Hoot of the Day: Russian oil gets to US via sanction loophole

I describe the roundtrip process in which Russian oil refined in Italy makes its way to to the US. It's a real hoot.

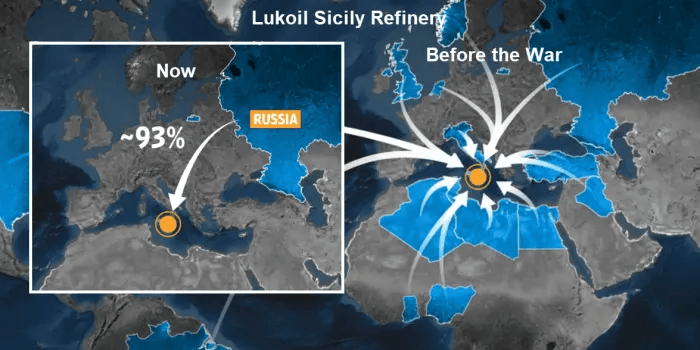

Image composite from WSJ video below

The Wall Street Journal has an interesting video that describes How Russian Crude Avoids Sanctions and Ends Up in the US.

The Lukoil connection

Image composite from WSJ video

Sanction avoidance process

- US sanctions are on crude oil, not refined products.

- Lukoil, Russia's second largest oil and gas company was not sanctioned by the US.

- Lukoil's refinery in Sicily is the second largest in Italy and fifth largest in Europe.

- A Lukoil refinery in Italy once processed crude from multiple countries. Now it inputs are 93 percent from Russia.

- After refining, the country of origin is Italy, not Russia. This is due to longstanding practice of changing the country of origin to where oil is refined.

- The refined product then makes its way Exxon and Lukoil plants in New Jersey and Texas.

- Lukoil still has a gas station presence in the US and it distributes products to eleven states.

Lukoil stations in 11 US States

Image composite from WSJ video

Note: Most of the 230 Lukoil gas stations in the US are owned by individual American franchisees, not the oil giant itself.

Understanding the process

-

The US has sanction exclusions for oil "substantially transformed into a foreign-made product."

-

US refiners cannot process Russian crude, but Italian refiners can, then distribute the product here.

-

In return, US can send its refined products to the EU, completing the round trip!

Lukoil is 6th largest refiner in Europe. It went from processing 30% Russian oil to 93%. That's a pretty big sieve even if amounts to US are small.

Conveniently timed for the US election, European bans on Lukoil do not come into play until December 5.

Unless the EU backs down, this could lead to another surge in the price of gasoline in December.

Meanwhile, In eleven US states, people are filling up their tanks in part with Russian oil products via the above convoluted means.

The US Treasury department refused to comment on this process. Gee, I wonder why.

Biden says this is all Putin's fault, while traipsing the globe begging Saudi Arabia and Venezuela for more oil.

Finally, after Biden told both OPEC and the US oil industry of its intent to kill the industry, the president now threatens both the US and Saudi produces with tax hikes and unspecified consequences.

For discussion, please see Biden Threatens Saudi Arabia With Unspecified Consequences for Slashing Oil Production

Consequences

"There will be consequences," says president Biden. "It's time to rethink our relationship with Saudi Arabia."

Yeah, there will be consequences.

The one on the immediate horizon is an election blowout on Tuesday, November 8.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc