How markets could respond to war – Nasdaq 100, Gold, EUR/USD

Weekly thoughts

How will the markets react to war?

The US has joined Israel in its aerial attack on Iran, bombing its 3 major nuclear sites. The situation is fluid with the possibility of Iran retaliating against the US. This is a big escalation over Israel’s airstrikes on Iran that we wrote about last week in week 24. As we suspected, oil prices have added to gains over the past week.

Investors usually react to war with a flight to safety. Since we covered oil last week, today we’re looking at 3 new ways that usually happens - and what it means if it doesn't happen!

1) Stock markets go down.

2) Gold goes up.

3) The US dollar goes up.

This is because stocks, which are perceived as risky get sold and gold and the US dollar, which tend to act as havens during periods of heightened uncertainty get bought.

Of course, things are never that black and white in markets. Two points here..

Since this is an escalation, markets might have priced in the uncertainty already. In the case of oil, that seems more of a possibility. But since gold and forex markets have so far had little volatility, it's harder to make the case that war is already ‘priced in’.

The other key consideration is, although of course war is horrible for those involved (in this case the Iranian people) the war might not have a direct effect on business or economic activity, and thus the impact on forex and stock markets could be limited.

Stock indices

- A sell-off in stocks would be counter-trend because they have been rising since April but, as you will see in the Nasdaq 100 chart, could be the beginning of a double top pattern in stock markets.

- If the Nasdaq, S&P 500 etc are able to shrug off the ‘bad news’ due to uncertainty arising from the Middle East, it will be a sign of strength. As such it would make sense to start looking for opportunities to buy on breakouts.

Gold

- A rise in gold would be a continuation of the huge rally over the past 18 months or so.

- Gold did close at a record high on Monday in reaction to Israel’s first strikes on Iran but has traded lower since.

- If gold can’t rally on news of uncertainty this week, it could be a sign that buyers have run out of enthusiasm and the market is due a steeper decline.

Forex

- Gains in the US dollar would be counter trend since it sits around 3-year lows versus other major currencies like the euro and British pound.

- Arguably the US dollar is ‘oversold’ at this point and could be due a rebound, helped by haven demand. NOTE our Short NZD/USD idea from last week has already started to play out

- Should the dollar continue to weaken, it could be a sign that sellers still have control of the markets and both EUR/USD, GBP/USD and others still have much further to go on the upside.

To round things off, we are looking for the market's reaction to this ‘bad news’. Will there be a flight to safety or are investors still happy to take risks and look past the situation in the Middle East, assuming that things will not escalate too far beyond what has already happened?

Setups and signals

We look at hundreds of charts each week and present you with three of our favourite setups and signals.

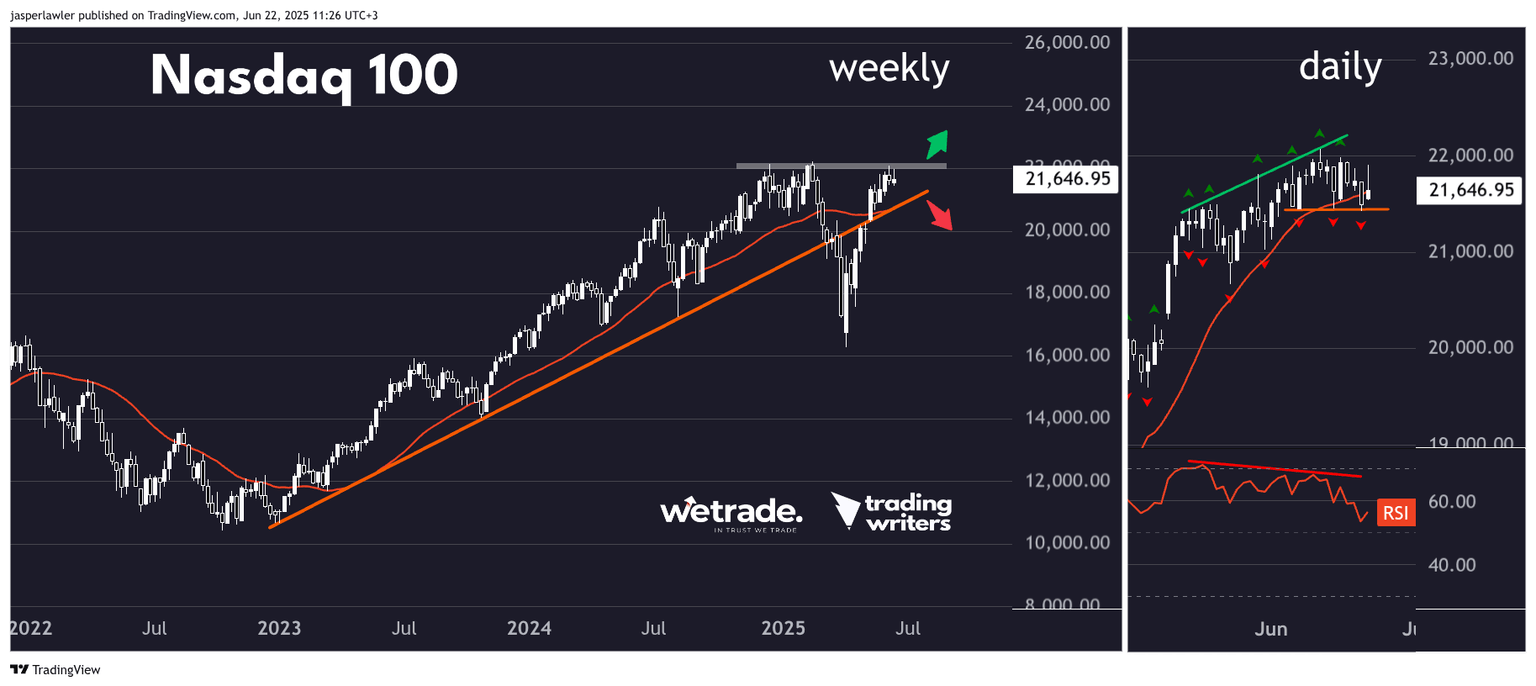

Nasdaq 100

Setup

Long term uptrend with likely breakout to new all-time highs over 22,000 on the horizon. Potential for failed breakout or double top pattern.

Signal

Price is trending higher above the 20-day SMA but there is bearish RSI divergence suggesting a possible break lower in line with the long term double top.

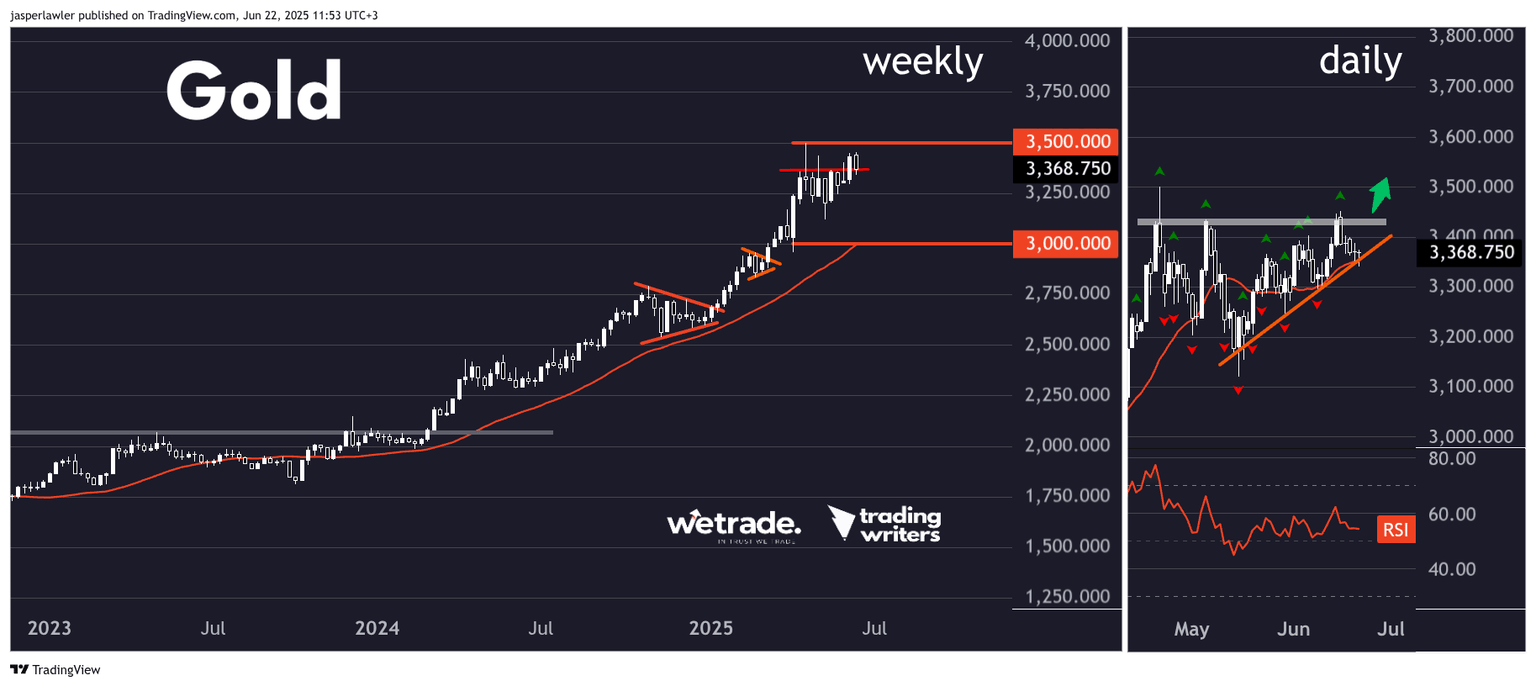

Gold

Setup

Long term uptrend but gold has stalled at 3,500 and closed lower last week.

Signal

A break above resistance at 3450 could prompt a new rally that takes gold out of its current consolidation phase. However a break below a rising trendline connecting recent lows could start a drop back to the lows just above 3100 or even test the 3K level.

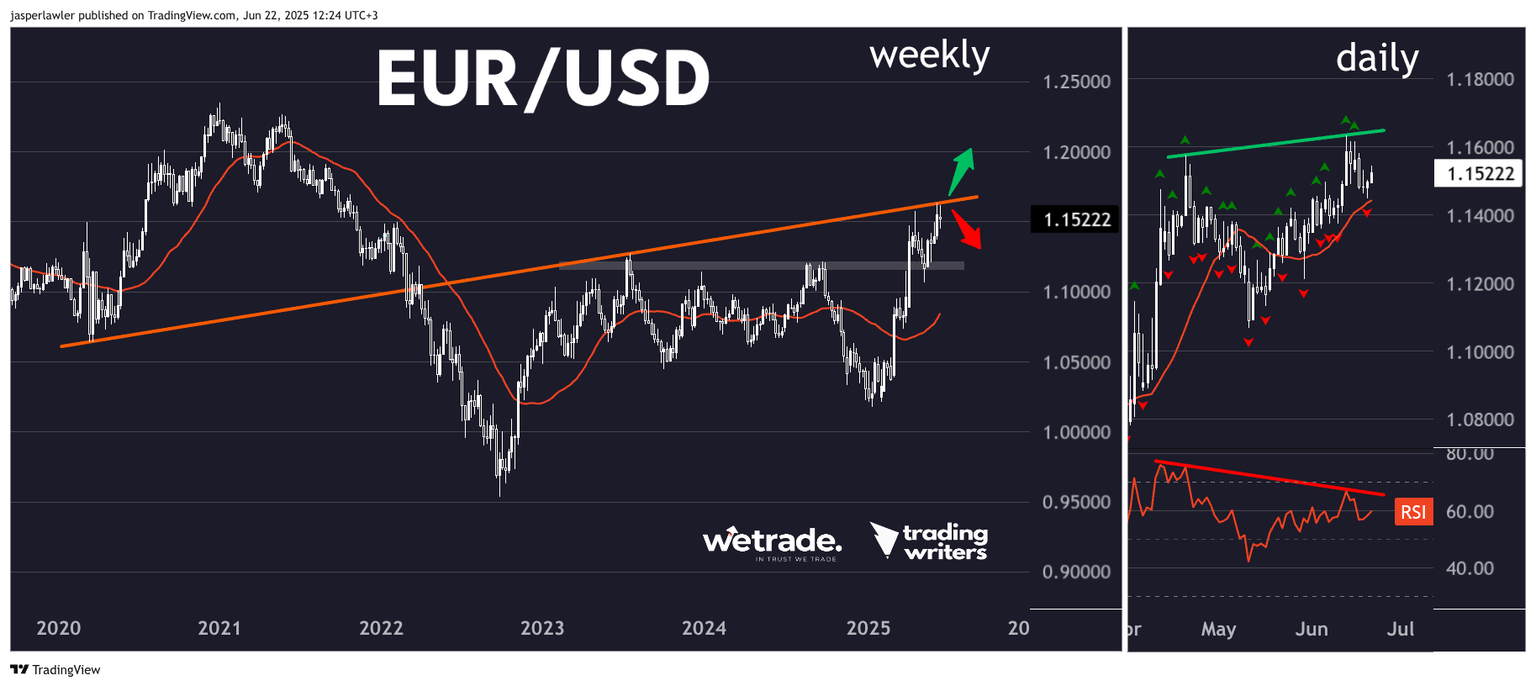

EUR/USD

Setup

The euro is trending strongly higher but looks very overbought relative to its 30-week moving average. A long term trendline could act as a resistance a 2nd time to help form a double top.

Signal

EUR/USD is just off multi-year highs and continuing its uptrend. There is so far only and earl warning sign of weak momentum via a bearish RSI divergence.

Author

Jasper Lawler

Trading Writers

With 18 years of trading experience, Jasper began his career as a stockbroker on Wall Street in New York City before sharpening his analytical skills at top trading firms in the City of London.