How to trade NFP, one of the most volatile events

NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world.

The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month. The release rocks financial markets for a long time, generally impacting the prices of stocks, Gold, the US Dollar (USD) and many other assets.

This makes it one of the best chances for traders to make a profit, albeit carrying its own set of risks.

Do NFP data provide opportunities for traders?

Nonfarm Payrolls are a critical indicator of the economic health of the United States, which is the world’s largest economy.

Trading around an NFP release is volatile and can be risky because almost all assets tend to move sharply in a matter of minutes, sometimes seconds. While some traders prefer to remain on the sidelines during the event, others find opportunities amid these market swings.

Several hours after the data is released, markets close for the week. Therefore, traders – especially those in the large financial hub of London – have little time to react to the data. This fact adds to the rush and the high volatility.

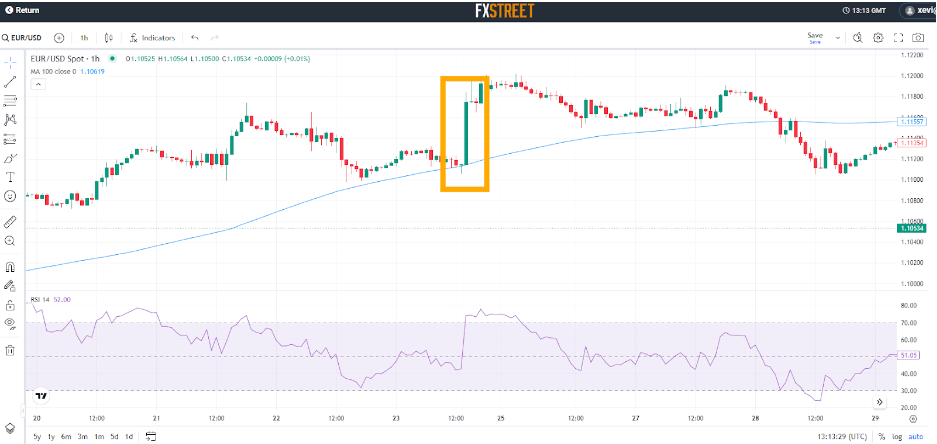

The valuation of the EUR/USD pair surged on August 2 within the following hour after the NFP release, when the data came in below estimates. This is because the outcome wasn’t good for the US Dollar, so it propelled the EUR/USD major.

How to trade NFP?

A positive print means that the US economy created new jobs over the month, while a negative one means that employers on average shed jobs.

A few days before the publication of the data, dozens of economists and analysts present their estimates of how many jobs they think the US economy created (or destroyed) over the month, forming a consensus.

Any significant deviation from this consensus – how far or close to the actual figure is from what was expected – usually becomes the main factor moving markets.

It is difficult to predict how will markets react, but generally NFP data that comes above the consensus tends to push shares of US stocks higher as it can imply higher company profits going forward.

However, the context is also important: when interest rates are rising, investors fear that a strong economy will mean even higher rates. In such a case, stock prices may fall despite the economic strength that the indicator implies.

As for the US Dollar, the reaction is mostly straightforward. A report showing a resilient labor market is generally bullish for the USD as it means a strong economy. On the contrary, a weak report means a softer economy, weighing on the Greenback.

However, the US economy leads the world and the US Dollar is the world's reserve currency.

That makes the US Dollar's reaction different in times of crisis. If the US economy is struggling, it means other places are doing even worse. A weak NFP report causes people to flee to the safety of the US Dollar. In other words, when things are bad, the US Dollar can also gain.

For Gold, a NFP report that shows a higher-than-expected increase in jobs tends to lead to price declines. On the contrary, a downside surprise – meaning that the economy has created fewer jobs than expected or has even destroyed jobs – supports price increases for the yellow metal.

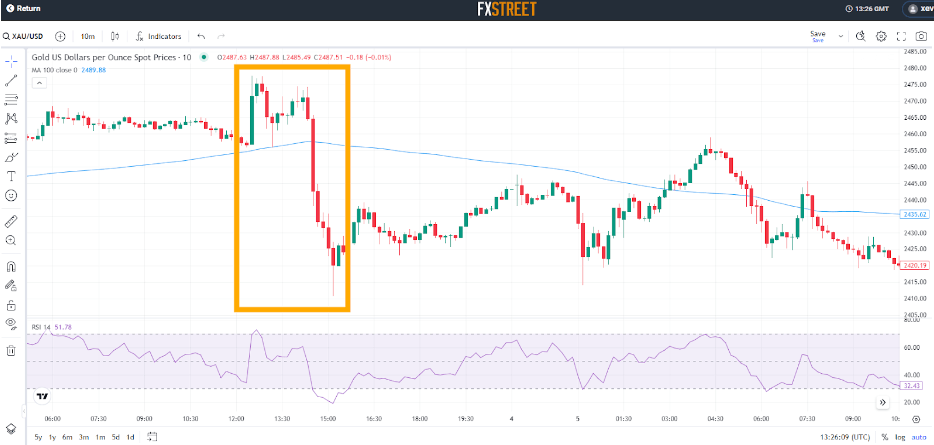

Gold price (XAU/USD) surged on August 2 within the first 20 minutes after the NFP release, when the data came in below estimates. However, traders quickly turned around afterwards and opted to take profits.

Apart from the headline NFP, which data do I need to look at?

This includes plenty of other statistics to which traders also pay attention. While the Nonfarm Payrolls change causes the first big reaction in markets, the nuances that bring other indicators need to be taken into account once the dust settles as these could even fully unwind the first reaction.

Two more components worth watching. The first one is Average Hourly Earnings, particularly when inflation is high, as these reflect changes in salaries.

When people make more money, higher inflation tends to follow.

When pay falls, price rises tend to moderate.

The second component worth examining is the Unemployment Rate. When markets are worried about an economic recession – when the economy doesn’t grow –, they check out every change in the jobless rate because a quick increase of the

Unemployment Rate is an early sign of a recession.

And that’s not all.

In some cases, the NFP report for the current month includes significant revisions for previous months. While markets are focused on the most recent figures, significant upward revisions make the report look better and considerable downward revisions make the response worse.

-638610554127911938.png&w=1536&q=95)

On August 2, almost all main indicators in the NFP report came in below what economists expected (red), so the market took it as a weak report.

Is there any reasonable strategy to trade NFP data for August?

The NFP data for August is particularly important because the US Federal Reserve (Fed), the country’s central bank, has said that almost for sure will cut interest rates in September.

But investors are wondering if the Fed will opt to cut rates at a “normal” pace or if it will decide to go big and implement a larger cut.

So the Fed cares about the labor market? Yes, because apart from controlling inflation its mandate is to “promote maximum employment.”

The NFP data holds the key to this because July’s data was poor: only 114,000 jobs were gained in America. Another soft result for August would put further doubts over the labor market's health, making the Fed more likely to go for the large interest-rate cut scenario because lower interest rates help the economy grow faster and thus create more jobs.

Economists expect that Nonfarm Payrolls will increase by 160,000 in August, more than in July. Here are some scenarios of how the main assets could move depending on the NFP outcome:

- Investors desire an outcome of 150,000-200,000, which would weigh on the US Dollar while boosting Gold and stocks.

- A larger increase of 200,000 to 250,000 jobs would buoy the US Dollar and weigh on Gold, but not so much.

- A blockbuster 250,000 or more would mean the labor market is still very good, causing some to doubt the Fed will cut interest rates significantly in the next few months. This scenario would send stocks and Gold lower while supporting the US Dollar.

- A 100,000 to 150,000 figure would be somewhat disappointing, but it would increase the chances of a big interest-rate cut, boosting Gold and hurting the US Dollar. Stocks would skid, but not collapse.

- Any reading below 100,000 would cause recession worries. While Gold would benefit, the US Dollar could stage a rally triggered by safe-haven flows. Stocks would shiver.

FXStreet covers Nonfarm Payrolls live, providing insights about all the components and their impact in each and every release.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.