Initial Jobless Claims Preview: Improvement is relative

- Unemployment Claims forecast at pandemic low of 700,000.

- Nonfarm Payrolls added 545,000 positions in January and February.

- End of most business restrictions should help put the brake on layoffs.

- Markets watching for all signs of US economic acceleration.

- Dollar and yields will benefit from improving labor statistics.

The long struggle of US employers to overcome the devastation of the lockdowns may finally be breaking new ground as unemployment requests are expected to fall to their lowest level of the pandemic.

Initial Jobless Claims are forecast to drop to 700,000 in the week of March 12 and Continuing Claims to 4.07 million, as business closures end and social restrictions are lifted across most of the nation. The prior low was 711,000 on November 6.

Initial Claims

The end of California's lockdown in January and the gradual reopening of most of the country has had a beneficial effect on layoffs.

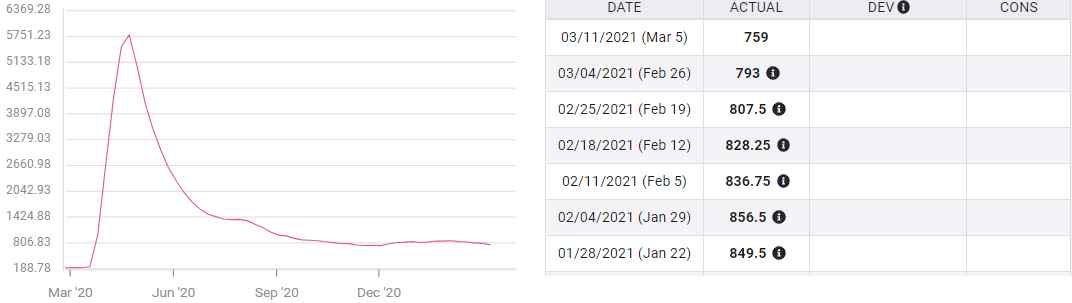

The four-week moving average for claims has fallen from 856,500 in the final week of January to 759,000 on March 5. If this week's forecast of 700,000 is correct the average will post a pandemic low of 725,500, finally improving on the November 27 total of 740,500.

Initial Jobless Claims, 4-week moving average

A year of economic turmoil has left small businesses in dire shape. Even though growth is expected to accelerate in the first and second quarters for some proprietors the revival will come too late.

Claims will likely continue at elevated but slowly declining rates for several months as the lockdown fallout works its way through the economy.

Nonfarm Payrolls and GDP

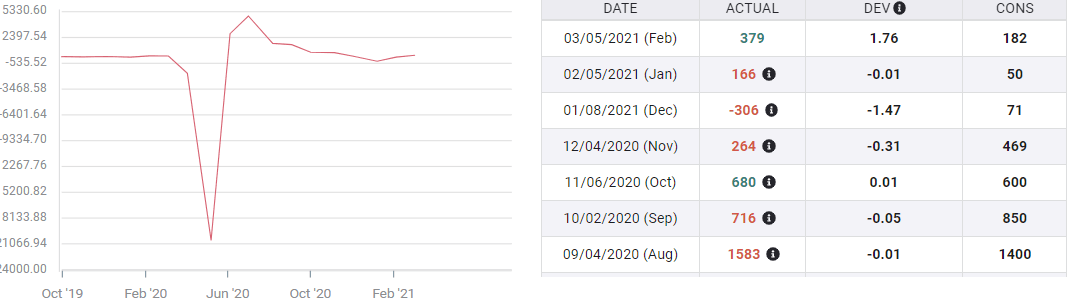

Job creation has rebounded from December's loss of 306,000 with US firms adding 545,000 employees in January and February.

In the strict accounting of Nonfarm Payrolls (NFP) the US economy has regained only 57%, 12.9 million, of the 22.3 million jobs lost in March and April last year.

Hiring should return at a much faster pace in the second quarter as the restaurants, hospitality and travel sectors begin to recover clients and receipts.

Nonfarm Payrolls

FXStreet

Stimulus spending and the pandemic retreat

Washington has added over three trillion dollars of stimulus spending to the economy since the November election. The most recent individual awards of $1400 should hit bank accounts this month. This largess should prompt an outburst of consumer spending in late March and April as the previous gift did in January when Retail Sales jumped 7.6%.

It is hoped that with pandemic restrictions ended in most of the country, consumers will return to many of their in-person shopping and travel habits which may salvage the remaining small businesses.

Conclusion

Markets are focused on on the economic recovery. Falling Jobless Claims, by whatever amount, are good news for interest rates and the dollar.

Small businesses, which have borne the brunt of the economic destruction of the lockdowns, have some reason to hope.

People may be ready to resume their normal lives and restart suspended activities. If that is the case, layoffs may fall far more rapidly than currently anticipated. On the other hand many of the changes wrought by the pandemic may be permanent and businesses that depend on old shopping habits may be doomed, even if the verdict takes time to arrive.

Layoffs and their reflection in Jobless Claims are a window into the new economy.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.