Ichimoku cloud analysis: EUR/USD, XAU/USD, USD/JPY

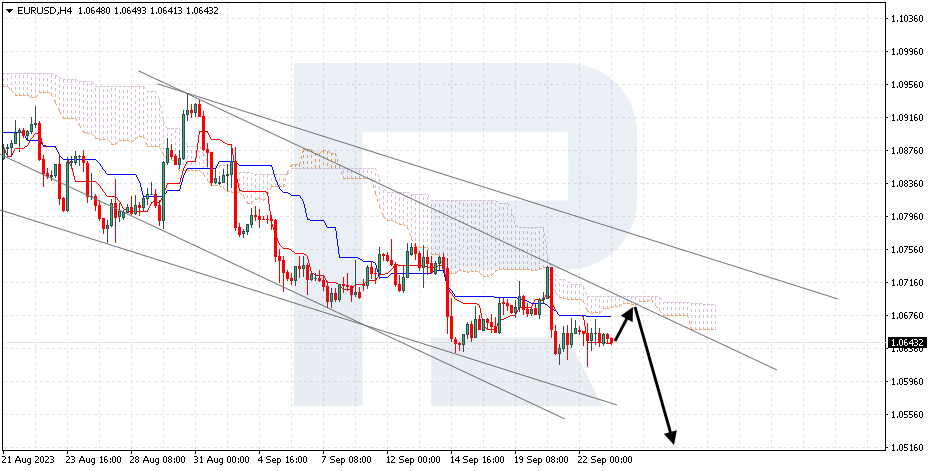

EUR/USD, "Euro vs US Dollar"

EUR/USD is testing the signal lines of the indicator. The instrument is going below the Ichimoku Cloud, which implies a downtrend. A test of the lower boundary of the Cloud at 1.0680 is expected, followed by a decline to 1.0515. An additional signal confirming the decline could be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price securing above the 1.0720 level, which will indicate a further rise to 1.0815.

XAU/USD, "Gold vs US Dollar"

Gold is pushing off the Cloud. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the lower boundary of the Cloud at 1920 is expected, followed by a rise to 1955. An additional signal confirming growth could be a rebound from the lower boundary of the ascending channel. The scenario can be cancelled by a breakout of the lower boundary of the Ichimoku Cloud with the price securing below 1910, which will signal a further decline to 1875.

USD/JPY, "US Dollar vs Japanese Yen"

USD/JPY is rising within a bullish channel. The instrument is going above the Ichimoku Cloud, which implies an uptrend. A test of the upper boundary of the Cloud at 147.70 is expected, followed by a rise to 149.75. An additional signal confirming growth could be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price securing below 146.55, which will indicate a further decline to 145.65.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.