USD/NOK

The dollar traded unchanged against most of its G10 counterparts during the European morning Wednesday, except AUD and NOK, where it was higher.

The 2nd estimate of UK Q3 GDP came in as expected at 0.7% qoq, unchanged from the initial estimate. Growth in the service sector was revised up but industrial production was revised down, adding to evidence that the recovery was less balanced than previously thought. GBP strengthened ahead of the GDP release but weakened afterwards to trade unchanged against the dollar. The growth report was not so encouraging and is likely to leave GBP vulnerable, especially if the US data to be released later in the day beat expectations.

The Norwegian krone depreciated after the country’s AKU unemployment rate for September failed to decline as the official unemployment figure did for the same month. Another reason for the increased pressure on NOK is the cautious mood of investors before the OPEC meeting on Thursday. Since Norway is the largest oil producer and exporter in Western Europe, the country’s currency could weaken further if the meeting ends without a consensus to stabilize oil market.

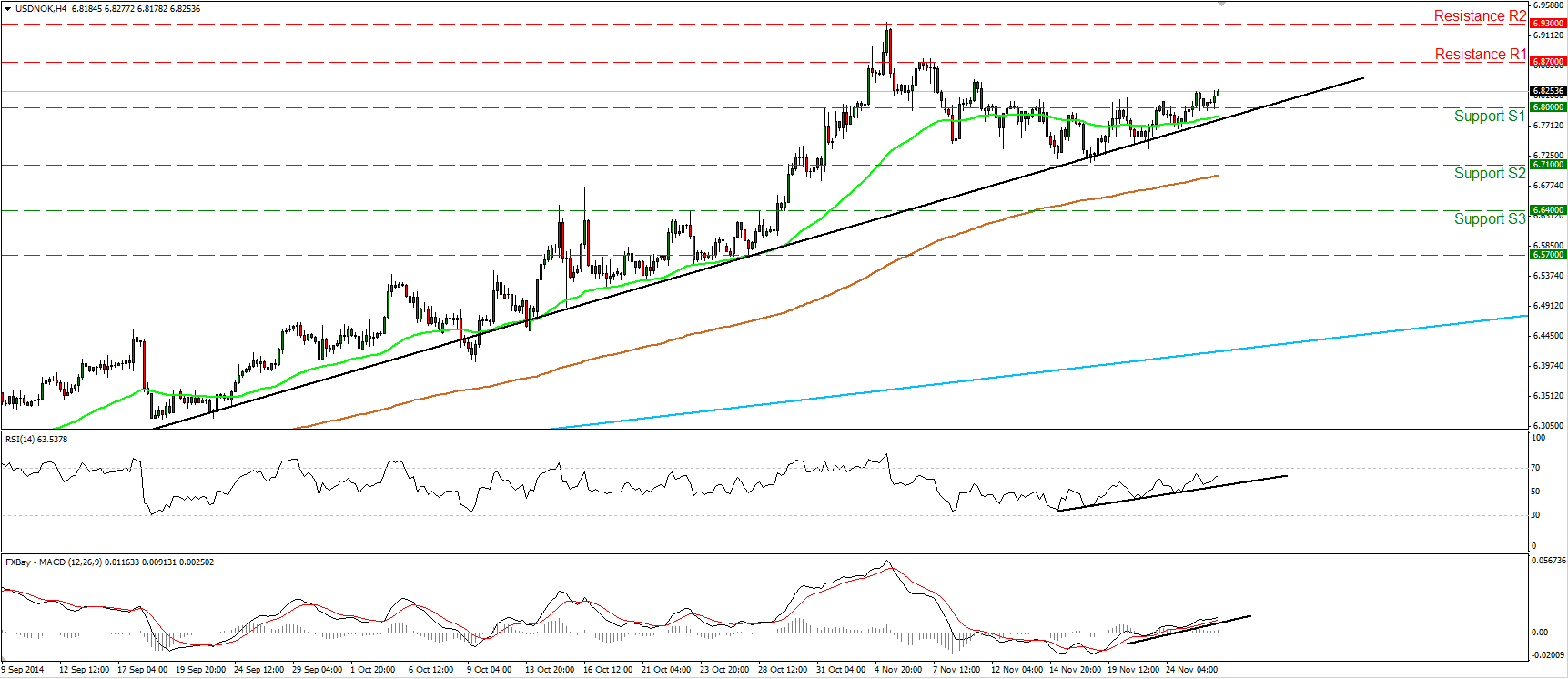

USD/NOK moved higher during the European morning after finding support near 6.8000 (S1). I would now expect the rebound to target the resistance zone of 6.8700 (R1). A clear break above that hurdle is likely to extend the bullish wave, perhaps towards the next resistance zone, at 6.9300 (R2), determined by the high of the 5th of November. Our short-term oscillators support this scenario. Both of them follow upside paths as marked by their upside support lines. Moreover, the RSI rebounded from slightly above its 50 line and edged higher, while the MACD stands above both its zero and signal lines. As long as the rate is trading above the black uptrend line drawn from the low of the 3rd of September, I consider the near-term picture to remain positive. On the daily chart, USD/NOK stands above the 50- and the 200-day moving averages and well above a longer-term uptrend line taken from back at the low of the 8th of March. This confirms that the overall outlook of the pair is to the upside.

Support: 6.8000 (S1), 6.7100 (S2), 6.6400 (S3) .

Resistance: 6.8700 (R1), 6.9300 (R2), 7.0000 (R3).

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.