How soon can SPX squeeze again?

S&P 500 first gave us a trappy ascent after better than expected NFPs, quickly faded and flushing to new lows as I called for it to happen. It did, and the same for rebound right before Powell assured us that more rate cuts aren‘t needed now. Hence, swift intraday gains, bringing up here only on the short side over +50 ES pts and +330 NDX pts, while swing trading clients see their short gains locked in.

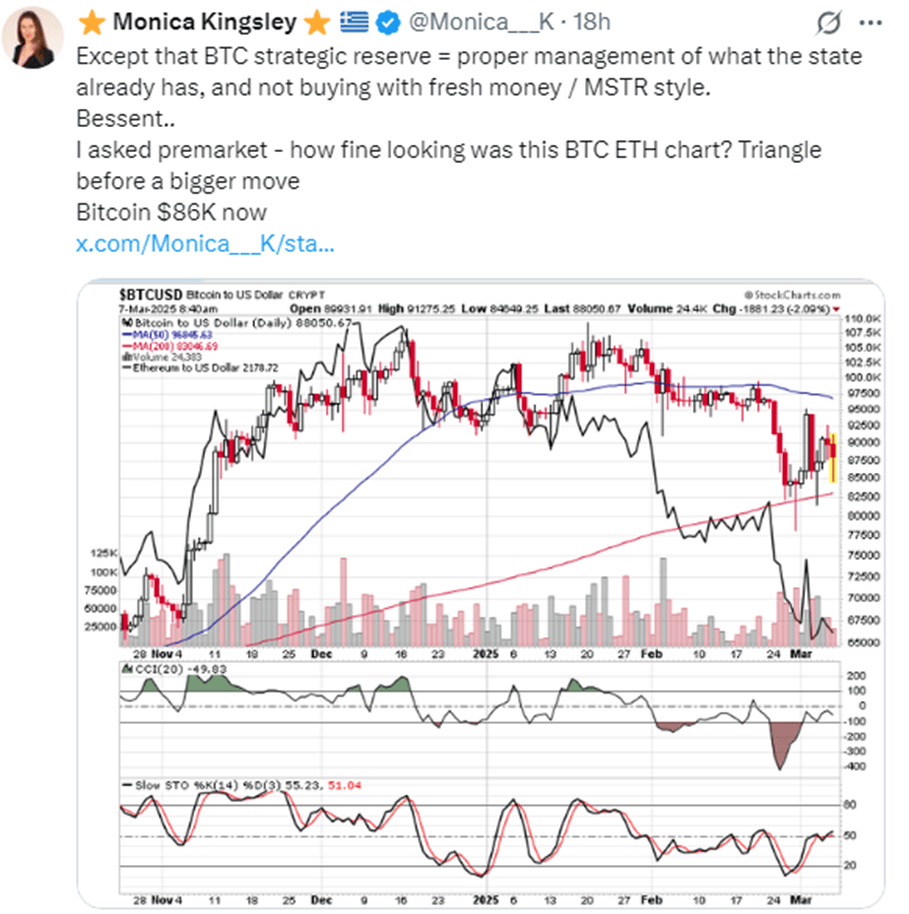

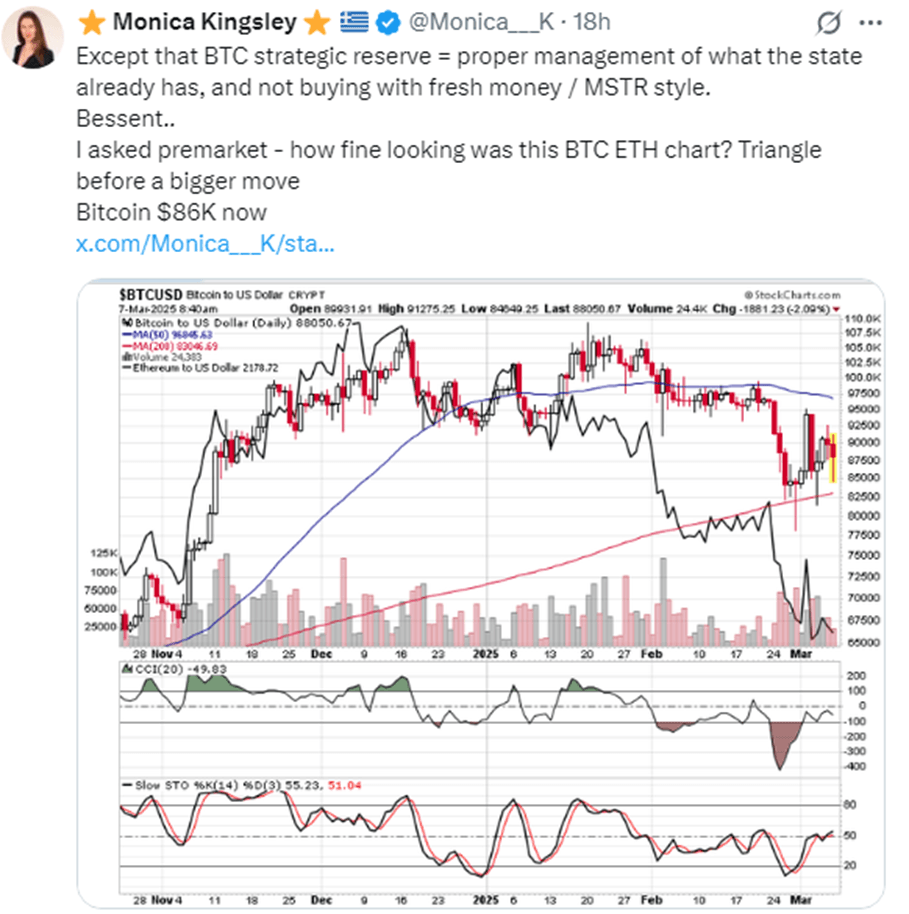

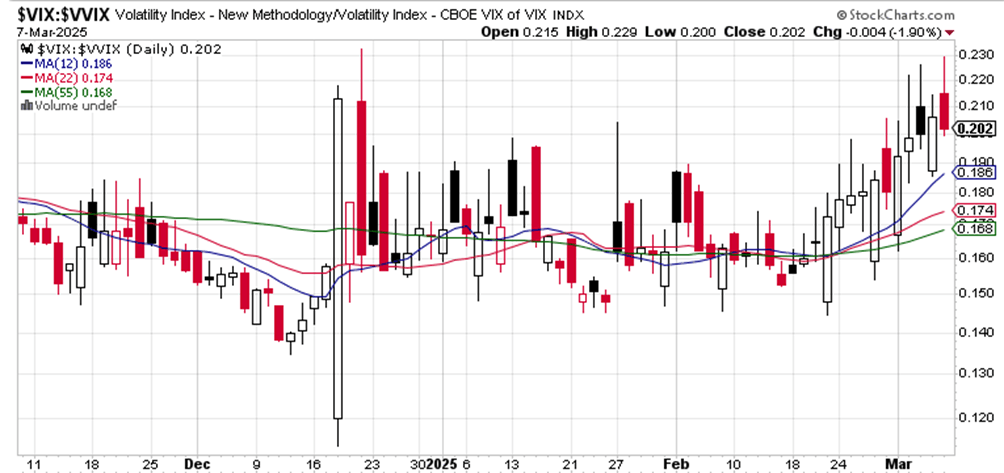

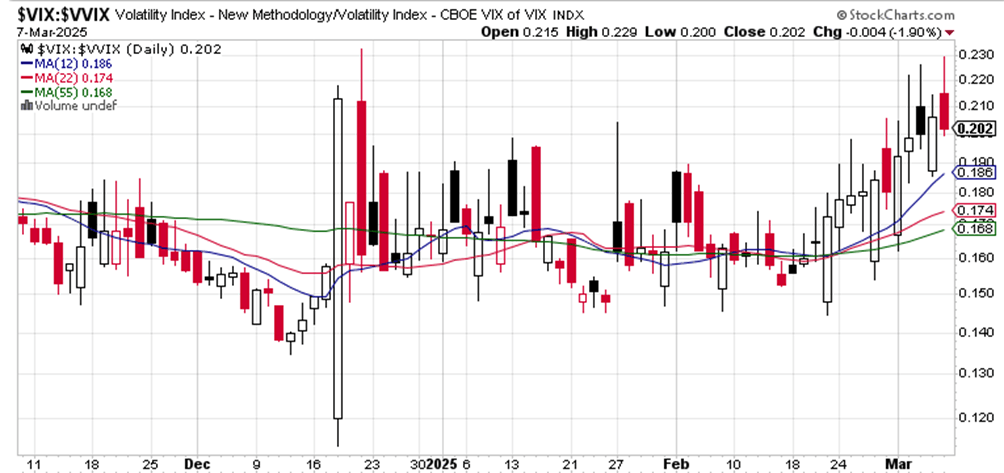

What‘s though important to ask, is whether we have seen the bottom – I mean is that THE bottom, or just a local one? Signs are mixed, but bare minimum a technical bounce (short squeeze) is S&P 500 is approaching (unless I see one key sign invalidating this outlook emerging pretty soon – will share with clients as we go) – volatility and sectoral view alongside fresh bearish BTC calls and Trading Signals (precious metals and oil) successes evaluation, that‘s the subject of your usual thorough weekend video.

Here is a brief taster for you to review the video in full (always packed and fast paced) – commentaries shared, so just dive into them.

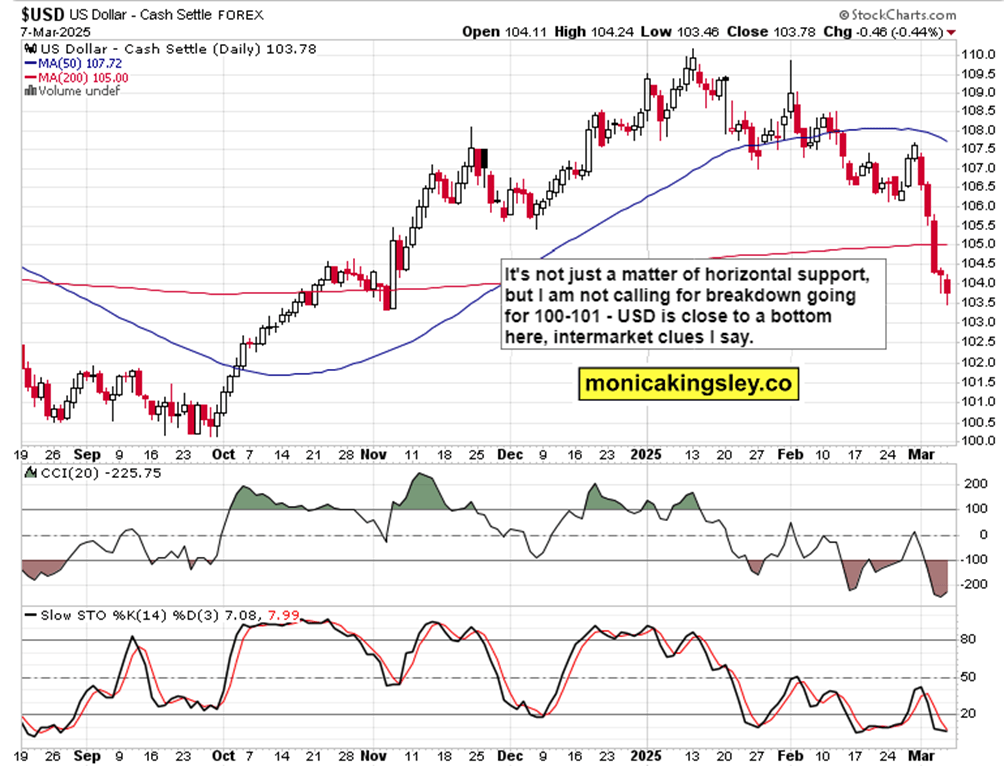

Another in-depth video today dives deep into the USDX, options and volatility aspect of SPX bottoming and BTC move.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.