How to trade the Fed interest rate decision

The Federal Reserve (Fed) is the United States (US) central bank. A central bank usually provides financial and banking services for its country's government and commercial banking system.

It also issues the local currency and implements monetary policy. Each decision has a vast impact on the value of the local currency, and hence, Forex (FX)traders pay extreme attention to each announcement.

The Fed meets roughly every six weeks, or eight times a year, for two consecutive days, announcing its decision afterwards. The decision is made by a limited number of Fed officials, known as the Federal Open Market Committee (FOMC).

The Fed’s upcoming announcement is expected to be the most relevant of the year, given that the central bank is finally meant to change its monetary policy.

Does the Fed's decision provide opportunities for traders?

Indeed, the Fed’s decisions usually trigger volatility across financial markets.

Generally speaking, changes in the interest rate affect all companies and households. Simply put, higher rates lift money costs, resulting in restricted consumption. The Fed hikes rates when it wants to cool down consumption and, hence, inflation.

The opposite scenario is also valid. Lower rates tend to boost consumption and, therefore, economic growth.

At the same time, hiking rates usually result in a stronger currency, in this case, the US Dollar (USD), while trimming them usually weakens the currency.

There is, however, one caveat: Market players usually anticipate the decision and price it in, in this case, selling the USD in anticipation of the announcement.

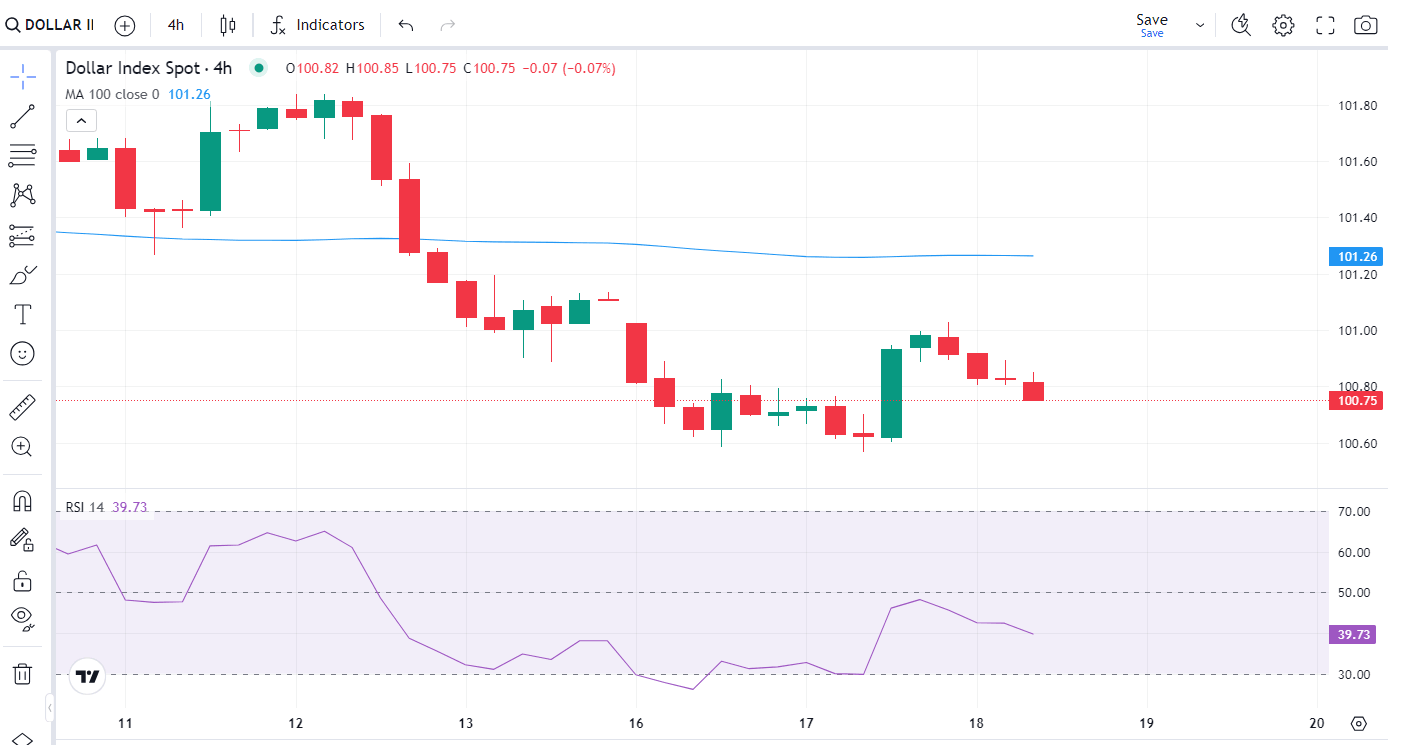

The DXY US Dollar Index, which gauges the value of the US Dollar against a basket of major currencies, has fallen in the days ahead of the Fed meeting as investors broadly expect the central bank to cut interest rates.

Volatility within this kind of event is usually linked to the deviation between the market’s expectation and the actual decision.

What is expected the Fed will do in the upcoming September meeting?

Before the announcement, investors have priced in a 25 basis points (bps) cut. Some market participants even believe the Fed will go for a more aggressive trim of 50 bps.

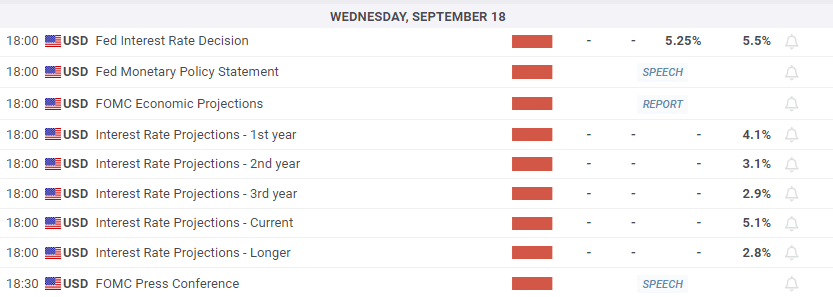

Besides the decision itself, the Fed will release the Summary of Economic Projections (SEP), a report that provides insights into the economic outlook and expectations of the FOMC members.

The document provides officials' perspectives on key economic figures, such as Real GDP Growth, the Unemployment Rate and Inflation. Additionally, the SEP projects the federal funds rate, which is the interest rate at which banks lend to each other.

The SEP does not grant future action or levels of economic improvement, it just outlines policymakers’ perspectives on them.

The SEP is the second most relevant factor. In fact, if the Fed delivers a rate cut as expected, it is the one that can actually trigger a volatile reaction in the USD. Once again, the higher the surprise, the more wild the reaction across the FX board.

Summary of Economic Projections from June. Source: Federal Reserve

In this case, investors are anticipating a dovish bias, that is, a conservative document hinting at additional rate cuts in the months to come. A huge surprise would be if officials, Chairman Jerome Powell included, adopt a hawkish stance by signaling that the rate cut is a one-off thing rather than the beginning of a trend towards lower rates.

Finally, the Fed will publish the Monetary Policy Statement, a resume of how and why policymakers came to the announced decision.

What are the different scenarios and how to trade September's Fed decision?

As said, the USD reaction will depend on Fed’s ability to surprise investors.

Interest rates will trigger the initial reaction. If policymakers keep rates on hold, that would be an unexpected outcome and be read as hawkish, resulting in the US Dollar soaring across the FX board.

Officials, however, are unlikely to proceed this way, as they usually refrain from triggering volatile markets’ reactions.

A 25 bps trim could put some pressure on the USD, while a larger 50 bps could put the USD on a bearish path.

Speculative interest, however, will quickly jump into economic projections. If the Fed sounds worried about growth and downwardly revises its outlook, it will deliver a dovish message.

Main events related to the September’s Federal Reserve decision. Source: FXStreet

Given that some dovishness is what investors expect, the USD could fall. Yet, once again, the reaction will be far less relevant than the one that could be seen on a hawkish stance.

Generally speaking, and unless the message is super clear from all sides, the market would take some 15 minutes to find its way. The initial reaction could be wiped out, and the USD could change course pretty fast afterwards.

Once the dust settles, and if there is a clear path for the Greenback, the most likely scenario is that such directional move will resume once Asian traders reach their desks.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.