Ichimoku cloud analysis: EUR/USD, USD/CAD, NZD/USD

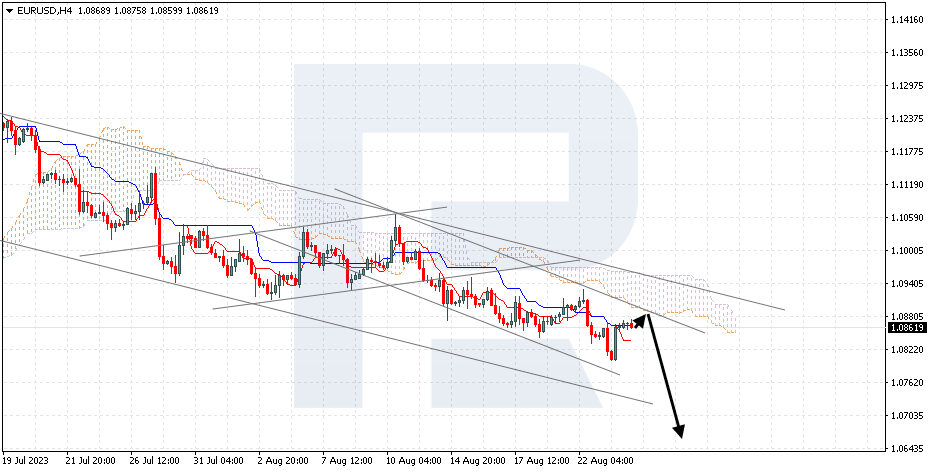

EUR/USD, “Euro vs US Dollar”

EUR/USD is pushing off the Tenkan-Sen line. The instrument is going below the Ichimoku Cloud, which suggests a bearish trend. A test of the lower boundary of the Cloud at 1.0880 is expected, followed by a decline to 1.0665. An additional signal confirming the decline will be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price securing above 1.0965, which will indicate further growth to 1.1055.

USD/CAD, “US Dollar vs Canadian Dollar”

USD/CAD is testing the support level. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the upper boundary of the Cloud is expected at 1.3495, followed by a rise to 1.3715. The growth can be additionally confirmed by a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price securing below 1.3430, which will indicate a further decline to 1.3340.

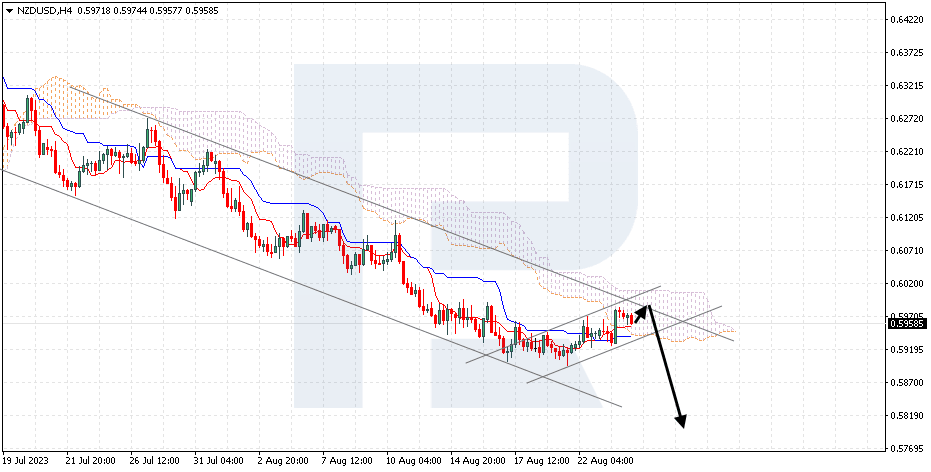

NZD/USD, “New Zealand Dollar vs US Dollar”

NZD/USD is correcting within a descending channel. The instrument is going inside the Ichimoku Cloud, which suggests a sideways movement. A test of the resistance level at 0.5980 is expected, followed by a decline to 0.5805. A signal confirming the decline will be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price securing above 0.6030, which will mean further growth to 0.6125. Meanwhile, the decline could be confirmed by a breakout of the lower boundary of the ascending channel with the price securing below 0.5905.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.