![]()

Markets remain snore-inducingly slow as we move into the latter portion of today’s US session. That said, traders may want to start looking ahead to some of the noteworthy data on tap in the coming Asian session.

First, shortly after this note goes to press, the RBNZ will release its semi-annual Financial Stability Report. Back at the last release in May, the New Zealand’s central bank keyed in on three major risks to the NZ economy: the housing market, dairy prices, and global financial conditions. Unfortunately, none of these factors have improved notably over the last 180 days, so we would expect a similar focus in today’s release.

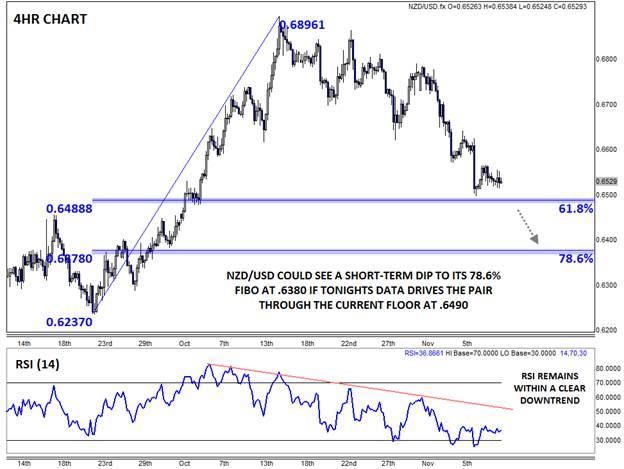

The RBNZ has also used this report, and Governor Wheeler’s accompanying press conference, to jawbone the kiwi lower in the past, so traders should be wary of any comments about the currency as well. Looking to the chart, the key areas of support to watch will be the Fibonacci retracements of the mid-September to mid-October rally at .6490 (61.8%) and .6380 (78.6%)

Across the Tasman, Australia’s Westpac bank will release the latest data on AU consumer sentiment. This report covers data from the current month, so it provides a timely view into the psyche of the Australian consumer. Unfortunately, the data tends to be extremely volatile on a month-by-month basis, so it’s impact on markets may be limited, even in the current data-starved environment.

Finally, traders will also get the latest update on the world’s second-largest economy, China. Specifically, China will release its latest industrial production and fixed asset investment data, which are critical reports for the manufacturing-led economy. Expectations are for the former report to tick up to a 5.8% y/y growth rate (from 5.7%) and the latter release to edge down to a 10.2% y/y gain (against 10.3% last month). If the data fails to live up to these still lofty expectations, more weakness is possible in both the Australian and New Zealand dollars, regardless of the domestic data.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD rebounds on Thursday after midweek pullback

EUR/USD tuned back into the high end on Thursday, getting bolstered by a broad-market selloff in the Greenback. US data that printed better than expected helped to ease concerns of a possible economic slowdown within the US economy looming over the horizon.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.