![]()

Markets are in a bit of a better mood this morning as virtually all of the major equity indexes around the world either closed in the green or are currently levitating healthily in that area with the lone exception being the Japanese Nikkei index that closed down over 2%. The impetus for the Nikkei fall was likely due to the Chinese GDP release that was actually better than consensus, but was still the worst result since 2009 and encouraged some JPY strength along with it. US stock markets on the other hand, have enjoyed a comfortable run to the topside despite McDonald’s missing on their earnings release this morning.

US economic data is lending a helping hand as well as Existing Home Sales beat consensus expectations of 5.11M with a 5.17M read. The 2.4% increase from last month’s number is a welcome surprise particularly after last week’s string of bad market days, and gives the US housing market a much needed boost.

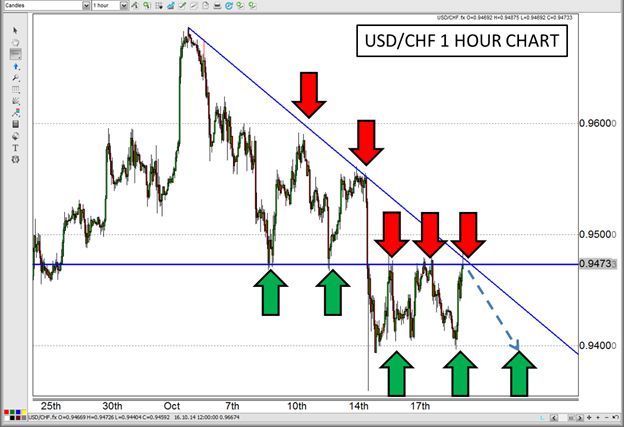

Due to the positive vibe and good US data, the USD is catching a bid this morning as well, with one of the more interesting currency pairs being the USD/CHF. Throughout the month of October, this pair has been slowly descending with an occasional retracement back up to a declining trend line, and coincidentally, it has approached that level once again. In addition, it is also approaching a level of previous support/resistance which, combined with the trend line, forms a very interesting confluence.

So despite the positive feel of the market for the USD, the USD/CHF may be prevented from advancing as our old friend, the trend, defends its turf. If this were to hold, watch for 0.9475/0.95 to potentially provide the necessary resistance for this pair to retest the 0.94 region once again, which it has been doing since early last week.

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that FOREX.com is not rendering investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. FOREX.com is regulated by the Commodity Futures Trading Commission (CFTC) in the US, by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investment Commission (ASIC) in Australia, the Financial Services Agency (FSA) in Japan, the Investment Industry Regulatory Organization of Canada (IIROC) in Canada and the Securities and Futures Commission of Hong Kong (SFC) in Hong Kong. Please read Characteristics and Risks of Standardized Options.

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase of sale of any currency. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.