Here is how to spot the market bottom using Wyckoff method and market breadth [Video]

![Here is how to spot the market bottom using Wyckoff method and market breadth [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/Sentiment/RiskAppetite/rock-climber-rappelling-into-a-slot-canyon-gm503376675-44109010_XtraLarge.jpg)

Original content: Here is how to spot the market bottom using Wyckoff method and market breadth [Video]

Here is how the price structure of the S&P 500 could look like if the low in May 2022 marked the market bottom without the market capitulation based on Wyckoff trading method and market breadth.

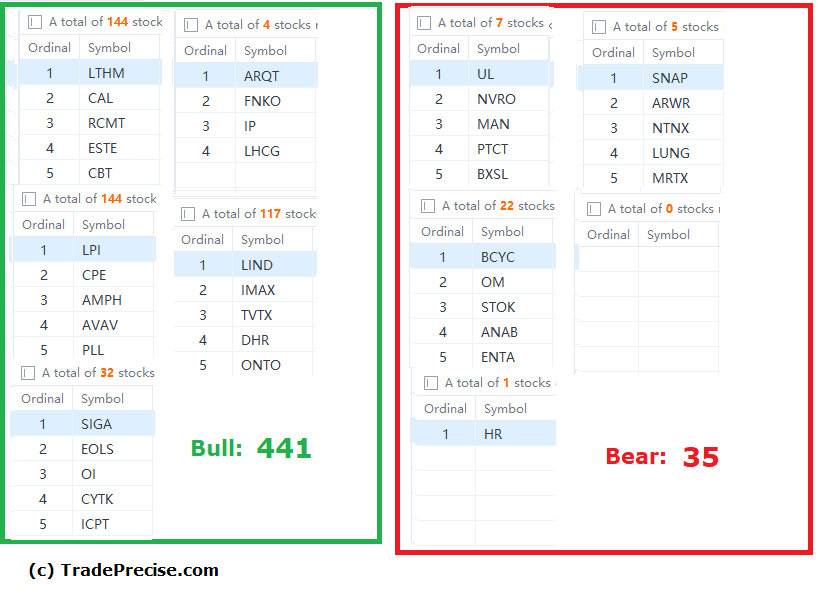

The bullish setup vs. bearish setup is 441 vs 35 from the screenshot of my stock screener below. This is a significant change from last week where lots of the stocks participated the rebound.

For trading tactics, aggressive traders could look for deeply oversold technology stocks or the leadership stocks in the oil and gas industry group. Bear in mind that a counter-trend rally is generally risky not to mention about the elevated volatility in both direction, which could whipsaw the bull and the bear.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.