and the company was worth around $780 Million. Since its IPO, Microsoft has never had an unprofitable quarter.

Contrast this with Lyft, whose initial public offering netted the company $2.34 Billion (yes, with a B), giving the ride-sharing company a valuation of $25 Billion. This was after being funded by over 72 VC Firms. The founder, John Zimmer, was an instant billionaire at the time. However, the S-1, a pre-IPO document that was filed, warned this as one of the key risks:

Around 18 months after their IPO and Lyft has yet to make a profit. From its IPO date to the start of 2020, shares were down approximately 44% from its IPO price.

Clearly, there are differences between the two IPO’s. Microsoft was profitable and did not need the money to continue. Lyft was and still is not beneficial and needed the money to continue.

Given the fundamental reason for an IPO is to raise capital for the business, it wouldn’t be wrong to assume Microsoft’s IPO shouldn’t have happened, and Lyft’s IPO was warranted. However, Bill Gates did not want to IPO. He hated the idea of the IPO, stating that “the whole process looked like a pain” and that it’s an “ongoing pain once you’re public.”.

Bill Gates, co founder, chairman and CEO of Microsoft in 1995: “hate the whole thing. All I’m thinking and dreaming about is selling software, not stock”

John Zimmer had no such quarrels. This begs the question, what is the real reason investors want to IPO?

Don’t get me wrong. I’m not saying that realizing wealth through an IPO isn’t a valid reason for doing one. However, it may be a sign for investors on the secondary market like you and me that the company’s leadership and initial values may not have the same outlook for the company as me and you. They get rich on IPO. You buying their shares makes them rich.

IPO Price? You can forget it.

DoorDash’ IPO Price of $102 does not even register as a price ever available on the secondary market

Today, Doordash, a business that delivers food similar to Uber Eats, IPO’d for $102. However, the price available to investors on the secondary market were upwards in the range of $180. We see these initial spikes just after the IPO on most IPO’s these days. This begs the question, will the strategy “Buy at the IPO price then sell straight after” work?

Yes – however, you can forget trying to get the stock at the IPO price. Long story short, shares allocated at IPO are earmarked for early investors, and the investment banks underwriting the public offering. Chances are, you will get the IPO at the price once it has already spiked.

Not all unprofitable companies get the green light for the IPO

wework IPO did not work

One of the most spectacular IPO failures in the past couple of years was the office-sharing company WeWork. I recommend reading this article on Bloomberg Businessweek on why it failed. However, a quick summary is as follows

- For Ever $1 Revenue incurred around $2 in expenses, and their S-1 stated no discernable plan to reverse that equation

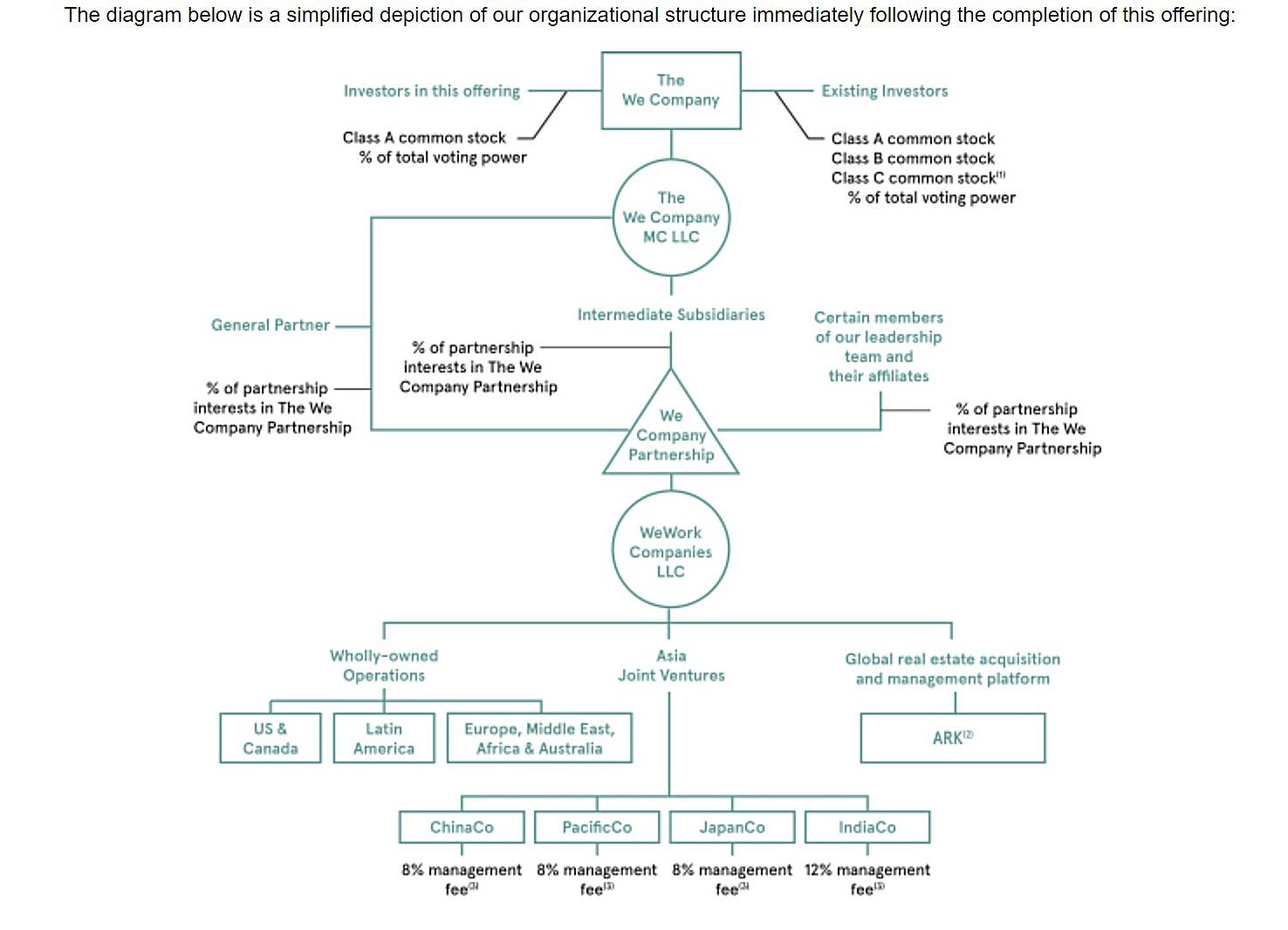

- Their Corporate structure looked like “a schematic for a microwave.”

- Conflict of interests, such as Adam Neumann charging his own company $5.9 Million for the rights to a trademark he held on the name “We”

Microwave Schematic, or “The We Company’s” corporate structure?

And many more. This may have been a spectacular failure with regards to WeWork eyeing out a $47 Billion valuation. However, this was a massive success regarding the market identifying what companies should and should not be in public investors’ hands.

Not all IPO’s are with unprofitable companies

A recent highlight in the IPO world was a company we all came to love during the lockdown. Zoom Video Communications generated a Net Profit before its IPO, indicating the company was in good standing before releasing their shares to the world.

IPO’s can be lucrative for investors who are in before the hype. Chances are, once you think about investing in an IPO, it’s too late. However, you may find the gem in the rough, such as Zoom or Beyond Meat, which continue to prosper post IPO. So IPO’s. Hot or not? Let’s say they’re lukewarm.

Author

Kyle Quindo

Blackbull Markets Limited

Kyle is a Research Analyst with BlackBull Markets in New Zealand. He writes articles on topical events and financial news, with a particular interest in commodities and long term investing.