How low will markets go? State of play after the Covid-related fall, ahead of a huge week

Autumn leaves are falling, and so are markets – mostly responding to surging coronavirus cases in Europe and consequent measures. Will King Dollar hold onto the throne? Valeria Bednarik, Joseph Trevisani, and Yohay Elam discuss these events, the ECB decision, and of course, the all-important US elections which are keeping everybody anxious.

Yohay Elam: It is almost Halloween and markets are scared. The surge in coronavirus cases has prompted the German and French governments to announce new national lockdowns. Is the virus situation the main driver?

Joseph Trevisani: In Europe, yes.. in the US, media attention is on the election. No governors as far as I know have threatened new closures.

Yohay Elam: In Europe, the announcements by the governments were followed by the European Central Bank's decision earlier today. The ECB expressed concern, indicated it would act in December, and pushed the euro even lower. Or is it more related to safe-haven bids toward the Dollar?

Joseph Trevisani: I don't think it is a significant safety move to the USD yet... The euro is at the bottom of its three month range but no lower.

Valeria Bednarik: I think is a bit of everything you mentioned plus growth imbalances. With a dovish ECB and fears mounting in one hand, and upbeat data in the other, probably a result of Trump's decision to keep the economy open. Lagarde said she expects a negative GDP for Q4. The US GDP has returned to life...

Joseph Trevisani: The March panic brought the euro to below 1.0700 so we have a way to go yet. But I agree the prognosis is not good for the euro. The Federal government has never tried to close the US economy. It probably has the power but it has never been tested. In the spring governors made the decision, not Washington and not Trump.

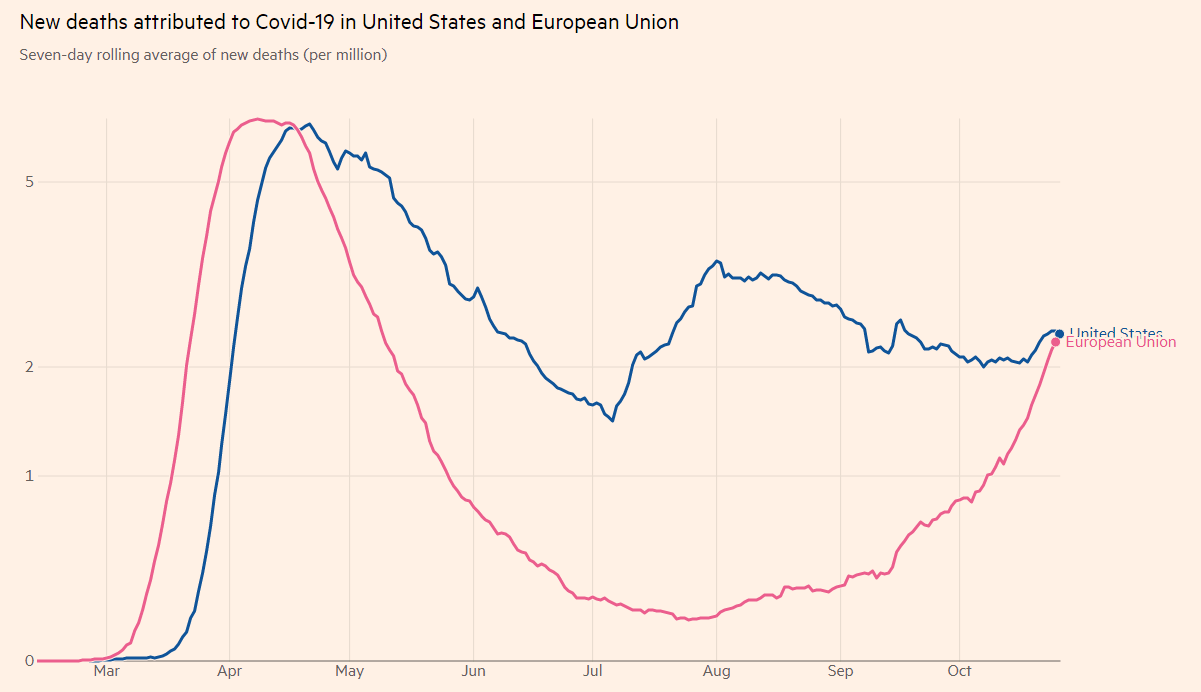

Yohay Elam: Deaths in the EU and the US

Valeria Bednarik: And unfortunately, COVID-19 numbers in and outside the US are probing the US made the right choice. Yeah, exactly Yohay.

Joseph Trevisani: I don't see how the US numbers can not get worse.

Valeria Bednarik: All could be worse Joseph, give it some time.

Yohay Elam: Covid cases reached new highs in the US, the disease spreads faster indoors.

Joseph Trevisani: That is what we saw the first time around but during the second wave in the US the fatalities were far less, a function of better treatment and the much younger cases...we shall see this time. At any rate, the federal government will likely leave the decision to the states. The election is dominating news coverage in the states. Very different than in the spring. And so far fatality rates have not moved much, that could and may change of course.

Yohay Elam: We are five days away from the elections, and nearly 80 million have already voted, around 57% of the total vote count in 2016.

Valeria Bednarik: Also. 5 days to go. 2 days of turmoil, and then we can take care of covid/growth imbalances.

Yohay Elam: The disease has certainly changed the elections, at least in when people vote.

Joseph Trevisani: Depends...if Trump wins were will have several days of rioting at least in many Democratic cities.

Yohay Elam: I think that most Americans will accept the election results. Maybe not Trump, but it doesn't really matter.

Joseph Trevisani: Yes, most but the active Antifa and BLM will not.. If Trump loses the transition will be as normal as always. The idea that it will not is pure media propaganda. I agree whoever wins the country will settle in a week or two to normality, I hope.

Yohay Elam: He refused to commit to a peaceful transition nor accept the results, but Republicans said they will.

Joseph Trevisani: The GDP report may give Trump a boost. It will certainly feature in his campaign until election day,.

Yohay Elam: I think they'll oppose any Biden-led stimulus package if they keep control of the Senate.

Valeria Bednarik: I'm not sure macroeconomic numbers will be enough to change voters' minds you know?

Yohay Elam: Until several days ago, the stimulus was the main topic, I think it will shortly return.

Joseph Trevisani: Yes but if the Republicans retain the Senate it depends on their majority.

Yohay Elam: I think NFP has more political impact than GDP.

Joseph Trevisani: No most voters have long since made up their minds... but it may be significant. Normally the economy is the most important consideration for voters. But this time, I am not sure.

Yohay Elam: Covid is the top item.

Joseph Trevisani: It is the area where Trump scores best, so it may be important for some.

Yohay Elam: I agree that most voters have made up their minds, and a majority have probably already voted. Of course, the elections depend on the margins in swing states, and maybe GDP data could have an impact.

Joseph Trevisani: I don't think Covid is the top item. It is the area that Biden has emphasized. As for the electorate, it is a very difficult polling year.

Yohay Elam: GDP year over year is still down. The elections are overshadowing an otherwise extraordinarily busy week. The Fed, the BOE's Super Thursday, and the NFP are all lined up.

Valeria Bednarik: Meanwhile, the doom and gloom keep the crown on Dollar's head.

Joseph Trevisani: Is that good?

Yohay Elam: A strong dollar reflects fear and is not that great for the global economy. Companies in non-dollar countries use the greenback for trade.

Joseph Trevisani: Ahh the crow as a sign of trouble?. I'm still working on the metaphor NFP is estimated at 850,000, so with the recent drop in claims, the lines will have crossed again.

Valeria Bednarik: As Yohay notes, is not great for the global economy. We are slowly understanding that despite macroeconomic numbers' bounce, the economic setbacks will last for much longer than anticipated. That's another factor fueling the greenback.

Joseph Trevisani: All true. It is going to be almost impossible to return to full normal as long as the changes wrought and still working by the pandemic are around.

Valeria Bednarik: May you live in interesting times...

Joseph Trevisani: US data. Do you know what's truly scary? truly scary?

Yohay Elam: French President Emmanuel Macron said that the second wave is worse than the first one. His words come despite far better medical knowledge, an abundance of equipment, etc. That's scary.

Joseph Trevisani: I first used that line to open a paper in grad school, over three decades ago.

Yohay Elam: That's a great intro.

Joseph Trevisani: Yes. and its a curse. But it is not Chinese. I'm not... It seems to have been first used by a British diplomat in China in the late 19th century.

Yohay Elam: EUR/USD has been far from scary during most of the past few years... not enough volatility...

Joseph Trevisani: Again... we are likely to get what we have wished for.

Yohay Elam: Every day I learn something new.

Joseph Trevisani: The progression of the virus is logical, if you open the country the virus spreads. It may in the end turn out that the Swedish approach is the only practical way.

Yohay Elam: Public, well-funded healthcare for all.

Valeria Bednarik: What's really scary is the unknown "new normal" and I'm not talking of wearing face masks or maintaining distance. I'm thinking of a "new normal" economy. With millions laid out globally and homeworking making as us less consumerist, I think there are much more unanswered questions related to how the economies are going to grow in the near future.

Yohay Elam: The Economist talked about the 90% economy.

Joseph Trevisani: I agree completely. Global growth has been built on vast consumerism.

Yohay Elam: Mask-wearing has the best cost-benefit value.

Valeria Bednarik: Why you say that Yohay?

Yohay Elam: The cheapest way to curb the spread of the disease.

Valeria Bednarik: Ah yep, if only people would use it properly... HE!

Yohay Elam: Yep, that's another issue. I bought a few fashionable ones, contributing to global consumerism, but I´m not sure they are the most protective ones.

Valeria Bednarik: Yeah, but what else did you buy these months fashion-related? Or how much did you spend in bars and dinner out? or cinema, or theatre or shows?

Joseph Trevisani: I bought a new computer, my first.

Valeria Bednarik: Don't know you guys, but I have two teens and I can't remember when I spent this little monthly basis. And we are still alive. Clearly, we were spending too much on things we never needed.

Yohay Elam: I spent money on weights, a better keyboard, and many useless things. But it's far less than what I spent when life returned to some normality.

Joseph Trevisani: Here in NYC the economy is on its back. The restaurant, theater, and tourism industries are a large part of the economy and they are absent.

Yohay Elam: When I order food from a restaurant, I don't get drinks, because I already have them at home and travel of course...

Joseph Trevisani: To Val's point. Habits are probably changing faster and more permanently than we think.

Valeria Bednarik: Exactly. And taking a huge toll on the "normal economy".

Yohay Elam: Here in Spain, many firms insisted on going back to the office, including ones run by the regional government, which encouraged people to telecommute. But I believe that the habits that didn't change in the first wave will likely change in the second one. Unless a vaccine comes before Christmas

Valeria Bednarik: That's something not even Santa can do for us. Let's say vaccine probes great, effective, sure, and all. We will still be needing 7.8 billion doses.

Joseph Trevisani: Economics will drive many changes. It is clear that offices are useful and nice...but not necessary to the degree we have seen in the past. That will drive changes in real estate valuations around the globe. Cities are about to be defunded.

Yohay Elam: Face-to-face meetings are useful for improving social cohesion and for creative brainstorming. But commuting is a huge waste of time when it comes to most performing most tasks.

Joseph Trevisani: I fear my apartment in NYC is about to become a white elephant.

Valeria Bednarik: I agree, social cohesion is critical. But is not as much needed in work as in life.. we finally learned.

Yohay Elam: Cities and especially NYC survived many crises.

Joseph Trevisani: But suburban homes have gained value, overall the economic effect is probably neutral. Unless you live in a city. True, but this feels different. And I say this as a New Yorker. Born and bred.

Valeria Bednarik: Agree with you Joseph, but depends on which side of the equation you are on. If you don't own a home, well, this crisis may help you get one. If you have a big home in a big city you are in trouble if you think about moving.

Joseph Trevisani: The change, if we are accurate will redistribute economy and political power over the next generation.

Valeria Bednarik: That's an optimistic scenario that I would love to see. Anyway! back to markets.

Yohay Elam: I'm bullish on a vaccine. After doom and gloom in markets, we could see a swift turnaround once immunization is approved

Valeria Bednarik: Me too, don't get me wrong, but won't be a short ride.

Joseph Trevisani: Yes the euro continues to drift lower. Support looks to be around 1.1630. There is potential for a rush lower.

Yohay Elam: Next week could be brutal.

Valeria Bednarik: I was about to mention that. Again, interesting times.

Joseph Trevisani: Will be I suggest.

Valeria Bednarik: The election is the first but not the only earthshaking event.

Joseph Trevisani: Here in the states, the worst option is an undecided election. It is a real possibility.

Yohay Elam: That is undoubtedly the worst, but I think that rising covid numbers all the world are enough to maintain some gloom regardless of the vote.

Joseph Trevisani: Ha, now that is an optimistic view. Well on the vote. About half the country is going to be sorely disappointed.

Yohay Elam: Yeah, and high turnout means more people are anxious than in 2000 when the public was far more apathetic to Bush vs. Gore. It's going to get darker for markets before it gets better, perhaps a Santa Rally.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

FXStreet Team

FXStreet