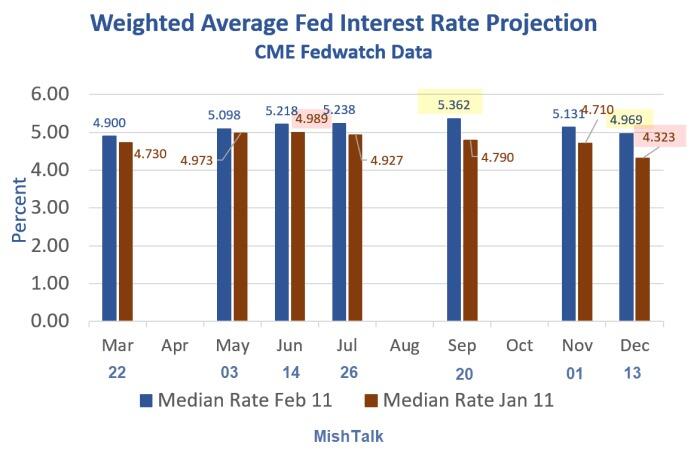

After an allegedly strong January jobs report and a Powell speech, let's look at rate hike expectations now vs a month ago.

I created the above graph in Excel manually typing in numbers as there is no data download from CME FedWatch.

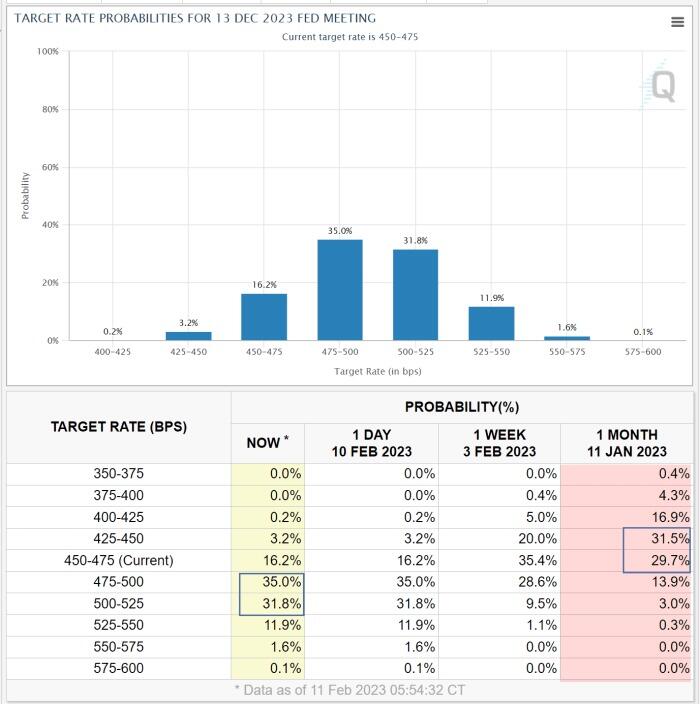

Target rate probabilities for December 2023

Weighed average example December 2023

Now vs a month ago

-

The market now sees a terminal rate of 5.36 percent in September, call it 5.25-5.50 percent.

-

A month ago the market thought the terminal rate was 5.00 percent in June.

-

Previously, the market expected a peak in June followed by two or three 25-basis point cuts all the way to 4.32 percent.

-

The market now sees a a cut from 5.36 percent to 5.0 percent.

The market has gotten the Fed's message higher rates for a longer period of time.

However, the market is still expecting a bit more than one 25-basis point cut in December.

Unemployment rate hits new low of 3.4 percent as jobs and employment jumps but

It was an allegedly strong jobs report that triggered belief in the Fed's stance of higher for longer.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

AUD/USD holds ground above 0.6300 after Chinese data

AUD/USD holds higher ground above 0.6300 in the Asian session on Monday. The pair stays firm after mostly upbeat China's activity data for Janauary and February. Chinese government to boost consumption also aids the Aussie's upside amid a weaker US Dollar and risk appetite.

USD/JPY remains below 149.00; focus shifts to BoJ/Fed meetings this week

USD/JPY kicks off the new week on a weaker note below 149.00 amid the prevalent bearish sentiment surrounding the US Dollar and the divergent Fed-BoJ policy expectations. However, a positive risk tone could undermine the Japanese Yen and limit the pair's losses.

Gold holds positive ground below $3,000 on safe-haven demand

Gold price remains strong but below $3,000 in the Asian session on Monday. The softer US Dollar and economic uncertainty over the impact of a global trade war provide some support to the precious metal. Dovish Fed expectations also keep the yieldless Gold price underpinned.

Will Ripple reach a $200 billion valuation if SEC approves altcoin ETFs in 2025?

XRP price rebounded above $2.42 on Friday, marking a 28% recovery from the weekly timeframe low of $1.90. The rally was fueled by the U.S. Securities and Exchange Commission’s kicking off settlement talks with Ripple, and speculations the Blackrock could launch altcoin derivatives products.

Week ahead – Central banks in focus amid trade war turmoil

Fed decides on policy amid recession fears. Yen traders lock gaze on BoJ for hike signals. SNB seen cutting interest rates by another 25bps. BoE to stand pat after February’s dovish cut.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.