Hold the presses, tariff man is back

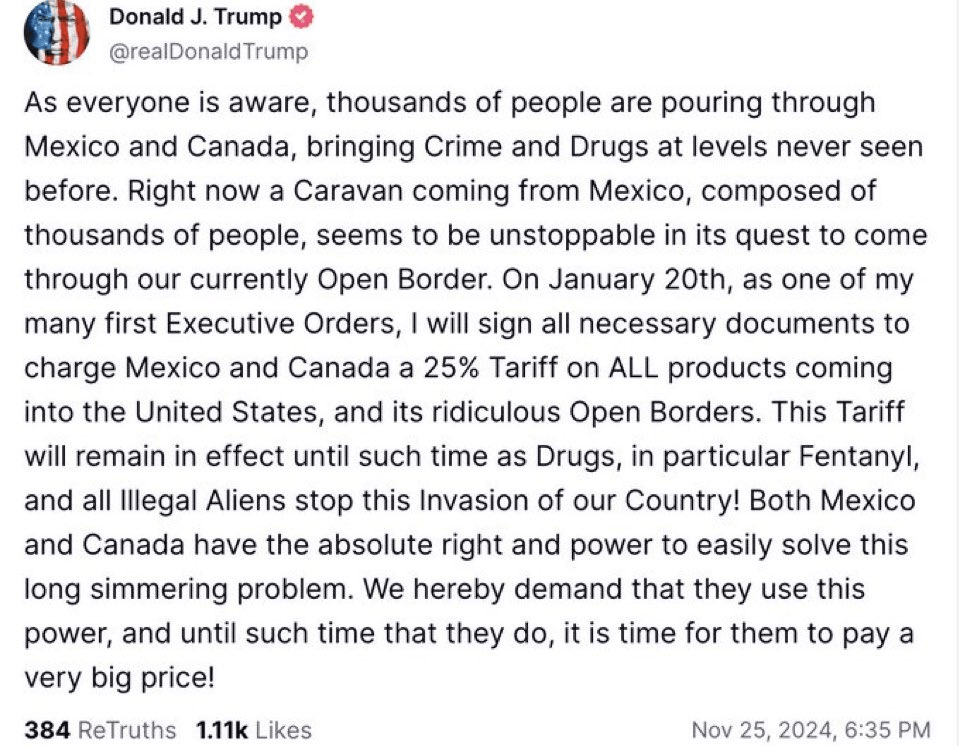

In a striking return to hardline policies, President-elect Trump has dramatically escalated tensions with a brash promise to impose a sweeping 25% tariff on all imports from Canada and Mexico the moment he reassumes office. This bold declaration shatters any lingering hopes that the new Treasury Secretary, Scott Bessent, might usher in an era of moderation. Initially hailed as a beacon of stability, Bessent’s influence now seems overshadowed by a resurgence of Trump’s uncompromising "America First" doctrine, which starkly excludes even the closest of allies from its protective embrace.

This abrupt pivot could send shockwaves through the bond markets, where the 'Bessent Bond Bid'—a term coined in hopeful anticipation of steadier fiscal waters—may evaporate as quickly as it appeared. The markets, previously buoyed by the prospect of tempered policies and diplomatic negotiations, now brace for the impact of these severe tariffs. It appears that any semblance of an olive branch has been withdrawn and snapped, casting a long shadow over the initial optimism and challenging the premise of Bessent’s calming presence in an administration known for its unpredictability. This stark turnaround serves as a sobering reminder that in the volatile arena of international trade, assurances are fleeting, and the swift stroke of political will can swiftly upend economic diplomacy.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.