How the ECB can taper without raising rates: Deny, deny, deny

- ECB will slow some bond purchases in the fourth quarter.

- President Christine Lagarde insists it is not a taper.

- Main refinance and deposit rates unchanged as expected.

- Markets ignore ECB actions, focus on lower US Treasury rates.

The European Central Bank will curtail its bond-buying program in the fourth quarter with a “modestly lower pace” that President Christine Lagarde insists is not a change in policy for the still tenuous eurozone economic recovery.

In her press conference following the Governing Council decision to reduce bond purchases from the 80 billion euros ($95 billion) of the last two quarters, Ms Lagarde called it “ a recalibration of the pandemic emergency purchase program” (PEPP), under the total envelope of 1.85 trillion euros.

The bank left its main refinance and deposit rates unchanged at 0.0% and -0.5%.

At the same time, bond buying under a separate Asset Purchase Program (APP) will continue at 20 billion euros ($24 billion) a month, said the ECB. This program is, according to the ECB statement accompanying the decision, set to run for as long as necessary to support the economy until a rate hike is envisioned.

“The lady isn't tapering,” Ms Lagarde told reporters attending virtually at ECB headquarters in Frankfurt.

New and improved ECB estimates for this year's economic growth and inflation were likely behind her description of the eurozone’s “increasingly advanced” rebound.

Gross domestic product (GDP) is now forecast to be 5% for 2021, up from 4.6% in June. Harmonized inflation is projected at 2.2% instead of 1.9%.

Market response

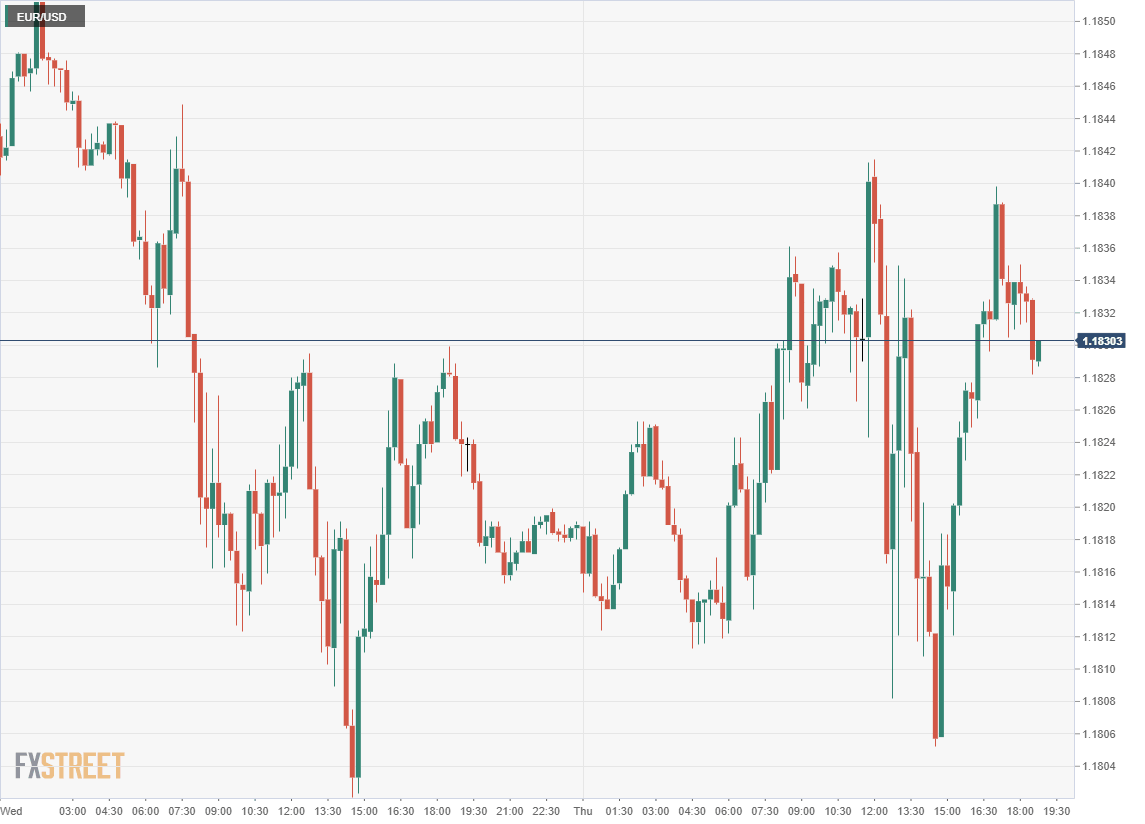

The EUR/USD initially fell on Ms Lagarde’s comments, shedding about 30 basis points to a low of 1.1805.

European sovereign yields faded slightly with the 10-year German bund closing down less than one basis point at -0.369%.

10-year Bund yield

CNBC

Treasury yields in the US were on an even keel in the morning but slipped steadily in the afternoon, with the 10-year, 2-year and 30-year losing altitude and 3-month unchanged.

10-year Treasury yield

CNBC

The reversal in Treasury returns undermined the dollar which by mid-afternoon in New York was down about 15 points from its open against the euro.

Central bank tapering without the credit market

The dilemma for the ECB and Ms Lagarde is the same as for the US Federal Reserve and Chair Jerome Powell.

How to end the potentially inflationary support of their economies without sending their debt markets into a rate soaring bond sell-off that could, they fear, cripple the still weak economic recovery?

Credit markets normally anticipate central bank policy shifts by weeks or even months.

In the first quarter, the expected GDP expansion drove the US 10-year Treasury yield from 0.916% to 1.746% in three months.

The reversal of that 83 basis point run was due mostly to the Fed’s insistence that its “sufficient further progress” criteria for a policy change had not been met.

Mr. Powell’s admission in August that the Fed expects to begin a reduction in its $120 billion a month of bond purchases by the end of the year did not set off a rush to the exits in the Treasury markets as neither the amount nor the timing was specified.

Ms Lagarde’s assertion that the prospective purchase reduction is not a taper and does not presage a policy change, is, like, the Fed’s, meant to keep credit markets from front-running the ECB decision.

Conclusion: Central bank policy and the pandemic

Behind the uncharacteristic credit market timidity in the face of a clear direction from both the Fed and the ECB, lies the uncertainty of the pandemic and its latest delta variation.

While it appears that this round of the pandemic is far less threatening and will cause relatively minor economic dislocations, it is likely that the speed and the intensity of the recovery will suffer.

After 18 months of nearly non-stop central bank intervention and economic support, even the stated intentions of the ECB and the Fed to change policy have not galvanized the credit markets.

Nothing but action will suffice.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637668119816026599.png&w=1536&q=95)