Ignoring hawkish Fed

S&P 500 entered yesterday‘s session on a corrective note, but similarly to recovering from Barkin‘s hawkish message, it did the same following FOMC minutes. Not even NVDA earnings volatility could take the ES below 4,535 – clients‘ long gains whether in swing or intraday publications, are growing – and the result really comes down to when you enter and how you work with risk along the way. Crucial question to ask – are these the circumstances favoring outsized bets, or not?

It boils down to what you think about the bond market – are we see another 10y yield rising episode?

Let‘s focus on the data – as I‘ve already announced premium, unemployment claims and (core) durable goods orders... the expectations are a bit on the gloomier side - I do favor data moderately lending support to higher for longer. That means tempered expectations for today in both stocks and (for all the great price action predicted lately in precious metals, for today at least) gold with silver.

In Thanksgiving spirit, I‘m opening today‘s Trading Signals content except stocks. Happy holidays.

Let‘s move right into the charts – today‘s full scale article contains 5 of them, featuring S&P 500, XLF, IWM, precious metals and oil.

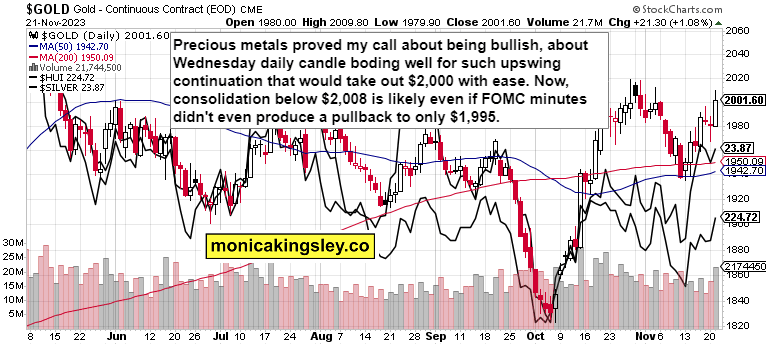

Gold, Silver and Miners

Precious metals proved being very bullish – yesterday‘s daily upswing on high volume with miners starting not to lag behind, bodes very well for overcoming the Oct highs. Gold keeps climbing every hawkish Fed wall of worry – but I called for its very short-term vulnetability over the premium Telegram channel for clients.

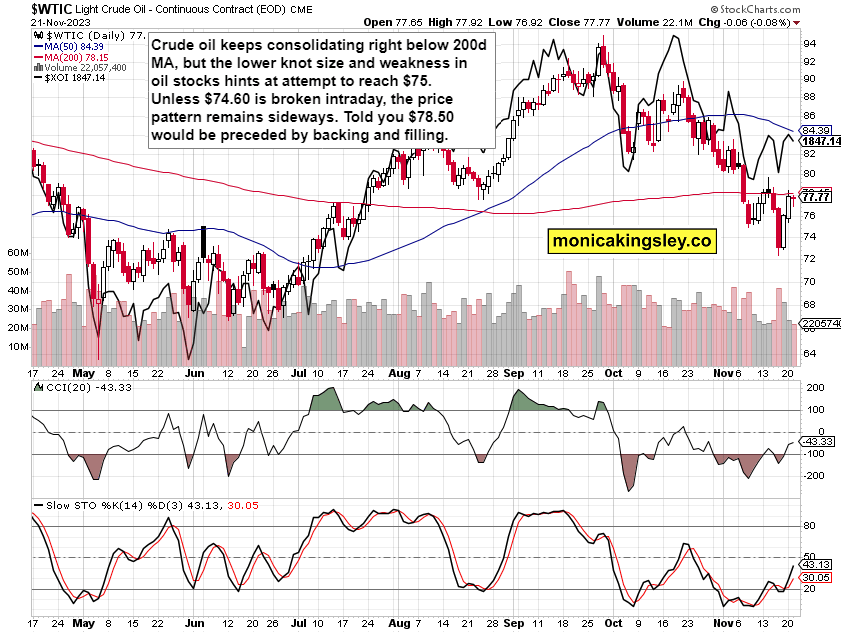

Crude Oil

Crude oil upswing is to be dialed back somewhat, yet $74.50 would slow down the sellers. If prices stay there on Friday still, then a break of $72.50 is very likely. Oil appreciates the slow weakening in leading data, and today‘s orders weren‘t good.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.