Investors are being punished for diversifying, it won’t last

While the NASDAQ 100 and S&P 500 are at all-time highs, many disciplined and diversified portfolios and funds are not. For instance, the Vanguard Target Dated 2030 Fund, designed for those looking to retire on or around 2030, offers an automated portfolio that adjusts allocation over time based on conventional diversification practices. This fund is still more than 10% below its 2021 high. If you are wondering, this particular fund contains both domestic and global stocks and bonds of varying quality and is allocated roughly at a 60%/40% balance. In essence, it is a perfectly balanced portfolio based on pre-Fed intervention finance.

The underperformance of traditionally prudent portfolios is largely due to the worst three-year stretch ever in the bond market. Still, it also has to do with the fact that most index gains have been on the backs of a few individual stocks (namely the Magnificent Seven), not the broad market. In short, investors practicing tried and true investing are being left behind, while those assuming outsized risks are rewarded handsomely. This is a dangerous game of musical chairs; nobody knows when and where the music will stop, but it will stop abruptly, and not everyone gets a chair.

History is repeating itself. I was in my early 20s during the dot.com bubble pop, but I’ll never forget its ramifications on those around me. I watched one relative grow a modest nest egg of $200,000 to $300,000 into tens of millions by throwing caution to the wind and allocating the funds into three individual stocks (Worldcom, Level 3 Communications, and I forget the other). The success of the undiversified portfolio was stellar; near the peak, I believe it was close to $13,000,000. Even wilder, the portfolio peak occurred despite large withdrawals for lavish spending on high roller style trips to Las Vegas, a custom-built home featured in Home and Garden Magazine, and an impressive collection of vehicles. Ignoring fundamental diversification strategies allowed this portfolio to flourish, but in the end, the lack of diversification wiped it out in a devastating fashion. It is possible to get rich by taking excessive risks (even for those who don’t realize their investment strategies are aggressive) but staying rich with such an approach to the market is a different story.

Fear of missing out is real. Nobody wants to be the one watching others “get rich” from the sidelines, but investing and building wealth is a marathon, not a sprint. There is a time to press the gas and another to tap the brakes. Ironically, the appropriate time to do either is when it is least comfortable and popular. Many of the voices that were wildly bearish a few years ago as the S&P 500 was testing the mid-3,000s are now adjusting targets higher. They were wrong then, and they might be wrong again. Stay on your toes and mind your risk.

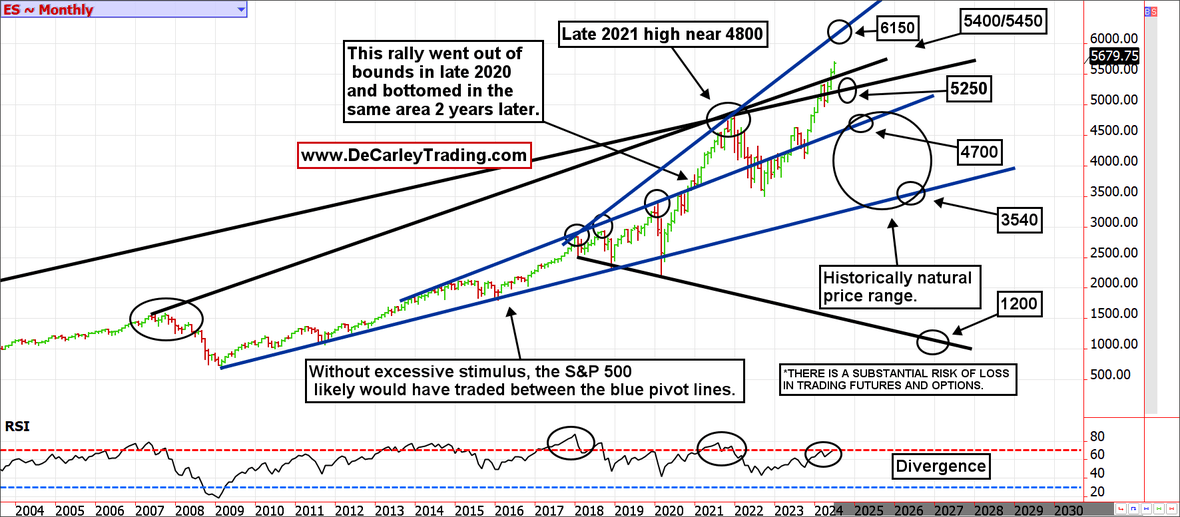

For those keeping score, while others were pounding the recession table and looking for lower equities last year, we had been suggesting 5,150 was a real possibility. That opinion was met with quite a bit of pushback and even some name-calling, but as it turns out, our projection was far too conservative. While I wouldn’t have believed it a few months ago, the chart has opened up to the possibility of the S&P reaching 6,150! The problem is that sticking to the course to capture another 400 points in the S&P requires acceptance of at least double, but likely triple, the risk. I’m not an investment advisor; I’m just a futures and options broker. However, in my personal finances, I’ve been systematically de-risking as the market inches higher and have encouraged my brokerage clients to hedge their downside risk with risk reversals or similar strategies. Risk reversals involve selling a call option and using the proceeds to purchase a put option. In short, it is free insurance.

The opportunity cost of using the market’s money to buy your portfolio insurance is giving up portfolio gains above the strike price of the short call option.

Protection should be bought when you can, not when you must. Volatility is historically low, and the indices are at all-time highs. There has never been a better time to hedge; it is possible to purchase proximal insurance for far less than is normally the case. Today, an investor can hedge their equity risk by selling a December e-Mini S&P 500 6100 call for about 50 points and using the proceeds to purchase a 5100 put. This allows the portfolio to grow to the next trendline but takes the tail risk away under 5100. Contact us at www.DeCarleyTrading.com if you would like to employ this type of hedging strategy.

Author

Carley Garner

DeCarley Trading

Carley Garner is an experienced commodity broker with DeCarley Trading, a division of Zaner, in Las Vegas, Nevada. She is also the author of multiple books including, “Higher Probability Commodity Trading” and “A Trader's First Book on Commodities”.