How to trade NFP, one of the most volatile events

NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world.

The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month. The release rocks financial markets for a long time, generally impacting the prices of stocks, Gold, the US Dollar (USD) and many other assets.

This makes it one of the best chances for traders to make a profit, albeit carrying its own set of risks.

Do NFP data provide opportunities for traders?

Yes, plenty.

Nonfarm Payrolls are a critical indicator of the economic health of the United States, which is the world’s largest economy.

Trading around an NFP release is volatile and can be risky because almost all assets tend to move sharply in a matter of minutes, sometimes seconds. While some traders prefer to remain on the sidelines during the event, others find opportunities amid these market swings.

Several hours after the data is released, markets close for the week. Therefore, traders – especially those in the large financial hub of London – have little time to react to the data. This fact adds to the rush and the high volatility.

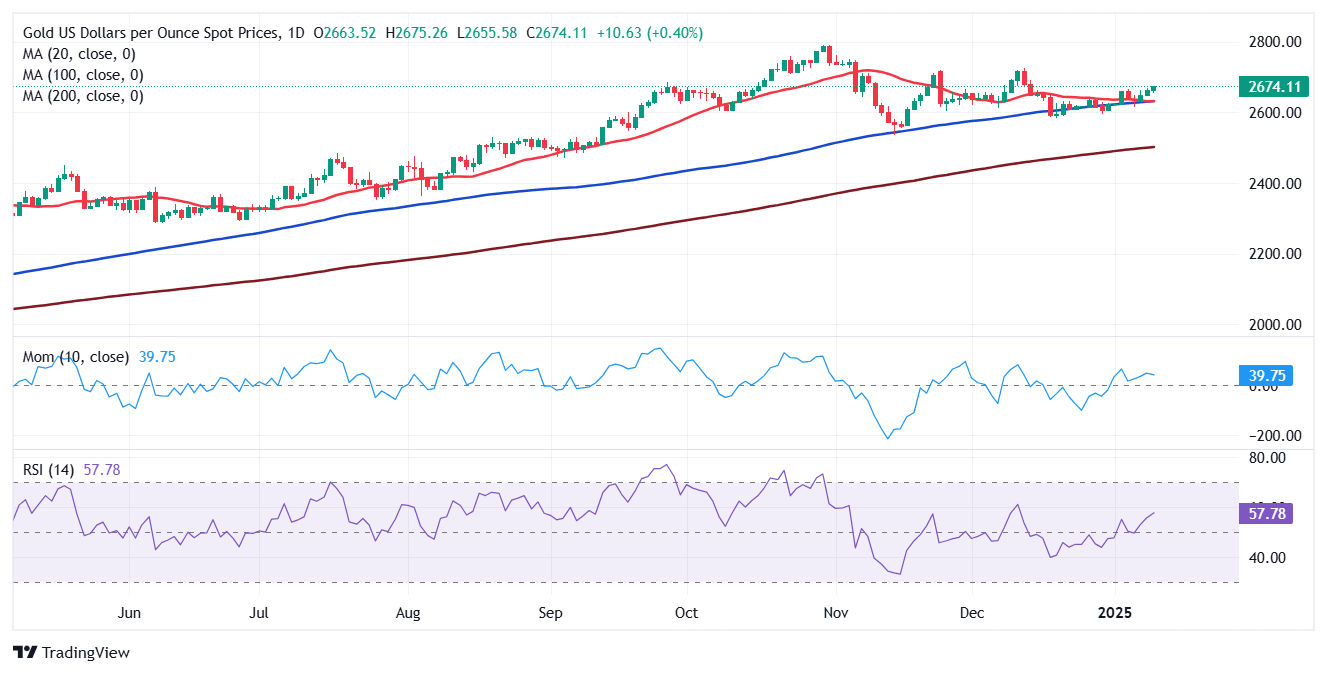

Gold price (XAU/USD) ahead of NFP

How to trade NFP?

The data comes along with many other indicators. When trading, it is essential to know that the first impact belongs to the headline Nonfarm Payrolls figure – the change in the number of jobs. It is expressed in thousands, and it can be positive or negative.

A positive print means that the US economy created new jobs over the month, while a negative one means that employers, on average, shed jobs.

A few days before the publication of the data, dozens of economists and analysts present their estimates of how many jobs they think the US economy created (or destroyed) over the month, forming a consensus.

Any significant deviation from this consensus – how far or close to the actual figure is from what was expected – usually becomes the main factor moving markets.

It is difficult to predict how markets will react, but generally, NFP data that comes above the consensus tends to push shares of US stocks higher as it can imply higher company profits going forward.

However, the context is also important: when interest rates are rising, investors fear that a strong economy will mean even higher rates. In such a case, stock prices may fall despite the economic strength that the indicator implies.

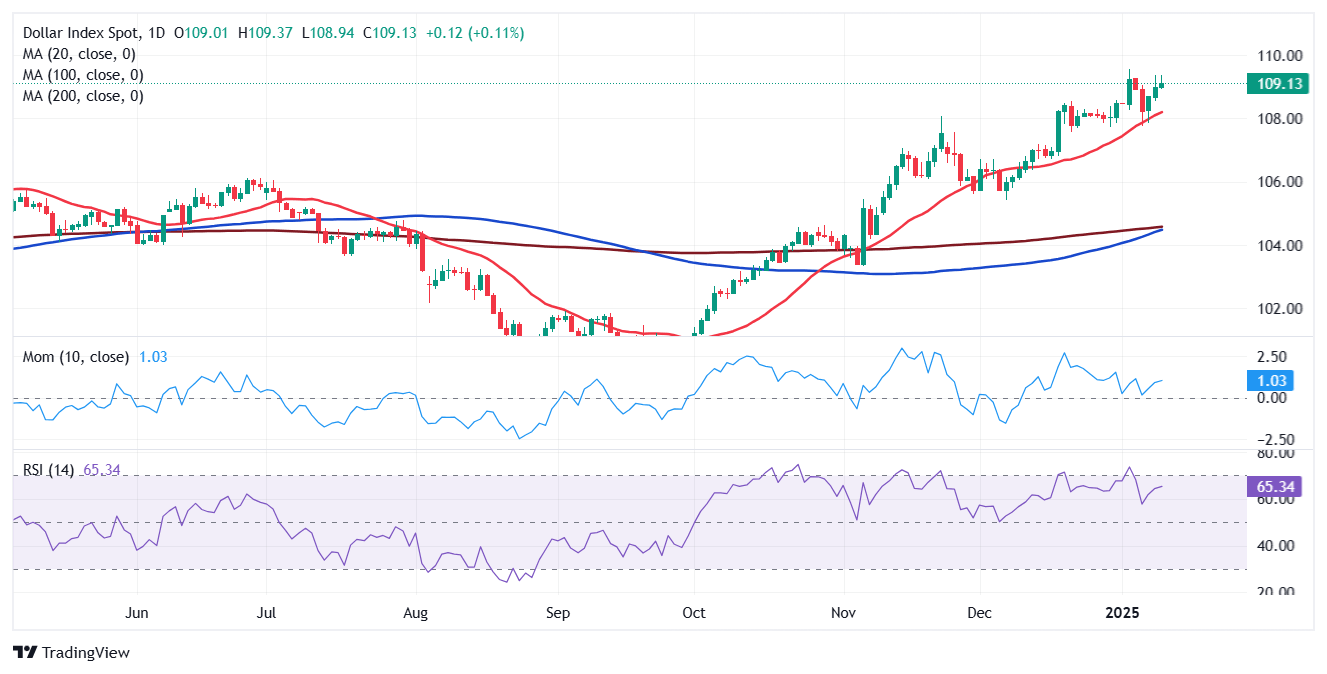

As for the US Dollar, the reaction is mostly straightforward. A report showing a resilient labor market is generally bullish for the USD as it means a strong economy. On the contrary, a weak report means a softer economy, weighing on the Greenback.

The valuation of the DXY US Dollar Index, which measures the value of the US Dollar against a basket of foreign currencies.

The valuation of the DXY US Dollar Index, which measures the value of the US Dollar against a basket of foreign currencies.

However, the US economy leads the world and the US Dollar is the world's reserve currency.

That makes the US Dollar's reaction different in times of crisis. If the US economy is struggling, it means other places are doing even worse. A weak NFP report causes people to flee to the safety of the US Dollar. In other words, when things are bad, the US Dollar can also gain.

For Gold, an NFP report showing a higher-than-expected increase in jobs tends to lead to price declines. On the contrary, a downside surprise – meaning that the economy has created fewer jobs than expected or has even destroyed jobs – supports price increases for the yellow metal.

Apart from the headline NFP, which data do I need to look at?

The headline NFP data is included in the so-called Employment Report.

This includes plenty of other statistics to which traders also pay attention. While the Nonfarm Payrolls headline change causes the first big reaction in markets, the nuances that bring other indicators need to be taken into account once the dust settles as these could even fully unwind the first reaction.

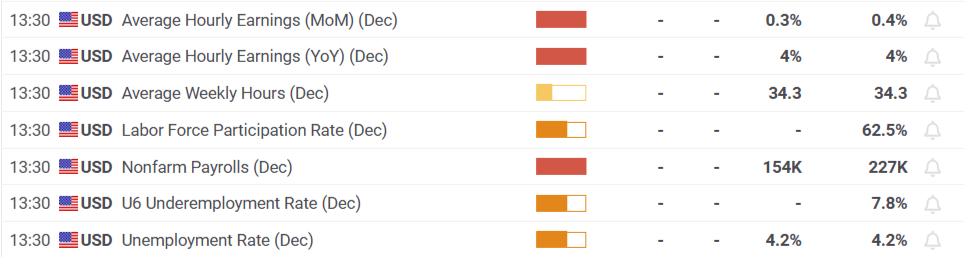

Two more components worth watching. The first one is Average Hourly Earnings, particularly when inflation is high, as these reflect changes in salaries.

When people make more money, higher inflation tends to follow.

When pay falls, price rises tend to moderate.

The second component worth examining is the Unemployment Rate. When markets are worried about an economic recession – when the economy doesn’t grow –, they check out every change in the jobless rate because a quick increase in the Unemployment Rate is an early sign of a recession.

And that’s not all.

In some cases, the NFP report for the current month includes significant revisions for previous months. While markets are focused on the most recent figures, significant upward revisions make the report look better, and considerable downward revisions make the response worse.

Expected outcomes of the December NFP report, according to FXStreet.com macroeconomic calendar.

What is expected for December NFP data?

The FXStreet economic calendar points to an increase of 160,000 jobs in December, easing modestly from the 227,000 gained in November, yet still a solid figure.

FXStreet covers Nonfarm Payrolls live, providing insights about all the components and their impact in each and every release.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.