![]()

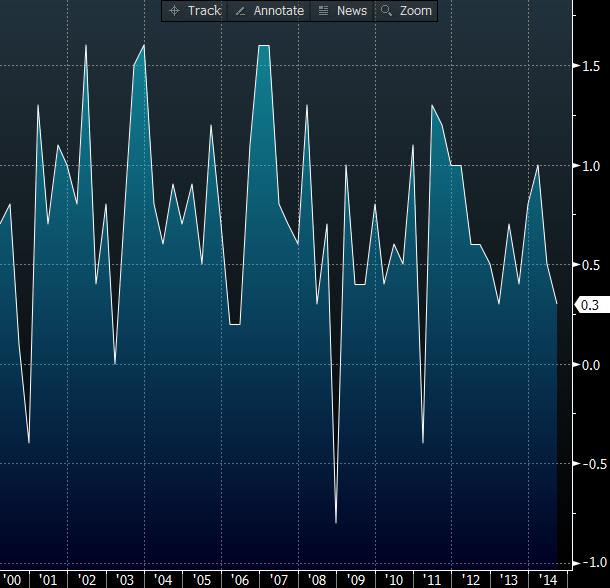

Later today we are expecting Australia’s growth figures for last quarter. The market is looking for a 0.6% q/q growth rate, which is better than the prior quarter’s very disappointing 0.3% jump – it was an important factor in our decision to lower our rates forecast for Australia. We think the risk for todays’ figures (released at 0030GMT) is tilted to the downside once again. Private non-farm inventories fell a worrying 0.8% q/q in Q4, which is a drastic change from Q3’s 1.2% increase. Without this backing, GDP figures for Q4 may underwhelm the market expectations and see AUDUSD test the base of its new trading range.

Australian q/q GDP growth

Source: FOREX.com, Bloomberg

Shortly after we are expecting to hear from Fed Chair Yellen and then glimpse HSBC’s services PMI data for February. Yellen is expected to talk about bank regulation so we aren’t expecting it to have a huge impact on USD, although it’s definitely worth keeping an eye on what the Fed chief has to say. At 0145GMT we are turn our focus to China and HSBC’s Services PMI (prior 51.8) – this index does carry the same weight as its Manufacturing brother, but further weakness in the services sector would only add the market’s concerns about China’s economy.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.