How to show who is boss

S2N spotlight

In order to show China who’s boss, we’re going to reduce our tariffs.

This has to be one of the most chaotic negotiations of all time. Stakes couldn’t be higher, yet the contradictory messages continue to fly thick and fast. If I were China, I would sit tight and wait for Trump to offer a subsidy.

I am prepared to put money on it Scott Bessent, the Treasury Secretary, will be gone before the end of the year. I think he will dump Trump before Trump dumps him. Tariffs are dumping, wow, so much dumping. What do I base my prediction on? Trump contradicts almost everything Bessent says. The Treasury Secretary’s latest tiff with Elon Musk about him saying a lot more than he is doing is just a projection of the frustration he is feeling towards the big boss. That is just one of my brain dumps.

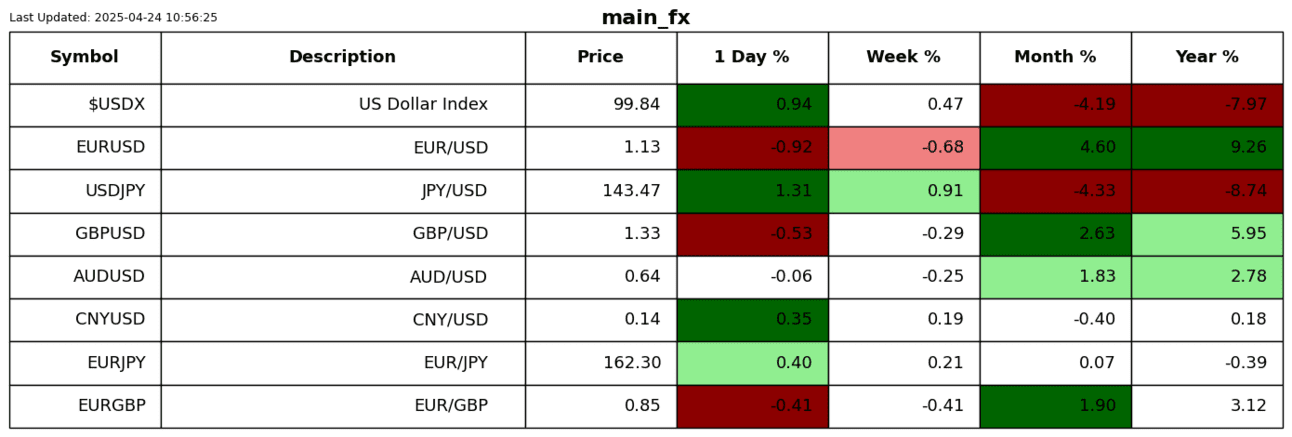

One of the classic safe havens I haven’t been paying that much attention to is the Swiss Franc. You can see in the chart below that over the last year it has led the way in performance amongst some of the major currencies.

What further amplifies the Swiss Franc’s safe haven status is that it has outperformed the US dollar despite a significant interest rate differential, which should be acting as a headwind.

S2N observations

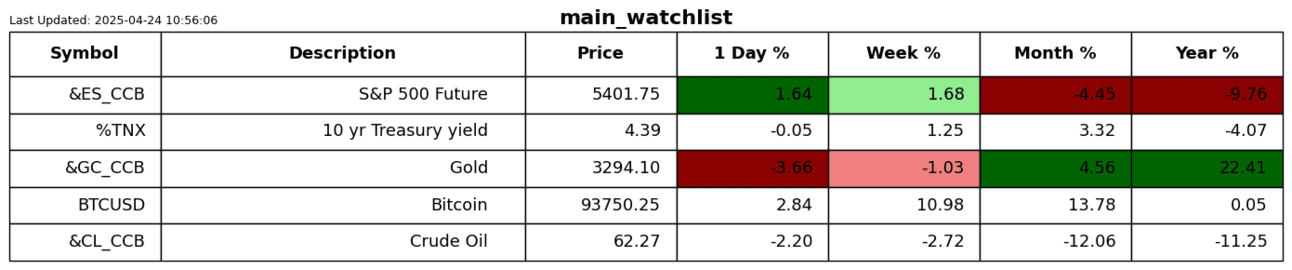

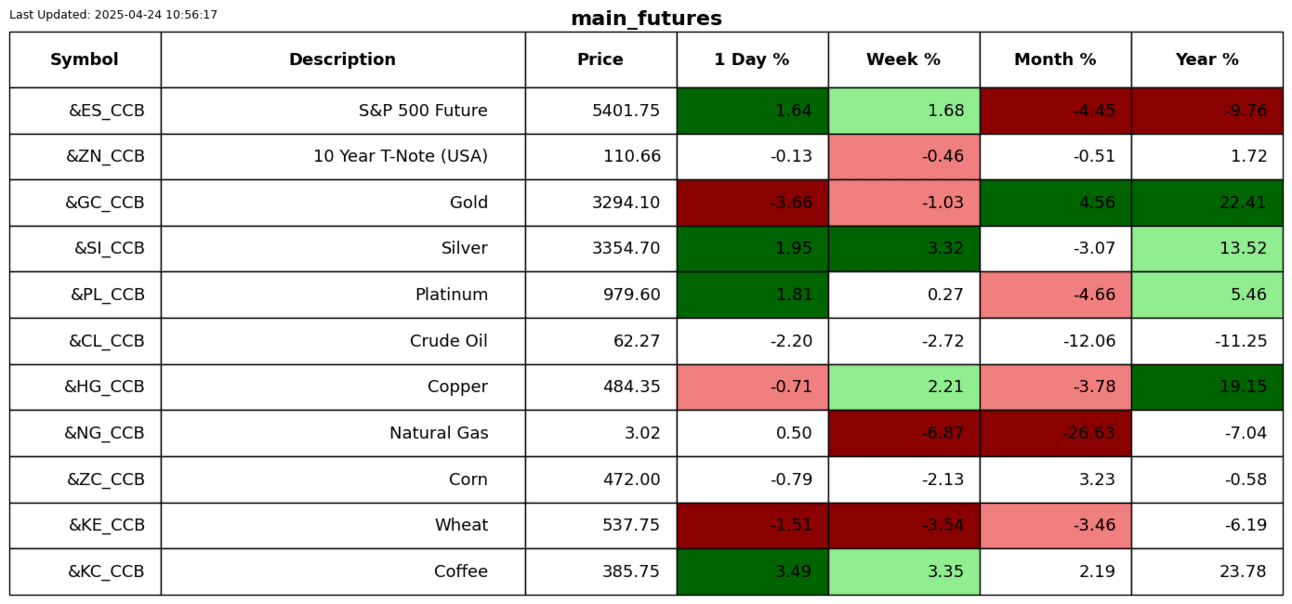

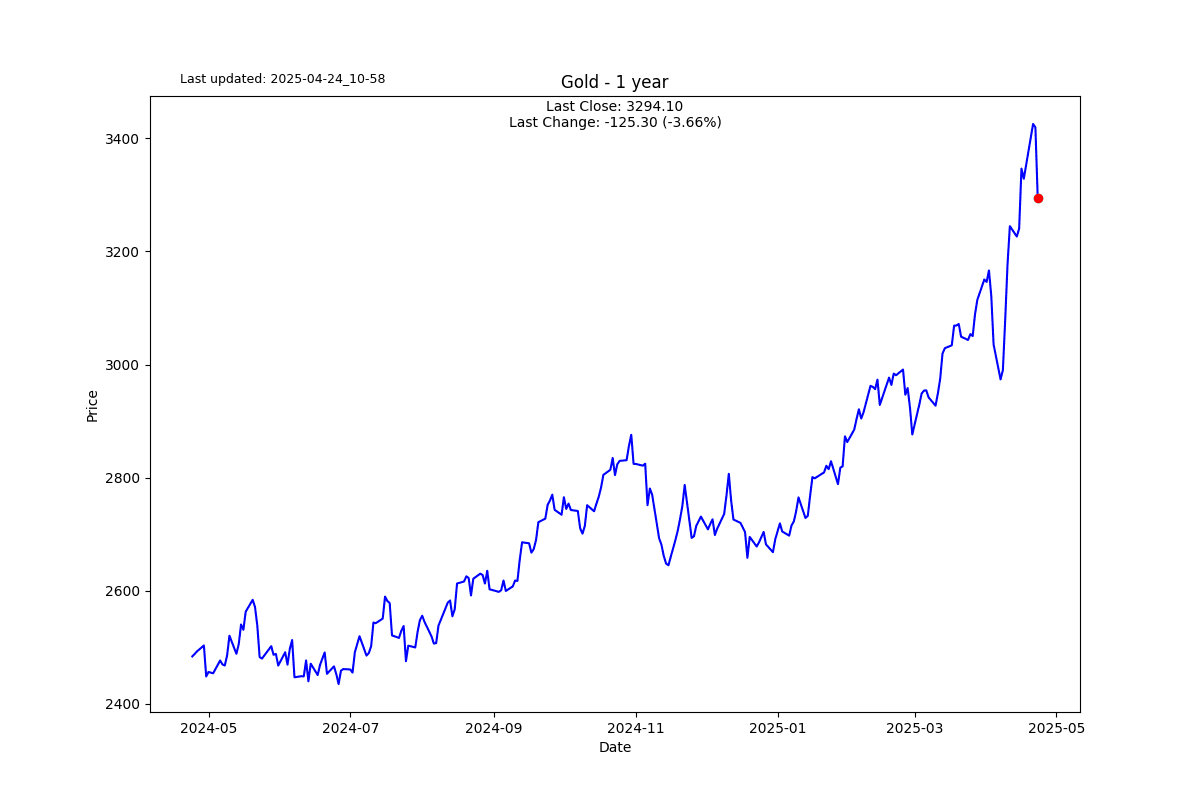

It turns out my call that gold was due a pullback was spot-on. Gold dropped more than 3% yesterday, which saw the total assets for the GLD ETF under management drop below the $100 billion mark, with -2.54 billion in outflows.

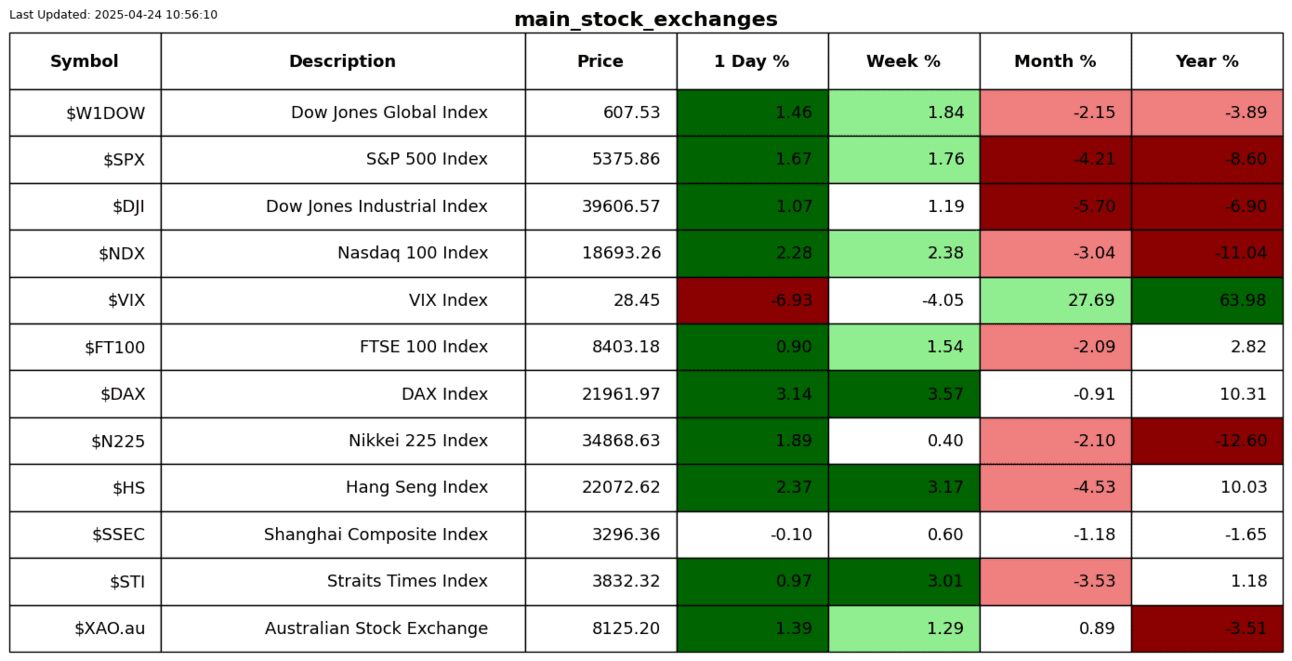

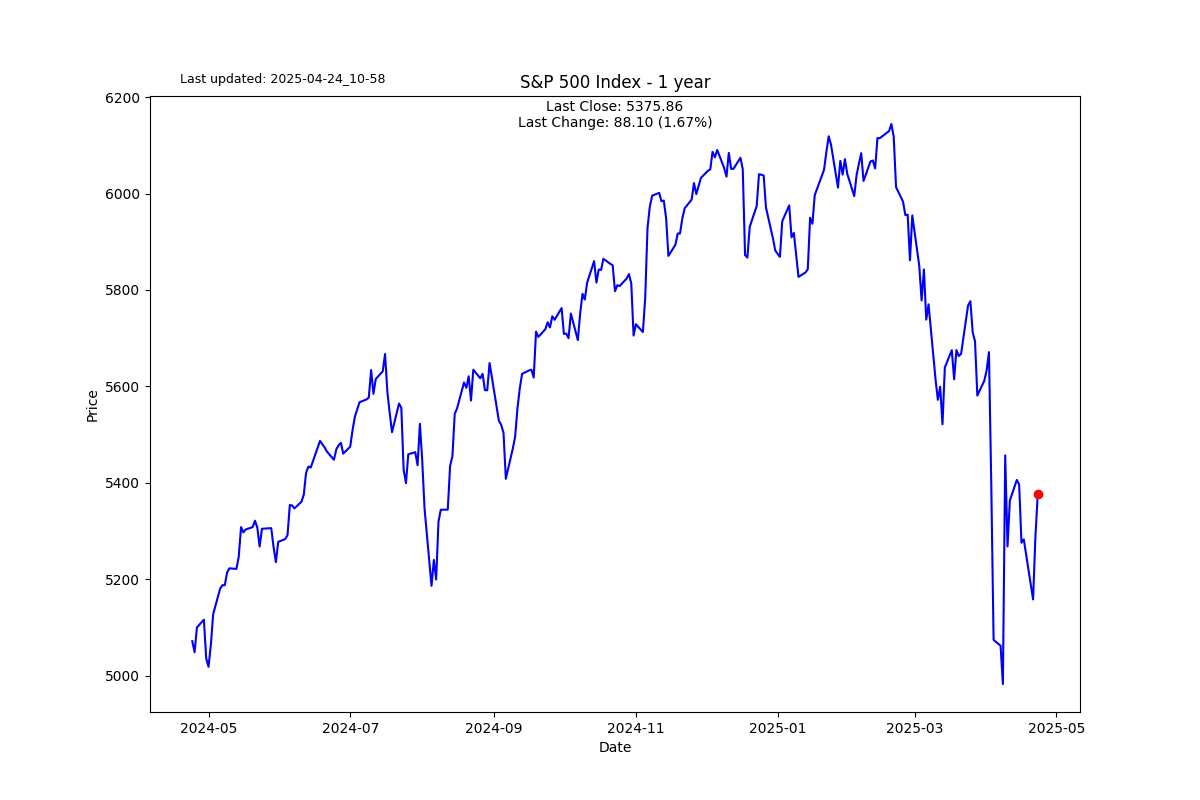

I was going through some of my charts, and this one stuck out. Markets have been so wild lately that many of us, me included, are looking at price action far too frequently. The 200-day moving average is a very solid trend-following indicator.

As you can see, the S&P 500, the Dow Industrial, and the Nasdaq are all well into a bearish trend, some distance below their 200-day moving averages.

Here is a slightly different take; you can see the S&P 500 against its own 50, 100, & 200-day moving averages. It is still below all 3.

Furthermore, to get a sense of the breadth in the underlying companies comprising the S&P 500 index, you can see the % of stocks above their 50, 100, & 200-day moving averages.

In summary, it is a weak market.

Over the last 50 years, gold has significantly outperformed silver. The truth is almost all the outperformance has come since silver made an all-time high in 2011. There are many, me included, who think that silver is likely to play catch-up and outperform gold in the next few years. At the very least, if you only have gold exposure, you could look to lighten up some in favour of silver to diversify your defence against what is looking like an increasingly fragile financial and monetary order.

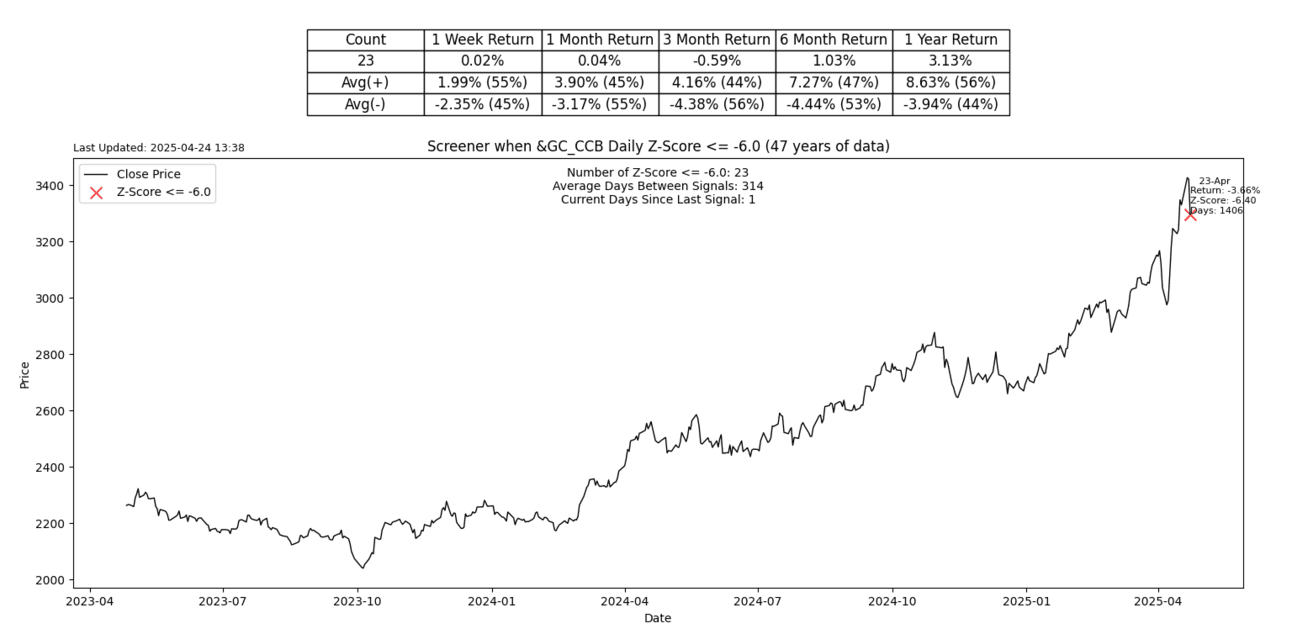

S2N screener alert

This is a big one, a negative 6 Z-score. Only happened 23 times in 47 years.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.