Inflation tracker of October: Focus on alternative measures of Eurozone inflation

Whilst euro area August inflation figures warned of the slowness of disinflation, September data (Eurostat’s preliminary estimates) point to an acceleration and an amplification of disinflation.

Headline and core inflations fell by almost one percentage point year-on-year. Besides, the decline is driven by the four main HICP items (harmonized index of consumer prices): manufactured goods (contribution down -0.1 percentage points), services (-0.3), food (-0.2) and energy (-0.1). Headline and core inflation remain high (4.3% and 4.5% y/y respectively) but their fall is becoming more visible.

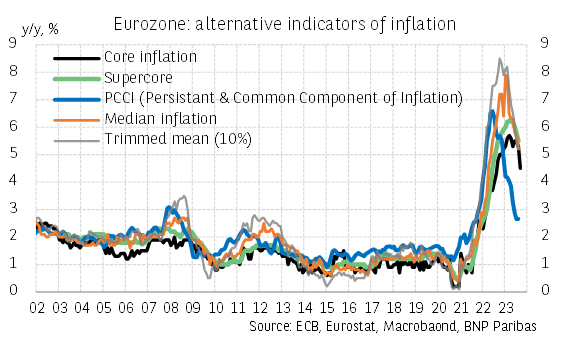

The decline in the various alternative measures of inflation (less volatile and more trend-informative measures of inflation), the main ones being shown in the graph, strengthens the encouraging global picture. The decrease in the persistent and common component of inflation (PCCI) is the most marked (this measure of inflation is the only one below 3%, since June 2023) and the earliest (the indicator turned downward in early 2022). This is a strong disinflationary signal of the diminishing persistence of inflation and its commonality across euro area countries and HICP items.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.