![]()

The roller coaster ride for the G10 FX market continues today with the unexpected announcement from the Swiss National Bank that it was disbanding its 3.5-year 1.20 floor in EURCHF. At its last meeting on 11th December the central bank kept its 1.20 peg and it seemed committed to using the currency as a policy tool.

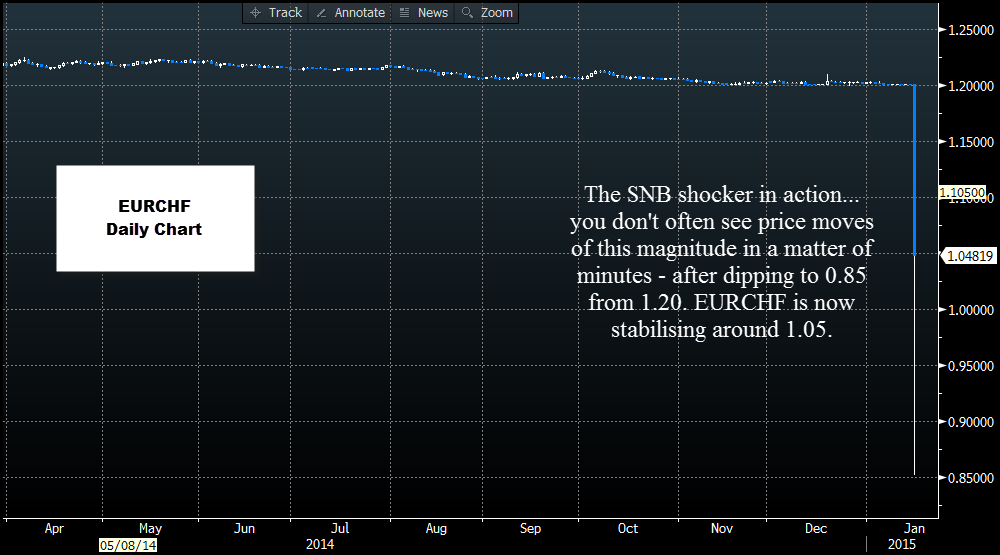

The immediate aftermath has been a more than 20% decline in EURCHF, this pair has fallen through parity for the first time, and the low so far this morning has been 0.8721. Right now this pair is falling like a stone as 3.5 years of the market trying to go against the SNB finally comes to fruition.

If the SNB though that it could make this adjustment in an orderly manner, then it has failed miserably. The EURCHF market has basically shut down so far this morning, while it waits for the dust to settle.

So why did the SNB do it?

The SNB has close ties with the ECB. This move could be a sign that the SNB thinks (or knows) that the ECB will embark on QE at next week’s meeting, and the size of its QE programme could be bigger than the market expects – perhaps $1 trillion, not the $500bn that was “leaked” last week.

If the SNB is so spooked it is disbanding with a policy that it has held dear since 2011, then the rest of the market may want to reconsider their expectations for next week’s ECB meeting. Hence the sharp fall in all EUR crosses.

On the other hand, maybe the SNB felt that maintaining the peg ahead of the ECB meeting was too costly, so they needed to act now. After all, the peg had to come to an end at some stage, why not at the start of the New Year.

This announcement signals a policy shift at the SNB – one that will hopefully preserve their FX reserves and reduce their exposure to EUR risks. The peg had proved costly for the SNB, and left the SNB with a sizeable EUR exposure, thus the market shouldn’t be that surprised that it wanted to end its peg, although the timing was unexpected.

At the same time as announcing it was disbanding with the peg, the SNB cut interest rates deep into negative territory. The deposit rate is now -0.75%, it was previously at 0%. The SNB may have thought that negative interest rates would limit unbridled Swissie buying in the market, but it didn’t. The market only focused on the end of the 1.20 peg. However in the long term the cut to interest rates may weaken the Swissie.

Where will Swissie go next?

After a huge surge higher on the announcement there are signs that the SNB may have had to come into the market this morning to stabilise the currency. EURCHF fell to a low of 0.8517 and is now trading back above parity around the 1.04-1.05 mark. We think there are two main risks going forward:

1, the ECB does not embark on a large QE programme next week, which triggers a dramatic reversal in EURCHF.

2, After such a sharp move higher the market may decide to sell the Swissie at this level, after all, the SNB has implemented negative interest rates, which should, in theory, flood the market with francs, causing CHF to weaken in the long term.

3, Right now the market is digesting the announcement from the SNB, and waiting for liquidity to come back on line. There remains intervention risk, so if you are planning on trading the Swissie at some stage in the near term expect some serious volatility.

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD trims losses and approaches 1.0800 after US data

The US Dollar renewed its bullish momentum on Tuesday, pressuring EUR/USD and keeping the pair under the critical 1.0800 threshold following the release of US ISM Manufacturing PMI and JOLTS readings.

GBP/USD meets support around 1.2880, USD remains strong

After bottoming out around the 1.2880 region, GBP/USD now manages to attempt a bounce and flirt with the 1.2900 zone in the wake of weaker-than-expected US data releases.

Gold looks range bound above $3,100

Gold is easing from its fresh record high near $3,150 but remains well supported above the $3,100 mark. A generalised pullback in US yields is underpinning the yellow metal, as traders stay on the sidelines awaiting clarity on upcoming US tariff announcements.

Dogecoin bulls defend lifeline support as risk-off sentiment continues

Dogecoin trades at $0.1731 during early American hours on Tuesday after recovering from Monday’s support at $0.16. The leading meme coin faced negative headwinds early in the week as investors reacted to comments by Tesla CEO Elon Musk, who heads the special Department of Government Efficiency (D.O.G.E.) in the US.

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.