![]()

The end of April Fool’s Day in North America was rather tepid even though both US equity markets as well as the USD tried to battle back from early declines. Stocks ended up down on the day despite that puncher’s mentality, but were well off the lows established in early trade. The USD as well shook off early weakness and found support in currencies like the USD/JPY around previous established price levels, but an overwhelming rally was lacking. As we careen in to the back half of this short week, liquidity is likely to get lighter as investors have spring break and Easter holiday on their minds more than price breaks and Greek loan payment holidays.

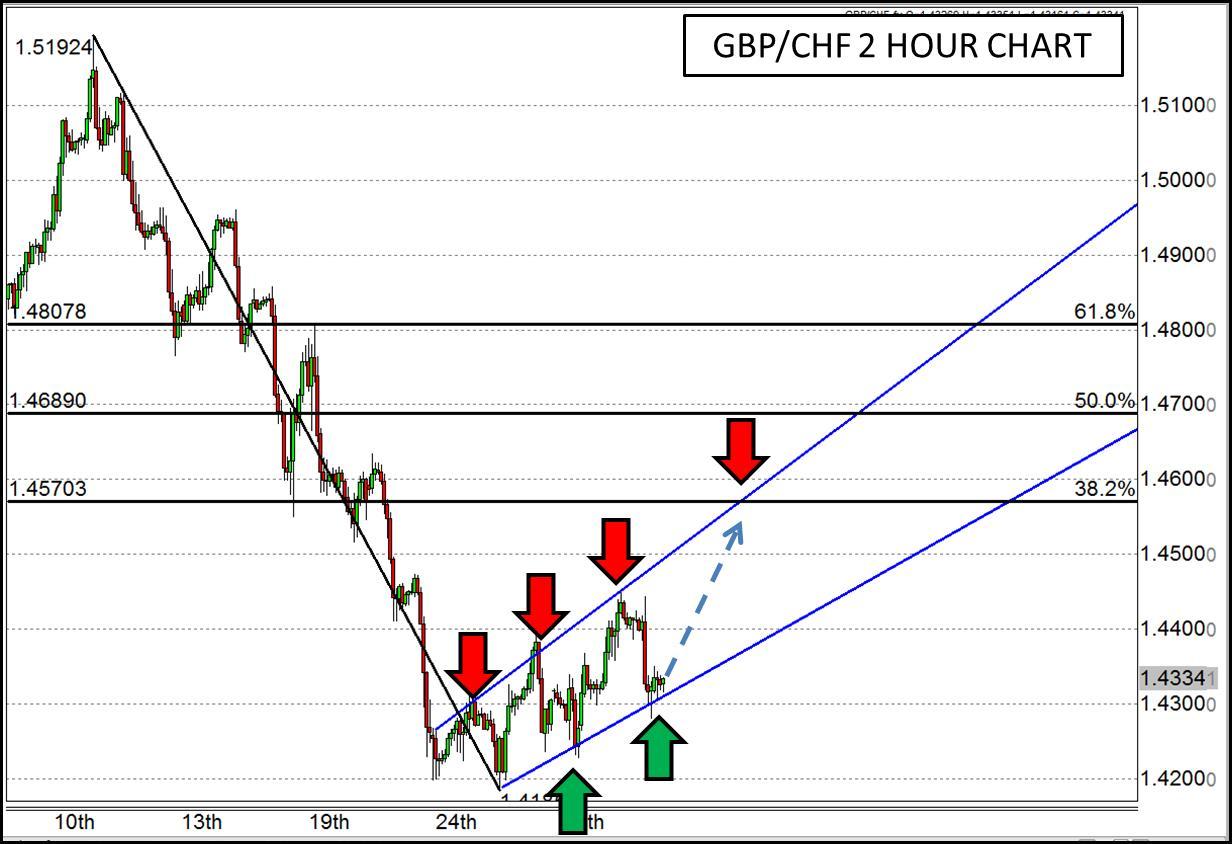

Despite the thin trading conditions likely to manifest over the next couple days, there are some intriguing possible moves beginning to set up; and one such move could be in the GBP/CHF. The GBP has been eviscerated over the last month against many other currencies mainly, it seems, on the fact that so much has been expected of it. Granted, inflation hasn’t been stellar and the unemployment rate ticked up from 5.6% to 5.7%, but other than that, economic figures haven’t been particularly dour. Most of the PMI figures are strong, borrowing is up, sales on the retail side are increasing with conviction, and even the final GDP release was revised higher for Q4. Perhaps some of this GBP bashing will come to an end and reverse some of the negative trends we’ve seen for the currency.

The GBP/CHF is an intriguing pair due to a potential changing of that downward trend. In the month of March, when this pair fell from nearly 1.52 down to 1.42, it followed a relatively tight channel on the way, but the end of the month and the beginning of the new month has revealed that a new channel could be developing in the opposite direction. Extrapolating Fibonacci retracements from the March high to low shows that there may be room for a run up to 1.46, 1.47, or even 1.48 if it were to rise at the pace of the currently developing channel. Being that prices are near the bottom of the new channel currently, the time is nigh to test this theory and see if the GBP can get some spring in its step and blaze a new trail higher.

Figure 1:

Source: www.forex.com

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.