EUR/CHF

The dollar traded unchanged or higher against most of its G10 peers during the European morning Thursday. It was higher against AUD, GBP, NOK and NZD, in that order, and was virtually unchanged against CAD, JPY, EUR, SEK and CHF.

Cable was among the losers during the European morning, after the UK house prices for July rose at their slowest pace since April 2013. House prices as measured by the Nationwide index rose +0.1% mom in July, down from +1.0% mom in June, recording their 15th consecutive increase but missing estimates of a +0.5% mom rise. Recent tighter mortgage-lending policy rules introduced by the Bank of England in an attempt to prevent home buyers taking on too much debt are most likely behind this month’s slowdown. The Bank’s Governor, Mark Carney, had point out the booming housing market as the biggest threat to UK’s recovery.

The Hungarian forint was one of the losers among the EM currencies. The dollar has been rallying against most EM currencies recently and investors have been particularly punishing the currencies of the former Soviet bloc nations along with the RUB recently despite the fact that they are now EU member states. The recent rebound in Hungary’s CPI rate and the moderate decline in the country’s unemployment rate were ignored by the market, sending USD/HUF to levels last seen in April 2013.

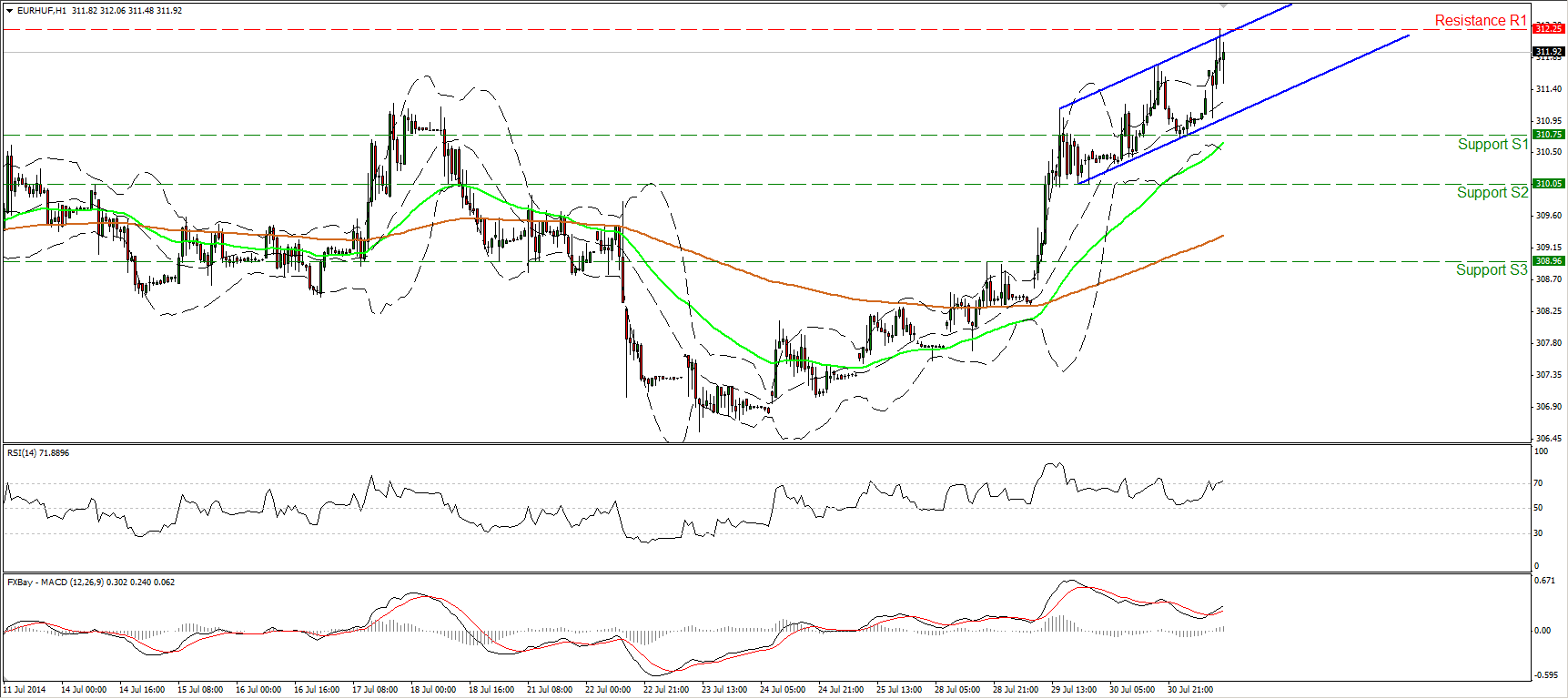

EUR/HUF edged higher during the European morning Thursday, after finding support at 310.75 (S1). However, the advance was halted by the upper boundary of the blue upside channel and the resistance barrier of 312.25 (R1). The rate is printing higher highs and higher lows within the channel and above both the moving averages and this keeps the short-term picture to the upside. The MACD, already within its positive field, moved above its signal line, confirming the recent bullish momentum of the rate. I would ignore the overbought reading of the RSI for now, since the indicator is pointing up and could stay within its extreme territory for a noticeable period of time. A decisive violation of the 312.25 (R1) obstacle could trigger further bullish extensions and could pave the way towards the next resistance at 313.00 (R2).

Support: 310.75 (S1), 310.05 (S2), 309.00 (S3) .

Resistance: 312.25 (R1), 313.00 (R2), 314.00 (R3).

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.