NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world.

The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month. The release rocks financial markets for a long time, generally impacting the prices of stocks, Gold, the US Dollar (USD) and many other assets.

This makes it one of the best chances for traders to make a profit, albeit carrying its own set of risks.

Do NFP data provide opportunities for traders?

Yes, plenty.

Nonfarm Payrolls are a critical indicator of the economic health of the United States, which is the world’s largest economy.

Trading around an NFP release is volatile and can be risky because almost all assets tend to move sharply in a matter of minutes, sometimes seconds. While some traders prefer to remain on the sidelines during the event, others find opportunities amid these market swings.

Several hours after the data is released, markets close for the week. Therefore, traders – especially those in the large financial hub of London – have little time to react to the data. This fact adds to the rush and the high volatility.

Gold price (XAU/USD) fell sharply on October 4 within the first 30 minutes after the NFP release, when the data beat estimates. However, traders quickly turned around afterward and Gold recovered its pre-NFP-release price around two hours later.

How to trade NFP?

The data comes along with many other indicators. When trading, it is essential to know that the first impact belongs to the headline Nonfarm Payrolls figure – the change in the number of jobs. It is expressed in thousands, and it can be positive or negative.

A positive print means that the US economy created new jobs over the month, while a negative one means that employers on average shed jobs.

A few days before the publication of the data, dozens of economists and analysts present their estimates of how many jobs they think the US economy created (or destroyed) over the month, forming a consensus.

Any significant deviation from this consensus – how far or close to the actual figure is from what was expected – usually becomes the main factor moving markets.

It is difficult to predict how will markets react, but generally NFP data that comes above the consensus tends to push shares of US stocks higher as it can imply higher company profits going forward.

However, the context is also important: when interest rates are rising, investors fear that a strong economy will mean even higher rates. In such a case, stock prices may fall despite the economic strength that the indicator implies.

As for the US Dollar, the reaction is mostly straightforward. A report showing a resilient labor market is generally bullish for the USD as it means a strong economy. On the contrary, a weak report means a softer economy, weighing on the Greenback.

The valuation of the DXY US Dollar Index, which measures the value of the US Dollar against a basket of foreign currencies, surged on October 4 within the following hour after the NFP release. This happened after the data beat estimates in almost all of its components.

However, the US economy leads the world and the US Dollar is the world's reserve currency.

That makes the US Dollar's reaction different in times of crisis. If the US economy is struggling, it means other places are doing even worse. A weak NFP report causes people to flee to the safety of the US Dollar. In other words, when things are bad, the US Dollar can also gain.

For Gold, a NFP report that shows a higher-than-expected increase in jobs tends to lead to price declines. On the contrary, a downside surprise – meaning that the economy has created fewer jobs than expected or has even destroyed jobs – supports price increases for the yellow metal.

Apart from the headline NFP, which data do I need to look at?

The headline NFP data is included in the so-called Employment Report.

This includes plenty of other statistics to which traders also pay attention. While the Nonfarm Payrolls change causes the first big reaction in markets, the nuances that bring other indicators need to be taken into account once the dust settles as these could even fully unwind the first reaction.

Two more components worth watching. The first one is Average Hourly Earnings, particularly when inflation is high, as these reflect changes in salaries.

When people make more money, higher inflation tends to follow.

When pay falls, price rises tend to moderate.

The second component worth examining is the Unemployment Rate. When markets are worried about an economic recession – when the economy doesn’t grow –, they check out every change in the jobless rate because a quick increase in the Unemployment Rate is an early sign of a recession.

And that’s not all.

In some cases, the NFP report for the current month includes significant revisions for previous months. While markets are focused on the most recent figures, significant upward revisions make the report look better and considerable downward revisions make the response worse.

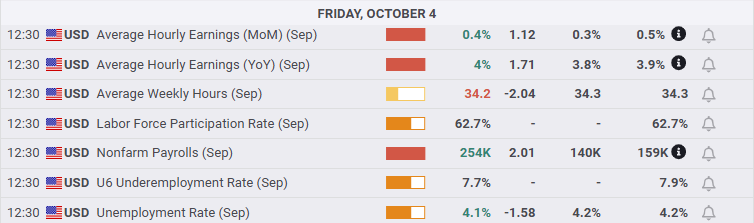

On October 4, almost all components of the US employment report beat economists’ expectations (green), and the previous months’ data was upwardly revised. Markets took the report as a very strong one.

Is there any reasonable strategy to trade NFP data for October?

The FXStreet economic calendar points to an increase of 113,000 jobs, way below the 254,000 that were created in September. There are three scenarios depending on the outcome:

1) Within expectations (113K-140K, Unemployment Rate stable at 4.1%)

An as-expected Nonfarm Payrolls report would allow Gold to extend its bullish run, albeit gradually. Stocks would edge up on a "Goldilocks" scenario of a strong economy and falling interest rates. The US Dollar (USD) would remain stable.

2) Above expectations (140K or more, Unemployment Rate down to 4% or lower)

Initial reaction: A better-than-expected jobs report would hurt Gold, as it means higher interest rates. Stocks would rise, as a robust economy is positive for company profits, while interest rates are set to fall in any case. The US Dollar would rise on prospects of a higher path of interest rates.

Second reaction: Once the dust settles, markets may look at the political implications ahead of the US presidential election. Such figures would help Vice President Kamala Harris, but not enough for a Democratic sweep, which has low chances anyway. Still, lower chances of a Donald Trump victory mean no new big tariffs, which means a lower path for interest rates. That is bullish for Stocks and Gold, and bearish for the US Dollar.

3) Below expectations (Less than 113K, Unemployment Rate up to 4.2% or higher)

Initial reaction: A terrible jobs report would send Gold up as it means lower rates. It would weigh on the US Dollar, and hurt Stocks on worsening prospects for the US economy.

Second reaction: Such a disappointment has political implications, increasing the chance Republicans win a clean sweep. That means that while would enact tariffs, his party would push for big tax cuts. Prospects of a "red wave" are bullish for stocks and Gold. The drop of the US Dollar would stall due to expectations of higher rates, a result of an increase in inflation.

FXStreet covers Nonfarm Payrolls live, providing insights about all the components and their impact in each and every release.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Buyers retake 0.6350 after Chinese GDP data

AUD/USD picks up fresh bids and retakes 0.6350 in Asian trading on Wednesday. The pair finds fresh demand after Chinese Q1 GDP beat estimaes with 5.4% YoY while Retail Sales and Industrial Production data also exceeded expectations. However, the further upside could be capped by US-China trade woes ahead of Powell.

Gold price hangs close to all-time highs at $3,275

Gold price holds the advannce to record another all-time high at $3,275 per troy ounce in the Asian session on Wednesday. Safe-haven demand amid US President Donald Trump's uncertain tariff plans, softer US Dollar and prospects of further easing by the Federal Reserve provide some support to the yellow metal.

USD/JPY stays pressured toward 142.50 amid renewed US Dollar selling

USD/JPY turns south toward 142.50 and remains close to a multi-month low touched last week. Tariff-driven uncertainty continued to weigh on the US Dollar. Adding to this hope for a US-Japan trade deal, the divergent BoJ-Fed policy expectations and a softer risk tone underpin the safe-haven Japanese Yen.

Binance and KuCoin traders panic as Amazon Web Service outage halts Crypto withdrawals

On Monday, a technical outage from Amazon Web Services temporarily halted operations at top cryptocurrency exchanges, including Binance and KuCoin. The outage disrupted withdrawals and trading services, sparking major concerns among cryptocurrency traders.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.