If you thought prices were rising faster than the BLS said, you were right. Let's discuss revisions.

On Friday, February 10, the BLS quietly revised the CPI higher for four of the past five months, with one month unchanged.

Here is the BLS Updated Seasonal Factors Announcement.

Each year with the release of the January CPI, seasonal adjustment factors are recalculated to reflect price movements from the just-completed calendar year. This routine annual recalculation may result in revisions to seasonally adjusted indexes for the previous 5 years. [And it did in spades] Recalculated seasonally adjusted indexes as well as recalculated seasonal adjustment factors for the period January 2018 through December 2022 were made available on Friday, February 10, 2023.

All Items as Reported and Revised

- December as Reported -0.1, As Revised +0.1

- November as Reported +0.1, As Revised +0.2

- October as Reported +0.4, As Revised +0.5

- September as Reported +0.4, As Revised +0.4

- August as Reported +0.1, As Revised +0.2

Hmm. It seems the bit of celebratory deflation in December didn't happen. Let's look further.

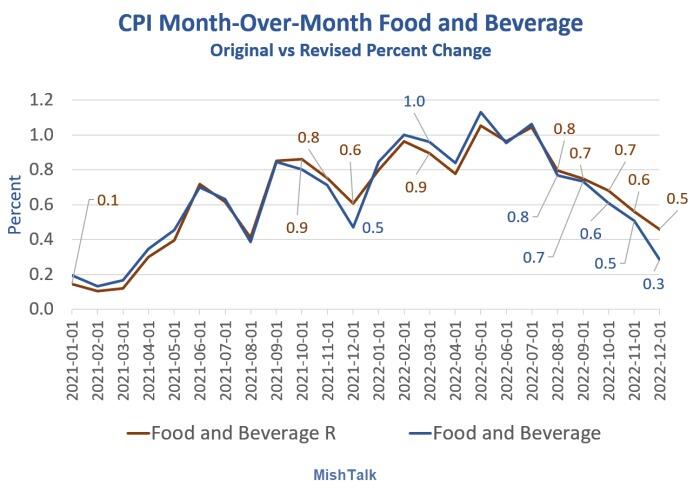

Food and Beverage Revisions

Food and Beverage Items as Reported and Revised

December as Reported +0.3, As Revised +0.5

November as Reported +0.5, As Revised +0.6

October as Reported +0.6, As Revised +0.7

Hmm. It seems the Thanksgiving Turkey you bought cost more than they said.

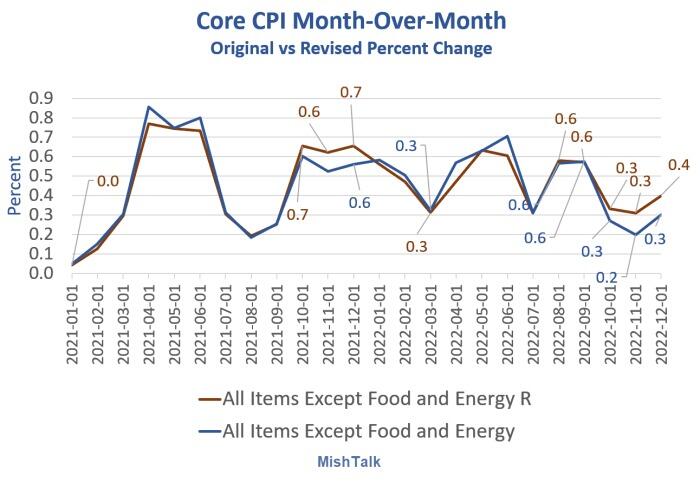

Core CPI Month-Over-Month

Core CPI as Reported and Revised

- December as Reported +0.3, As Revised +0.4

- November as Reported +0.2, As Revised +0.3

Core CPI is all items minus food and energy. Even that was up in the final two months of the year.

Smelly Revisions

Looking back to 2021, I also see a pattern of upward revisions late in the year.

Perhaps this all balances out. But even if so, revisions of this size are more than a bit smelly.

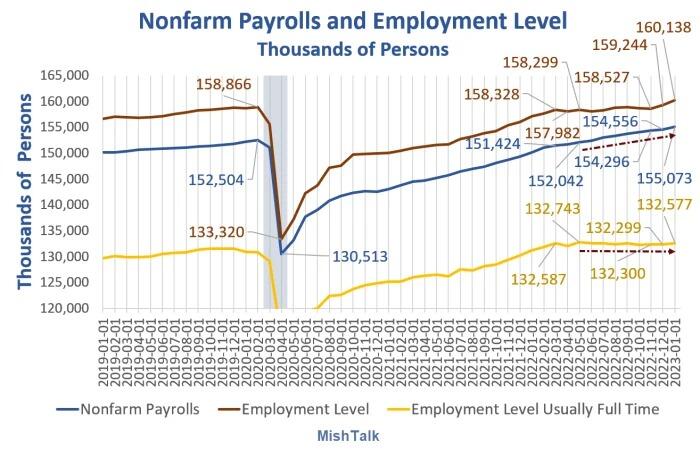

Expect Negative Job Revisions

Speaking of revisions, I have been expecting negative revisions on jobs given the massive discrepancy between employment and nonfarm payrolls.

For discussion please see Unemployment Rate Hits New Low of 3.4 Percent as Jobs and Employment Jump But...

Jobs and employment rose more than expected in January. But because of massive revisions, the BLS cautions all of its household data is full of errors.

Hmm. The BLS household data is full of errors too. Who coudda thunk?

And please note that of the alleged job increase of 894,000 in January, 810,000 was a population control revision.

Payrolls vs Employment Since May 2022

- Nonfarm Payrolls: +3,031,000

- Employment Level: +1,893,000

- Full Time Employment: -166,000

Employment and payroll revisions are a given. And they probably won't be pretty.

While we are at it, does anyone have a lot of faith in that fourth-quarter 2022 GDP report?

I smell revisions there too. And by the way, the 4th Quarter 2022 GDP Is Much Weaker Than Headline Numbers.

A 2022 recession is very much in play, although Some Believe It Will Be a Rolling Recession.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.