NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world.

The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month. The release rocks financial markets for a long time, generally impacting the prices of stocks, Gold, the US Dollar (USD), and many other assets.

This makes it one of the best chances for traders to make a profit, albeit carrying its own set of risks.

Do NFP data provide opportunities for traders?

Yes, plenty.

Nonfarm Payrolls are a critical indicator of the economic health of the United States, which is the world’s largest economy.

Trading around an NFP release is volatile and can be risky because almost all assets tend to move sharply in a matter of minutes, sometimes seconds. While some traders prefer to remain on the sidelines during the event, others find opportunities amid these market swings.

Several hours after the data is released, markets close for the week. Therefore, traders – especially those in the large financial hub of London – have little time to react to the data. This fact adds to the rush and the high volatility.

The valuation of the EUR/USD pair surged on August 2 within the following hour after the NFP release, when the data came in below estimates. This is because the outcome wasn’t good for the US Dollar, so it propelled the EUR/USD major.

How to trade NFP?

The data comes along with many other indicators. When trading, it is essential to know that the first impact belongs to the headline Nonfarm Payrolls figure – the change in the number of jobs. It is expressed in thousands, and it can be positive or negative.

A positive print means that the US economy created new jobs over the month, while a negative one means that employers on average shed jobs.

A few days before the publication of the data, dozens of economists and analysts present their estimates of how many jobs they think the US economy created (or destroyed) over the month, forming a consensus.

Any significant deviation from this consensus – how far or close to the actual figure is from what was expected – usually becomes the main factor moving markets.

It is difficult to predict how will markets react, but generally NFP data that comes above the consensus tends to push shares of US stocks higher as it can imply higher company profits going forward.

However, the context is also important: when interest rates are rising, investors fear that a strong economy will mean even higher rates. In such a case, stock prices may fall despite the economic strength that the indicator implies.

As for the US Dollar, the reaction is mostly straightforward. A report showing a resilient labor market is generally bullish for the USD as it means a strong economy. On the contrary, a weak report means a softer economy, weighing on the Greenback.

However, the US economy leads the world and the US Dollar is the world's reserve currency.

That makes the US Dollar's reaction different in times of crisis. If the US economy is struggling, it means other places are doing even worse. A weak NFP report causes people to flee to the safety of the US Dollar. In other words, when things are bad, the US Dollar can also gain.

For Gold, a NFP report that shows a higher-than-expected increase in jobs tends to lead to price declines. On the contrary, a downside surprise – meaning that the economy has created fewer jobs than expected or has even destroyed jobs – supports price increases for the yellow metal.

Gold price (XAU/USD) surged on August 2 within the first 20 minutes after the NFP release, when the data came in below estimates. However, traders quickly turned around afterwards and opted to take profits.

Apart from the headline NFP, which data do I need to look at?

The headline NFP data is included in the so-called Employment Report.

This includes plenty of other statistics to which traders also pay attention. While the Nonfarm Payrolls change causes the first big reaction in markets, the nuances that bring other indicators need to be taken into account once the dust settles as these could even fully unwind the first reaction.

Two more components worth watching. The first one is Average Hourly Earnings, particularly when inflation is high, as these reflect changes in salaries.

When people make more money, higher inflation tends to follow.

When pay falls, price rises tend to moderate.

The second component worth examining is the Unemployment Rate. When markets are worried about an economic recession – when the economy doesn’t grow –, they check out every change in the jobless rate because a quick increase of the Unemployment Rate is an early sign of a recession.

And that’s not all.

In some cases, the NFP report for the current month includes significant revisions for previous months. While markets are focused on the most recent figures, significant upward revisions make the report look better and considerable downward revisions make the response worse.

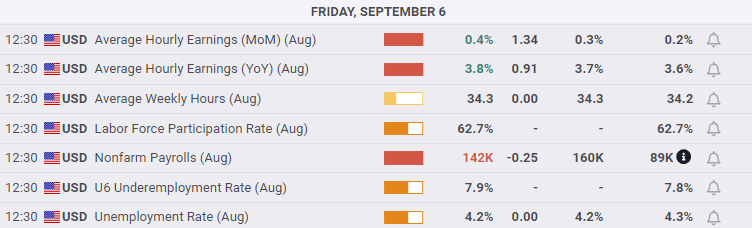

On September 6, the headline NFP gain came in below what economists expected (red) and previous months’ data were downwardly revised. Even as the wages component rose more than expected (green), markets broadly took the report as weak.

Is there any reasonable strategy to trade NFP data for September?

The FXStreet economic calendar points to an increase of 140,000 jobs. There are five scenarios depending on the outcome:

1) Within expectations (130K-150K)

If economists nailed it, speculation about interest rate cuts will continue, and pessimism might eventually win. Why? Federal Reserve Chair Jerome Powell cooled expectations for further aggressive moves, the Middle East conflict is intensifying and the enthusiasm from Chinese stimulus has faded.

I expect an initial whipsaw and then for a trend to emerge: Gold bearish on fading rate cut expectations, US Dollar bullish on the risk-off mood, and Stocks bearish, extending the weekly trend.

2) Moderately above expectations (150-180K)

Stronger job growth may push the Fed toward a smaller rate cut, but that would not be a done deal just yet. The good news is that recession fears are exaggerated. This is a "Goldilocks" scenario: not too hot, nor too cold.

I expect Gold bearish on rate fears, US Dollar bullish on stronger data, and stocks bullish on better economic growth prospects.

3) Significantly above estimates (above 180K)

An excellent jobs report would be great news for the US, but may disappoint markets which want a rate cut.

I expect Gold bearish on fears of higher rates, US Dollar bullish to rise on strong data, and stocks bearish, as rate fears could win over economic optimism.

4) Moderately below expectations (100K-130K)

A disappointing jobs report would raise expectations for a 50 bps rate cut, and would cause some worry, but not too much.

In this case, Gold bullish on falling yields, US Dollar bearish on weaker data, and stocks bearish on economic concerns.

5) Significantly below estimates (below 100K)

An increase of fewer than 100K jobs would be alarming, raising concerns of a recession.

I expect Gold strongly bullish on expectations for lower rates, US Dollar bullish on safe-haven flows as fears about the global economy would rise, and stocks bearish on fears of a downturn.

FXStreet covers Nonfarm Payrolls live, providing insights about all the components and their impact in each and every release.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.