California wants higher property taxes. Illinois wants income taxes. Both may get their wishes.

This is a guest post from WirePoints founder Mark Glennon.

Coveting California? Beware Its Perverse Tax Envy

Many Illinois progressives openly favor California’s progressive income tax structure and Governor-elect Pritzker is committed to taking Illinois at least partially in that direction. Something like California’s approach is key to solving Illinois’ fiscal crisis and funding a wish list of new programs, we’re often told.

But guess what’s happening in California. Progressives are making headway steering their state a little more in Illinois’ direction on an additional revenue source. They want property tax increases made easier – something that’s been off limits in California for 40 years. That’s where Illinois has excelled, taking its property tax rates to about the worst in the nation – twice the national average.

The Tax Foundation ranks California second worst among states for income taxes. Its one-percenters pay almost half of all its income tax, with rates up to 13.3%. What more could Illinois progressives hope for?

California property owners have been protected, however. Proposition 13, passed in 1978, imposed tough restrictions on frequency of reassessments and maximum annual tax increases for many properties. Since then, messing with Prop 13 has been a political third rail. Even California’s notoriously liberal lawmakers have been loath to touch it.

Not any longer

“Proposition 13 is no longer off-limits in California,” said a headline last week in the San Francisco Chronicle. Proponents of chopping Prop 13 down now claim to have enough signatures to get an initiative on the ballot in 2020 that would pave the way for an additional $14 billion in property tax revenue, according to the Chronicle.

And in the legislature, a constitutional amendment is pending that would takes aim at Proposition 58, part of Prop 13’s legacy, which voters approved in 1986. The amendment would eliminate Prop 58’s provisions insulating children from spikes in property taxes triggered by reassessments when parents die.

Perhaps not surprisingly, one of the primary activists behind the proposed changes to Prop 13 is a former Chicagoan, according to the Chronicle. That’s Catherine Bracy, executive director ofTechEquity Collaborative, who moved to California from Chicago six years ago. Says Bracy: “For newcomers (to California) like me, who were born after Prop. 13, we want to experience the California dream, too. But we don’t have the opportunity to, because all the goodies have been locked up by the older generations.”

Maybe Bracy has been inspired by developments back home. Illinois property tax rates often exceed 5 3%, 4% and 6% per year on homes, and often far higher on commercial property. With property values remaining exceptionally high in California, there’s a gold rush in waiting for tax collectors.

And since California, like Illinois, has more people moving out than moving in, maybe she’s keeping up on the rationale for taxing property in a shrinking state. Property can’t flee, so seize it. That the reasoning behind that idea for a statewide property tax in Illinois, detailed earlier this year by three economists from the Federal Reserve Bank of Chicago.

Also not surprisingly, the League of Women Voters is playing a major role in the attack on Prop 13. As in Illinois, the League in California apparently tossed its identity as nonpartisan and became a left-leaning activist operation.

Among the “ways that Prop 13 sucks,” as that outfit wanting higher California property taxes put it, is that keeping property taxes down forces California to raise taxes in other ways.

But is conditioning higher property taxes on cuts to other taxes part of the proposal?

Nah.

Isn’t that the lesson? Will anything ever be enough?

Mark Glennon

Mish Comments

- Our plans to escape Illinois are progressing. Either 2019 or 2020 is highly likely.

- Illinois will no doubt pass more tax hikes.

- All the money will go to Illinois pensions, and they will still be insolvent.

Pertinent Notes

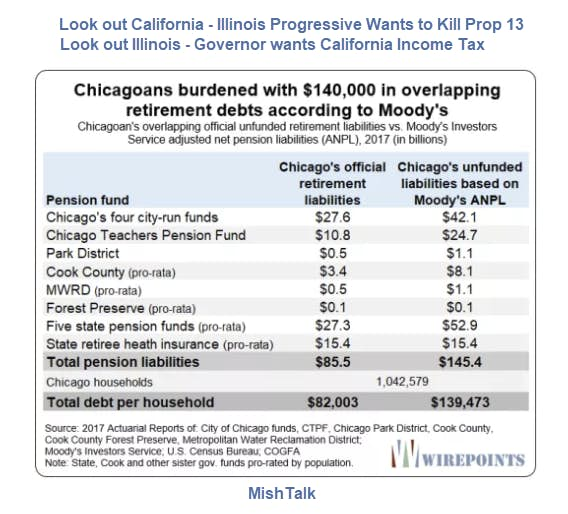

- Each Chicagoan Owes $140,000 to Bail Out Chicago Pensions

- Illinois Pension Benefits, Other Promises, and Insolvency

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0900 amid weaker US Dollar

EUR/USD defends gains below 1.0900 in the European session on Monday. The US Dollar weakens, as risk sentiment improves, supporting the pair. The focus remains on the US political updates and mid-tier US data for fresh trading impetus.

GBP/USD trades sideways above 1.2900 despite risk recovery

GBP/USD is keeping its range play intact above 1.2900 in the European session on Monday. The pair fails to take advantage of the recovery in risk sentiment and broad US Dollar weakness, as traders stay cautious ahead of key US event risks later this week.

Gold price remains on edge on firm prospects of Trump’s victory

Gold price exhibits uncertainty near key support of $2,400 in Monday’s European session. The precious metal remains on tenterhooks amid growing speculation that Donald Trump-led-Republicans will win the US presidential elections in November.

Solana could cross $200 if these three conditions are met

Solana corrects lower at around $180 and halts its rally towards the psychologically important $200 level early on Monday. The Ethereum competitor has noted a consistent increase in the number of active and new addresses in its network throughout July.

Election volatility and tech earnings take centre stage

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

The US Dollar managed to end the week higher as Trump Trades ensued. Safe-havens CHF and JPY were also higher while activity currencies such as NOK and NZD underperformed.