How are the pros doing?

S2N spotlight

I wanted to share a few performance overviews of various Hedge Fund and Managed Futures (CTA) Indexes from the excellent Nilsson Hedge website.

Here is the classic Long/Short Equity Hedge Fund Index performance.

The CTA / Managed Futures Industry is having a tougher time, with April hurting a lot.

The main reason why the CTA industry is hurting so much is because of momentum traders getting savaged in April.

S2N observations

Does anyone actually know what Palantir does for a living? I think it was the best or one of the best-performing stocks of 2024 and 2025. A 10% drop followed by 7% up is just an ordinary day at this spook company.

I know there has been a lot of hoopla with the US and UK administrations slapping each other on the back over the newly inked trade deal. By the way, Donald Trump has a handwriting even more flamboyant than his personality. It is quite beautiful. I am talking about the handwriting.

In case you never knew, the UK is a surplus trade partner for the US. Yes, they are the good guys if you follow the Trump logic of trading partners ripping off the US, but the 10% tariff was still slapped on. Great deal.

The IMF just released its latest trade war impact research. It turns out the country that will be hardest hit is the US. Talk about an own goal.

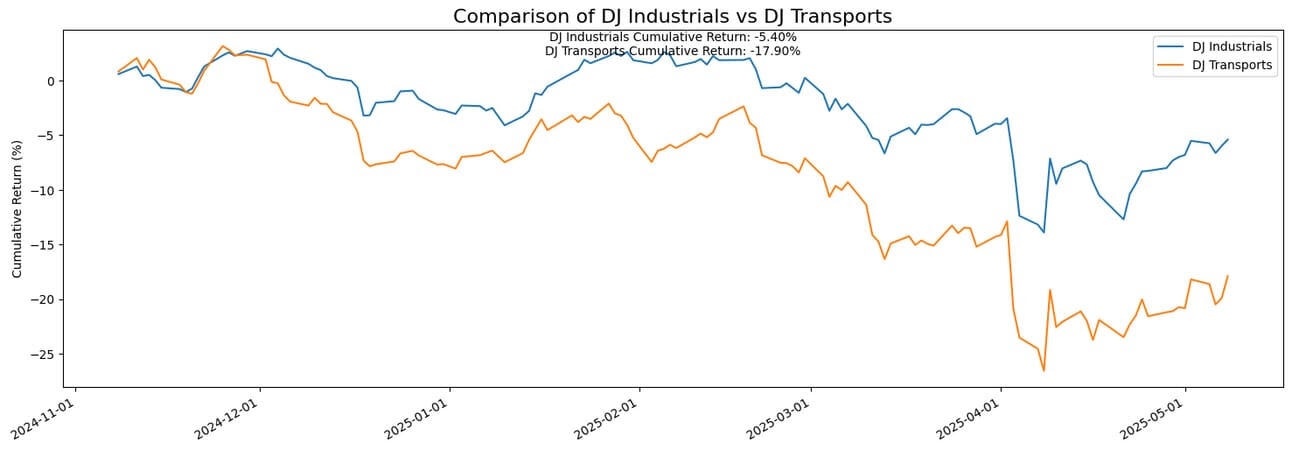

Dow Theory tops are called when one of the indexes, the Dow Jones Industrial or the Dow Jones Transports, doesn’t confirm a new high. I programmed the analysis with a non-confirmation signal last year.

I was thinking about the transports the other day as I have been sharing some real-time economic data points on shipping traffic. What better way to keep an eye on whether the economy is slowing down than by keeping an eye on the transport index. The index covers trucking, shipping, and all things transport-related. I will refer to this chart regularly as we take the trade war temperature.

S2N screener alert

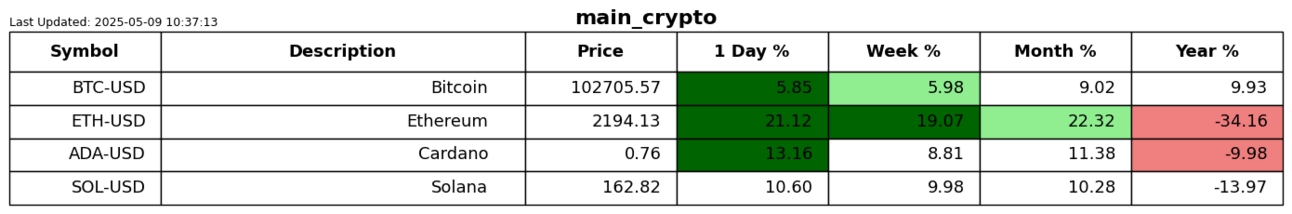

Not sure what happened with Ethereum yesterday, but it got more of a pump than I did at the gym. 20% up is quite a flex.

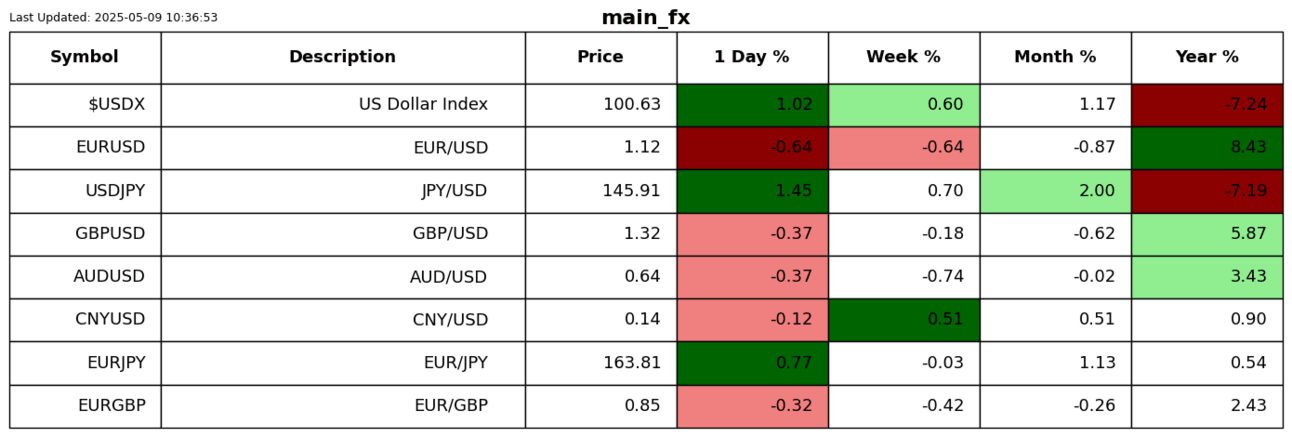

The Hong Kong Dollar peg ain’t looking so well pegged in.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.

-638823563206248192.png&w=1536&q=95)

-638823572580707141.png&w=1536&q=95)