EURGBP

The dollar traded higher against almost all of its G10 counterparts during the European morning Wednesday. It was lower against NOK and AUD, in that order, while it was stable vs GBP.

The UK’s unemployment rate remained unchanged at 6.0% in October, its lowest level since September 2008. More importantly, average weekly earnings including bonuses rose 1.4% yoy, up from +1.0% yoy in September and higher than expected. The figure was the most important development as it was higher than inflation and therefore real wages are growing. At the same time, the Bank of England released the minutes of its early December policy meeting. The vote remained 7-2 in favor of no change in interest rates. The majority saw heightened risk that growth may soften more than expected or that inflation may stay below target for longer than expected. The latter risk has been intensified by the collapse in oil prices.

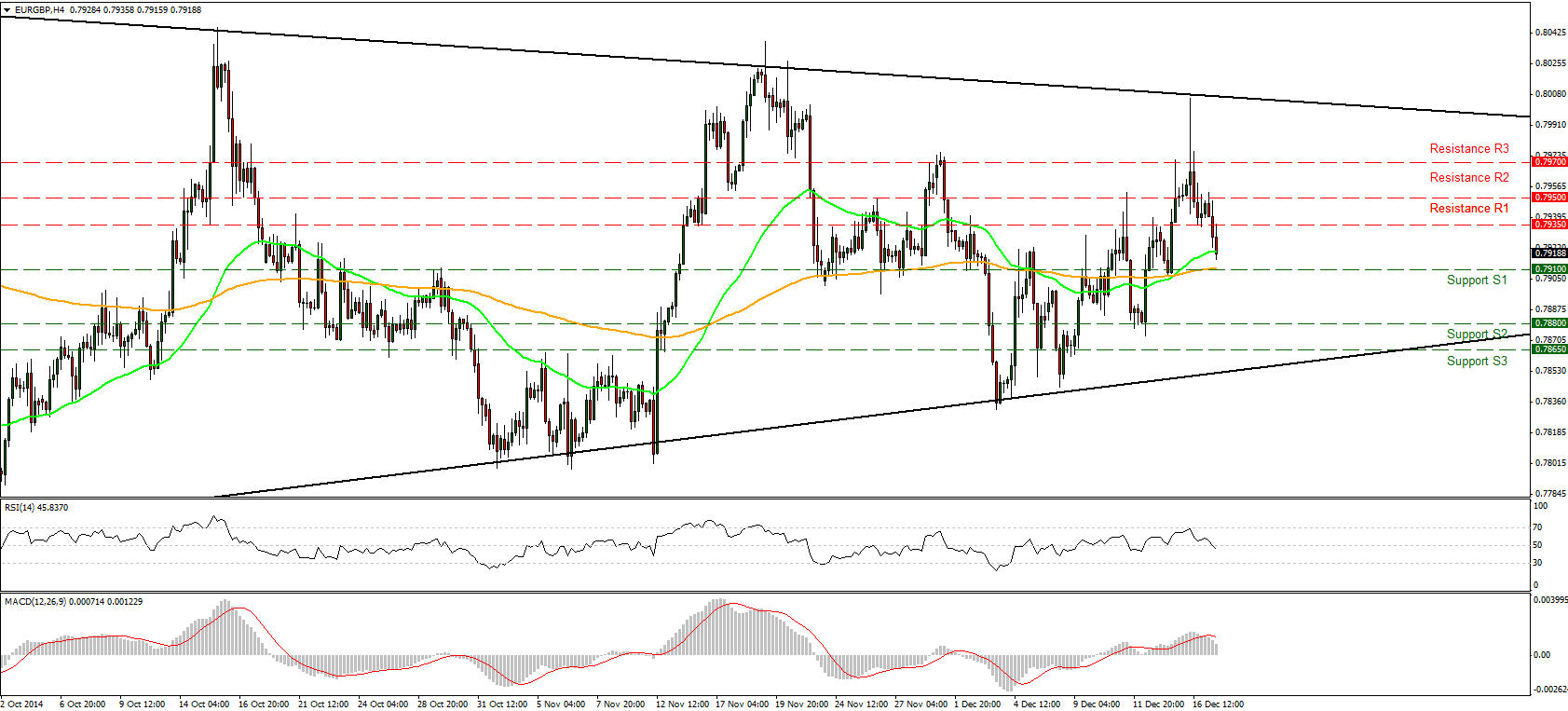

EUR/GBP moved lower following the strong labor data but the move was halted few pips above the 200-period moving average. I would expect the rate to test the 0.7910 (S1) support line, where a break of that hurdle could trigger further extensions towards our next support of 0.7880 (S2) line. Our short-term momentum studies support this notion. The RSI crossed the 50 line and is pointing down, while the MACD, crossed below its trigger line and is also pointing down. Although these signs designate accelerating bearish momentum, I would wait for a break below the 0.7910 (S1) support level to get more confident for the decline. On the daily chart, although the overall path of the pair is to the downside, it seems to be forming a symmetrical triangle formation reflecting investors’ indecisiveness in recent months. Usually, symmetrical triangles are thought of as a continuation pattern and a break in either direction is likely to determine the subsequent bias.

Support: 0.7910 (S1), 0.7880 (S2), 0.7865 (S3).

Resistance: 0.7935 (R1), 0.7950 (R2), 0.7970 (R3) .

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.