How the 2025 Davos consensus was upended in two months, and what comes next

They say the Davos consensus is always wrong, but it usually takes longer than a couple of months to be apparent. Not so in 2025.

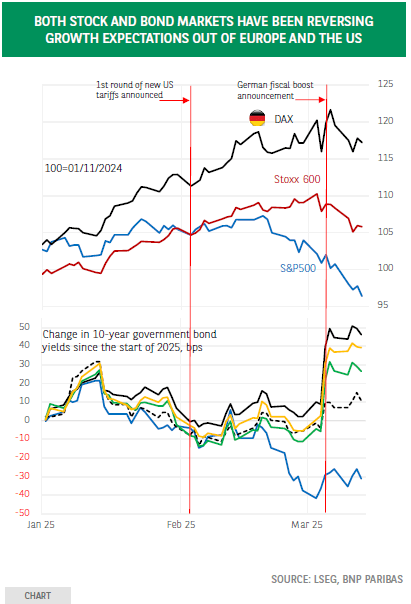

Back on Inauguration Day, world elites gathered in the Swiss Alps were enthusiastic about the prospects of the US economy under Donald Trump’s second mandate. So were US households and small business owners, according to confidence surveys. The US stock and bond markets agreed, with the former reaching an all-time high that week and the latter touching 4.79% days earlier, its 2nd highest level since 2008. Meanwhile, after historic underperformance of the STOXX Europe 600 index versus the S&P 500 in 2024 (by 23% percentage points in dollar terms), consensus was for the euro to fall to parity with the dollar. The Eurozone’s already sluggish economy was seen as ill-prepared to absorb the shock of President’s Trump looming tariffs. Questions were frequently being asked about recession risks in Europe.

Fast forward to today, and recession risk is back in focus, but this time for the US economy. US 10-year interest rates have plummeted, while European ones have soared, the euro is up over 5% against the dollar year to date, and stock markets’ respective performances have been reversed (see chart). In the US, households and business confidence indicators are rolling over—in some cases sharply, while they are starting to improve in Europe.

What explains this sudden reversal, and is it warranted? Developments on both sides of the Atlantic have moved against expectations. US investors were counting on the sweets from President Trump’s economic platform and had high hopes for tax cuts and deregulation. Instead, they got the sours in the form of massive tariffs on the US largest trading partners, along with federal spending and job cuts. That both have been rolled out in a highly discretionary and hence unpredictable manner has caused uncertainty to surge, and magnified their chilling effect on activity. Meanwhile, in Europe, the sudden urgency to boost military capabilities has led to an historic change in mindset, both in Germany, its largest and one of its most frugal economies, and at EU level. This week, Germany’s Parliament is expected to approve a plan allowing an additional 1 trillion euros in infrastructure and defense investment over the next 10 years, while the European Commission has proposed reforms that would allow additional defense spending of 800bn euros. German growth could triple as a result in 2025 (from a low base, admittedly), and Eurozone growth be higher by several decimal points of GDP.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.