How strong is the US Dollar?

S2N spotlight

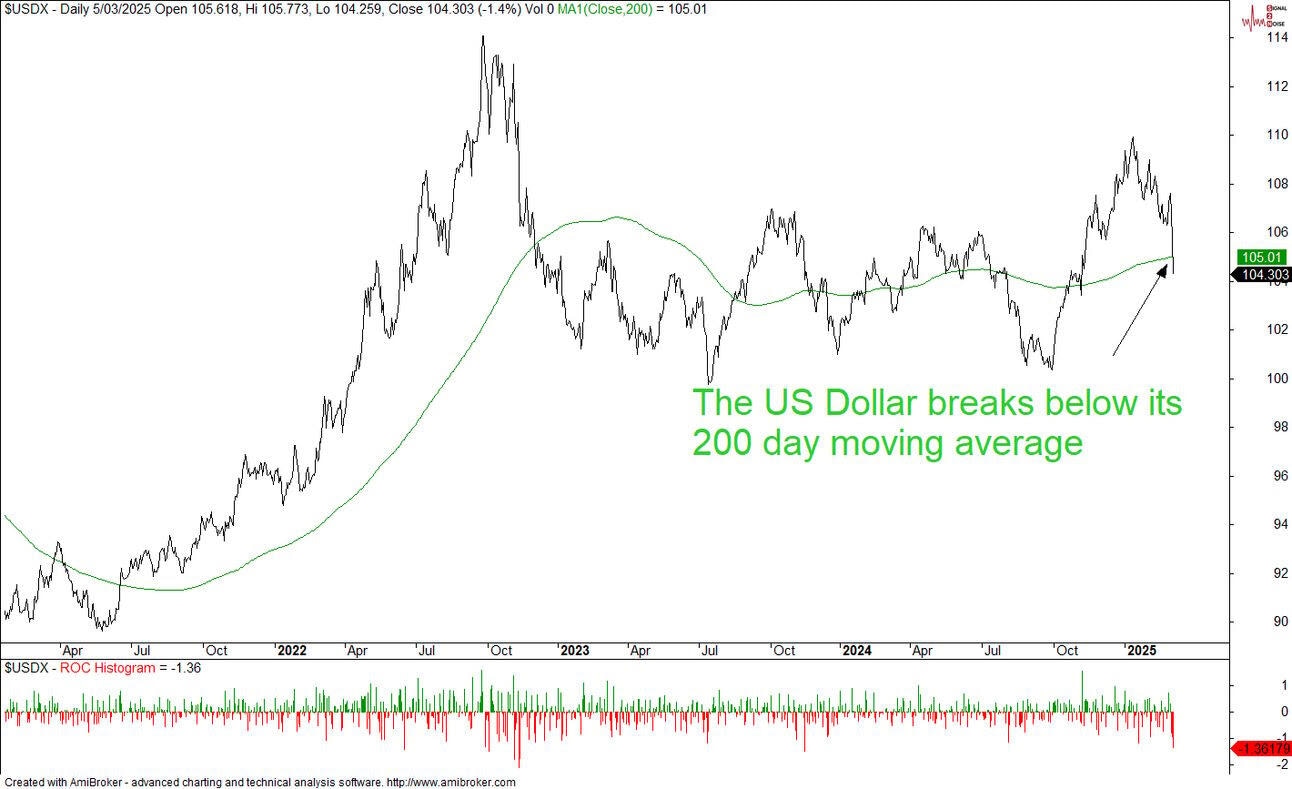

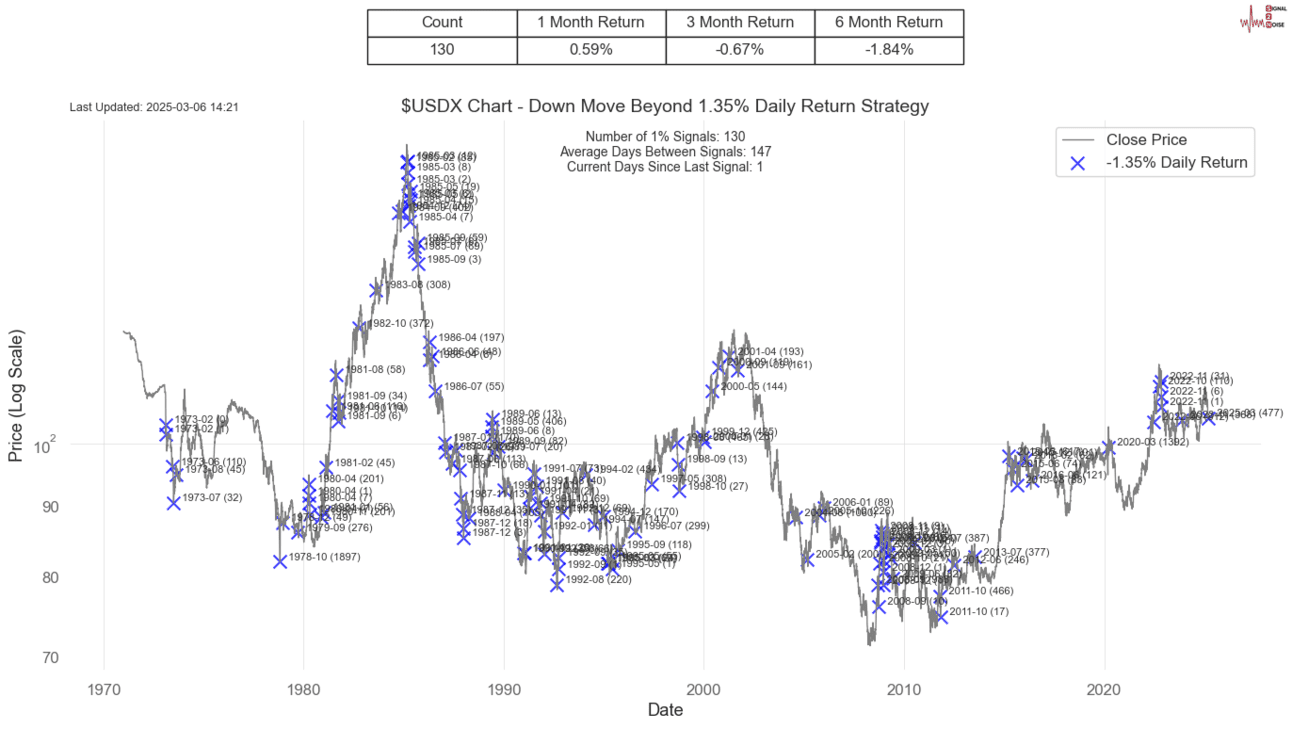

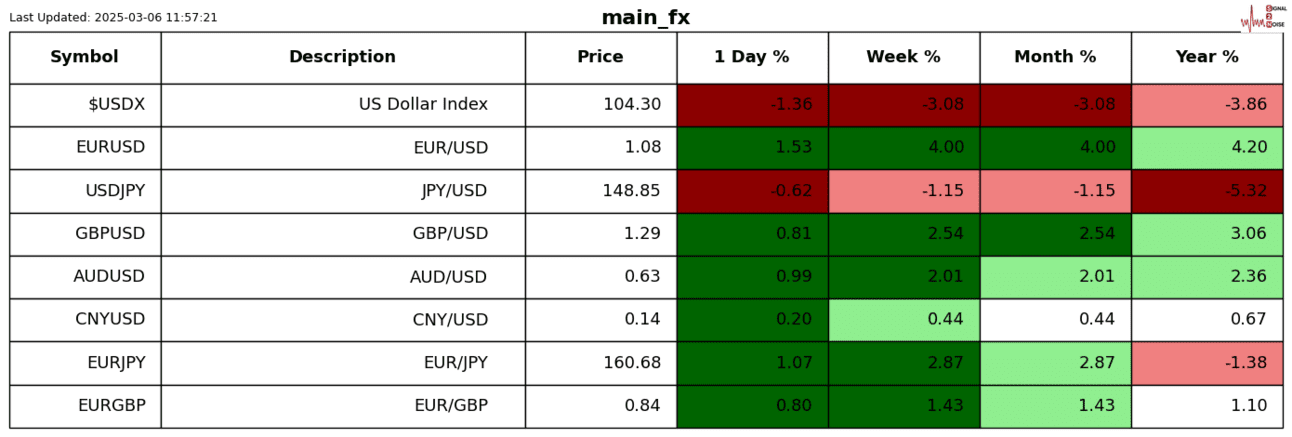

With the trade wars in full force, the once mighty US Dollar is hurting. In fact, yesterday the greenback dropped below its 200-day moving average. The obvious question should be, What does that mean? But first let us look at how rare yesterday’s drop of -1.36% was. My analysis suggests 130 times in 50 years of data.

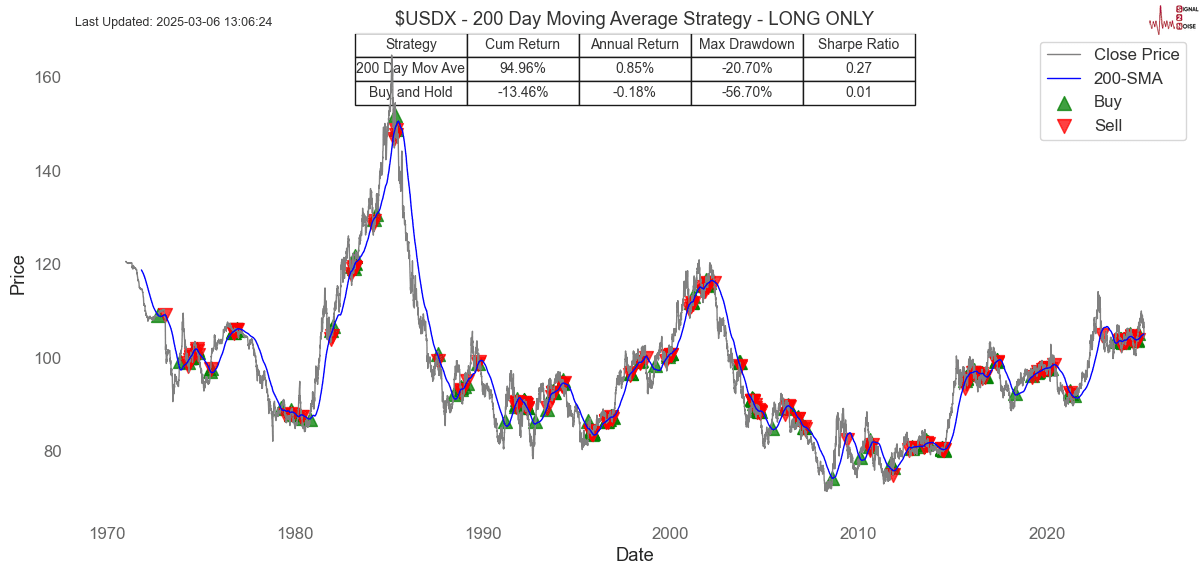

We now look at the long-term analysis of the US Dollar dropping below its 200-day moving average. The strategy is long only, so when the dollar drops below the 200-day, you go to cash. It turns out the mighty dollar has not been so mighty over the last 50 plus years as it is down -13.46%.

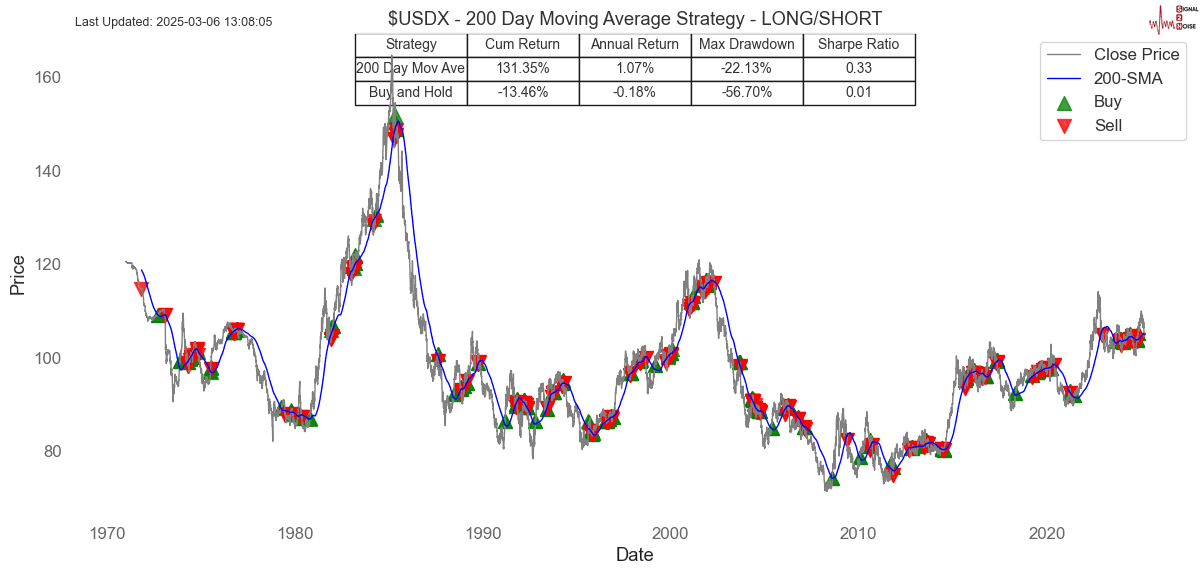

For the sake of the adventurous, I ran a backtest of a strategy that goes either long or short depending if the dollar is above or below its 200-day. It turns out to be a pretty decent strategy.

S2N observations

An hors devour before a bigger observation.

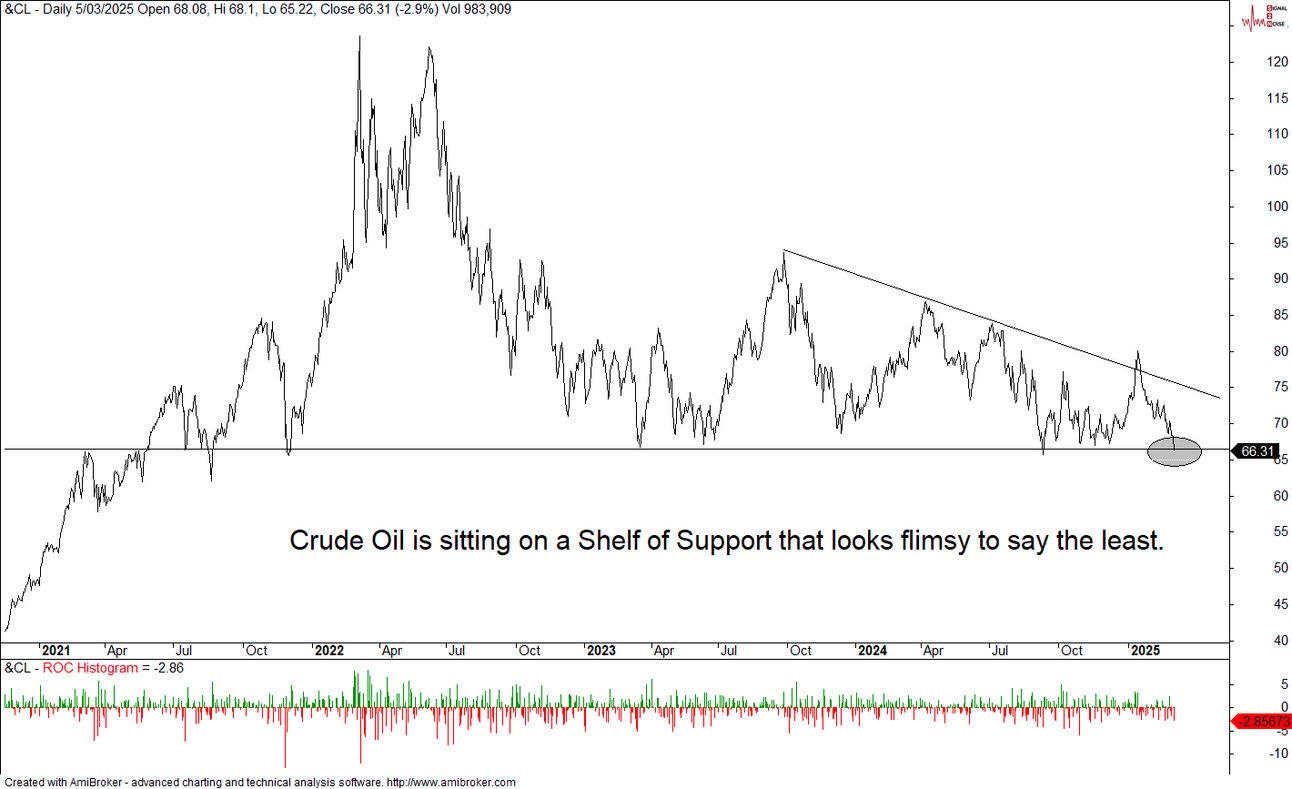

Crude oil is sitting on a shelf of support that is probably weaker than Putin’s handshake. I cannot see this holding; all puns intended.

German bonds shatz themselves yesterday, spiking higher.

This is the one that really caught my attention. The VIX volatility dropped yesterday as the markets rallied. However, the SKEW dropped alarmingly. The alarming part is that it means the market is no longer alarmed. The expectation of something bad happening suddenly disappeared with one performance by the Greatest Showman.

I saw a few people commenting on this point on X. So I did a quick and dirty analysis; it is interesting and something I will explore with other assets down the track.

I looked at the spread of the June VIX future over the March VIX future. You would expect the further out to be higher due to uncertainty. However, you can see the spread is showing red, which has meant higher in the past. It is a bigger exercise than what I had time for today as I am off to a wedding. I must be getting old, as my friends kids seem to be getting married one after the other.

S2N screener alert

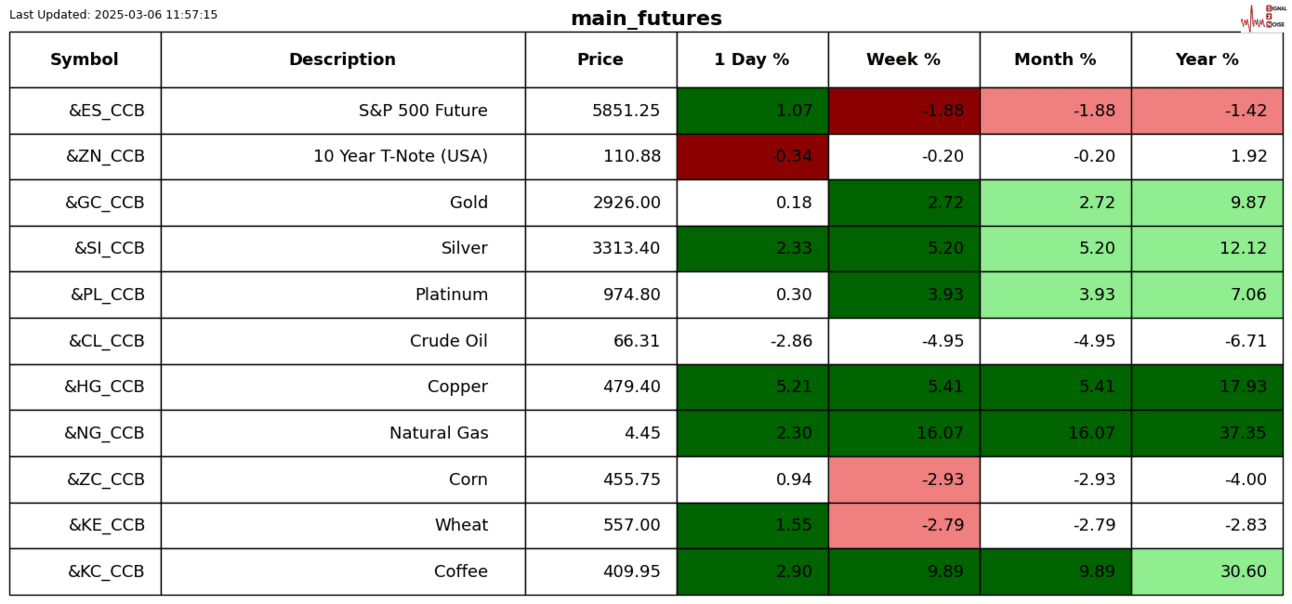

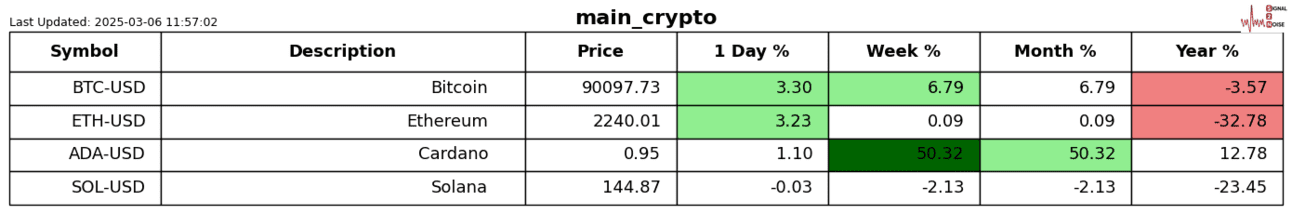

Copper futures were up more than 3 standard deviations, as was the Euro against the Swiss Franc.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.

-638768311993729446.png&w=1536&q=95)

-638768312207002220.png&w=1536&q=95)

-638768312403028635.png&w=1536&q=95)

-638768312646587040.png&w=1536&q=95)

-638768314248441703.png&w=1536&q=95)

-638768314316222803.png&w=1536&q=95)

-638768314365475491.png&w=1536&q=95)

-638768314416943040.png&w=1536&q=95)

-638768314470516852.png&w=1536&q=95)

-638768314515780939.png&w=1536&q=95)

-638768314778887857.png&w=1536&q=95)