Implications of Fed balance sheet growth

Executive Summary

As a follow-up to a recently published report, we explore the implications of the phenomenal increase in the Fed's balance sheet so far this year. In our view, the expansion of the Fed's balance sheet is largely benign from an economic and financial standpoint, at least in the foreseeable future. Higher money supply growth likely will not lead to a spike in inflation anytime soon, and the Fed's purchases of high quality assets, such as U.S. Treasury securities, likely will keep bond yields low and liquidity ample in short-term funding markets. However, the Federal Reserve could become technically insolvent if it were to experience significant credit losses on some of the higher risk assets it is currently purchasing. In that event, the Fed could face a political backlash that could have potential implications for its ability to respond to future crises.

Could Balance Sheet Expansion Lead to Higher Inflation?

We estimated in a report that we published on July 14 that the size of the Fed's balance sheet, which currently stands at nearly $7.0 trillion, would grow to roughly $7.6 trillion by the end of 2020, under our base-case scenario. But in a "worst-case" scenario, in which the economy rolls over again and tensions in financial markets spike anew, the balance sheet could easily explode to $11 trillion by the end of the year. What are the implications of this significant growth in the size of the Fed's balance sheet?

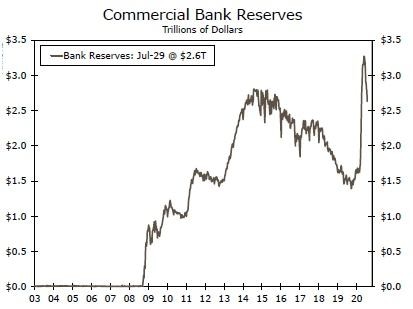

As we discussed in our previous report, the current policy instruments of the Federal Reserve operate largely through the asset side of its balance sheet. That is, the Fed has been actively purchasing assets to reduce tensions in financial markets and to support the credit-creation process in the U.S. economy. The liability side of the balance sheet is essentially moving in a mechanical fashion with the asset side. In that regard, the reserves that commercial banks hold at the Fed have shot up to roughly $2.7 trillion from $1.7 trillion in early March (Figure 1).

Along with vault cash, banking system reserves constitute the monetary base, which is also known as "high-powered money." Because commercial banks need to hold only a fraction of their deposits (liabilities of a commercial bank) in the form of vault cash and reserves at the Fed (assets of a commercial bank), banks can create a multiple of loans and deposits when reserves increase. In short, rapid reserve expansion could potentially lead to a significant rise in the money supply, which could prove to be inflationary.

On a year-ago basis, the monetary base in July was up about 45% (Figure 2). But this marked acceleration in the monetary base since March pales in comparison to the experience of the financial crisis of a decade ago when "high-powered money" was surging in excess of 100%. Growth in the M2 money supply edged higher in late-2008/early-2009, but clearly not to the same extent as the "high-powered" money supply.1 As we will discuss subsequently, the so-called "velocity" of money fell sharply during the financial crisis, which kept a lid on growth in the M2 money supply.

Source: Federal Reserve Board and Wells Fargo Securities

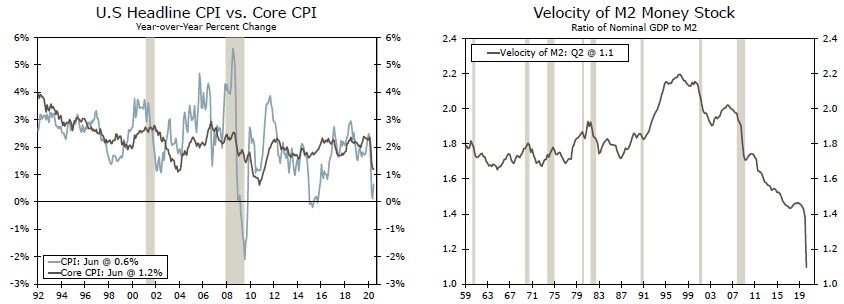

Furthermore, headline and core consumer price inflation both fell in the immediate aftermath of the financial crisis.

But could this time be different? The M2 money supply in June was up nearly 23% on a year ago basis. Not only is currency in circulation 13% higher than it was last year at this time, but deposits at the nation's commercial banks are up more than 20% on a year-ago basis. Could this acceleration in the M2 money supply lead to higher inflation?

In the near term, the answer appears to be "no." Both overall and core CPI inflation have receded notably since the pandemic struck earlier this year (Figure 3). And if the experience of the financial crisis is any guide, inflation likely won't shoot higher as long as the economy remains depressed. But could inflation rise significantly in the years ahead? For that to happen, the velocity of money would need to reverse the downward trend that it has followed for the past few decades (Figure 4).

Source: U.S. Department of Labor, Federal Reserve Bank of St. Louis and Wells Fargo Securities

The velocity of money is the number of times that a unit of money (currency in circulation and bank deposits) is used to buy goods and services during a period of time. An increase in the velocity of money would support higher spending on goods and services, everything else equal, which could lead to higher inflation if resource constraints inhibit businesses from ramping up output quickly Although it is not entirely clear why money velocity has declined over the past two decades, the low interest rate environment over that period has likely played a role. That is, individuals are willing to hold excess cash balances if other assets are earning low rates of return. In addition, low inflationary expectations probably have contributed to the decline in the velocity of money as well. If individuals do not expect inflation to increase significantly, then they do not feel necessarily compelled to spend their cash balances before higher inflation erodes their purchasing power. As long as interest rates remain low and inflationary expectations remain depressed, a marked increase in the velocity of money does not seem likely. In other words, the recent increase in the size of the Fed's balance sheet probably will not lead to significantly higher inflation anytime soon.

As a point of reference, note that the balance sheet of the Bank of Japan (BoJ) has ballooned to nearly 120% today from 30% of Japanese GDP at the beginning of 2012. Over that period, the consumer price index in Japan has risen less than 6%, which is an annual average rate of only 0.7%. Clearly, balance sheet expansion by the BoJ has not led to a significant bout of inflation in Japan.2 This is not to say an exploding monetary base cannot lead to higher inflation, but rather that it does not necessarily need to lead to higher inflation.

Bond Yields: An Unstoppable Force Meets an Immovable Object

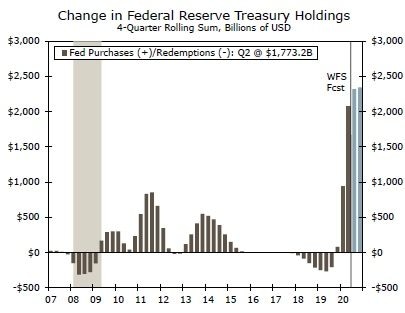

The Fed's robust purchases of Treasury securities have helped keep a lid on yields despite the surge in federal debt issuance. The federal budget deficit has ballooned since the onset of COVID-19, and with it has come an explosion of debt issuance by the federal government that has already surpassed the peaks seen during the Great Recession (Figure 5). This has led some financial market participants to speculate that a jump in bond yields is in the offing.

Source: U.S. Department of the Treasury and Wells Fargo Securities

But, just looking at the change in public debt outstanding ignores the role the Federal Reserve plays in the Treasury market. After accounting for the Fed's Treasury security purchases/redemptions, total net Treasury issuance this year will only be moderately higher than it was during the Great Recession. And for net issuance of securities with maturities of two years or longer, our forecast is for supply to be outright negative by more than $500 billion, after accounting for Fed purchases (Figure 6). This illustrates just how aggressive the Federal Reserve has been in the Treasury market since mid-March. At the peak, the Fed was buying $75 billion per day of Treasury securities, none of which were short-dated Treasury bills. This explosion in Treasury holdings by the central bank easily exceeds what was done by the Federal Reserve during and after the Great Recession (Figure 7).

This is not to say that debt issuance will have no impact on markets going forward. The Fed has subsequently dialed back its purchases to $80 billion per month, and the U.S. Treasury Department likely will continue to ramp up issuance of intermediate and longer-dated Treasury securities in the quarters ahead. But it is our expectation that increased debt issuance will push up longer-dated yields only at the margin over the next 12-18 months. Specifically, we forecast that the yield on the 10-year Treasury security will stand at roughly 1.5% at the end of 2021, which would still be about 50 bps below where it was at the end of 2019. For a more material breakout in Treasury yields, the economy would need to strengthen enough such that financial markets begin to price in at least some Fed rate hikes in the 2020s (Figure 8).

Source: Federal Reserve Board, Bloomberg LP and Wells Fargo Securities

Liquidity: Keeping Strains in Short-Term Funding Markets at Bay

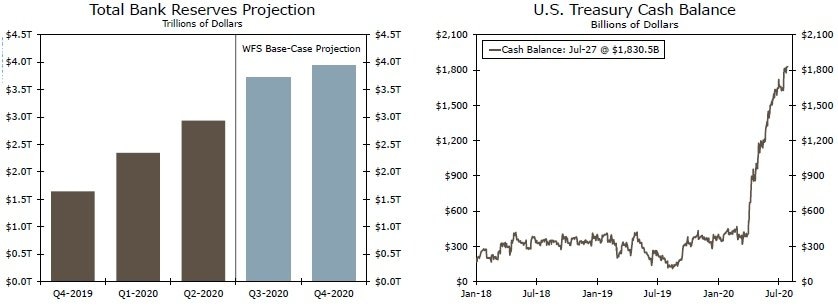

Liquidity concerns have periodically arisen over the past year, from the spike in repo rates in September 2019 to the widespread financial market havoc that was induced by COVID-19 in midto late-March. Since then, however, money markets and other key segments of the financial plumbing have generally operated much more smoothly, aided mightily by the expansion of the Federal Reserve's balance sheet. As discussed above, bank reserves have risen nearly $1 trillion since early March, and we anticipate that they will increase by at least another $1 trillion by year's end (Figure 9). Continued Fed purchases of Treasury securities and MBS, as well as an eventual decline in the Treasury's cash balance (Figure 10), should keep new cash flowing into the financial system for the foreseeable future.3

Source: Federal Reserve Board, Bloomberg LP and Wells Fargo Securities

The sources of this extra liquidity have not just been outright asset purchases by the Fed, but also the slew of emergency lending programs by the central bank that were covered in Part I of this report. On July 28, the Federal Reserve announced that it would extend through December 31 seven of its facilities that were scheduled to expire on September 30.4 In addition, the Federal Open Market Committee FOMC) announced at it July 29 meeting that the Fed "will continue to offer large-scale overnight and term repurchase agreement operations" and that it was extending the swaps agreements that it has in place with other major central banks through March 2021. Although usage of many of these programs may remain low in the months ahead, their continued presence should help to ensure that liquidity is not a major problem. In short, the willingness of the Federal Reserve to use its balance sheet to provide liquidity to financial institutions and foreign central banks should keep strains in short term funding markets, such as those experienced in March, at bay.

Could the Fed Become Insolvent?

While the Fed's balance sheet has ballooned to roughly $7 trillion, its capital base has remained constant at about $39 billion. With this leverage ratio of roughly 175-to-1 (Figure 11), it seems plausible that a loss could wipe out the Fed's relatively meager capital buffer and leave it with a negative net worth. Although this is possible, things may not be as worrisome as this figure suggests. The Fed's balance sheet is largely comprised of assets with relatively minimal credit risk. While the Fed is adding new, riskier assets to its balance sheet through its crisis lending facilities, the Treasury has seeded these facilities with capital that can help protect the Fed from some default risk. Even if the Fed were to become technically insolvent, the consequences are much more likely to be political rather than economic.

Source: Federal Reserve Board, Bloomberg LP and Wells Fargo Securities

U.S. Treasury securities currently account for about $4.3 trillion of the $7.0 trillion worth of assets that the Federal Reserve currently holds on its balance sheet. These securities essentially have no credit risk because they are backed by the "full faith and credit" of the U.S. government. The Fed also owns $2.0 trillion worth of mortgage-backed securities (MBS). Although these securities do not explicitly have the "full faith and credit" of the U.S. government, the credit risk inherent in them is probably fairly low. In the event of another housing market meltdown, the U.S. government likely would backstop the MBS issued by Fannie Mae and Freddie Mac as it did during the financial crisis. Together, Treasury securities and MBS make up about 90% of the assets on the balance sheet and a similar share of the balance sheet's growth since early March.

That said, the Fed has created a number of programs since March that could alter the composition and credit risk of its balance sheet. For example, corporate bonds and state & municipal bonds, which the Federal Reserve is buying, have higher default risk than Treasury securities or MBS. Furthermore, the loans that the Fed is now buying from commercial banks through its Main Street Lending Program also have default risk. The amount of credit that the Federal Reserve has extended to these facilities totals about $200 billion at present, but they could grow to a maximum of $2.3 trillion, in aggregate. All of these facilities are capitalized by $215 billion from the U.S. Treasury Department, which would have any first-loss exposure. However, this equity infusion from the Treasury Department as well as the $39 billion worth of capital that the Fed holds could be completely depleted if the credit losses incurred by these facilities exceed $254 billion.5

Of course the Federal Reserve is not an ordinary commercial bank. Congress could pass legislation requiring commercial banks, which are the Fed's primary equity contributors, to re-capitalize the Fed, or the federal government could also stake a significant new equity stake in the central bank. Although the technical insolvency of the nation's central bank may not have tremendous economic consequences, falling into a negative net worth situation could have significant political implications for the Federal Reserve.

Thus far, many observers have lauded the Fed for the actions it has taken to stem the ongoing economic crisis, but these actions have also taken it into uncharted territory. Suffering significant credit losses on some these new programs could lead some in Congress to question whether the Fed's crisis mitigation efforts go beyond its mandate. New legislation or more stringent congressional oversight could weigh on the Fed's independence and its ability to respond to new problems as they arise. The Federal Reserve may face some criticism even in the absence of any solvency issues, as it did following the 2008 financial crisis. However, entering into technical insolvency, should that eventuality transpire, could lead to a political backlash that could potentially have implications for the Federal Reserve to respond to future crises.

Conclusion

The balance sheet of the Federal Reserve has expanded to nearly $7.0 trillion from about $4.2 trillion in late February. Under our base-case scenario, we project that it will grow to roughly $7.6 trillion by the end of the year, although we acknowledge that the balance sheet could climb higher if the FOMC needs to provide even more monetary accommodation to the economy. In our view, the economic and financial implications of rapid balance sheet expansion are rather benign, at least in the foreseeable future. We think there is a low probability that increased growth in the money supply will lead to a spike in inflation. The asset purchases that the Fed is undertaking should keep bond yields low while also providing ample liquidity to the financial system.

That said, we believe there could be potential political implications from balance sheet expansion. The Federal Reserve is taking on credit risk through some of the facilities it has created to support the credit-creation process in the U.S. economy. If credit losses were to become extreme, the Federal Reserve could become insolvent, at least in a technical sense. In that event, some members of Congress and/or the administration could question whether the Fed went beyond its mandate and they could take steps to reign in the Fed's independence, which could conceivably constraint the Fed's ability to respond to future crises.

Download The Full Special Reports

Author

Wells Fargo Research Team

Wells Fargo