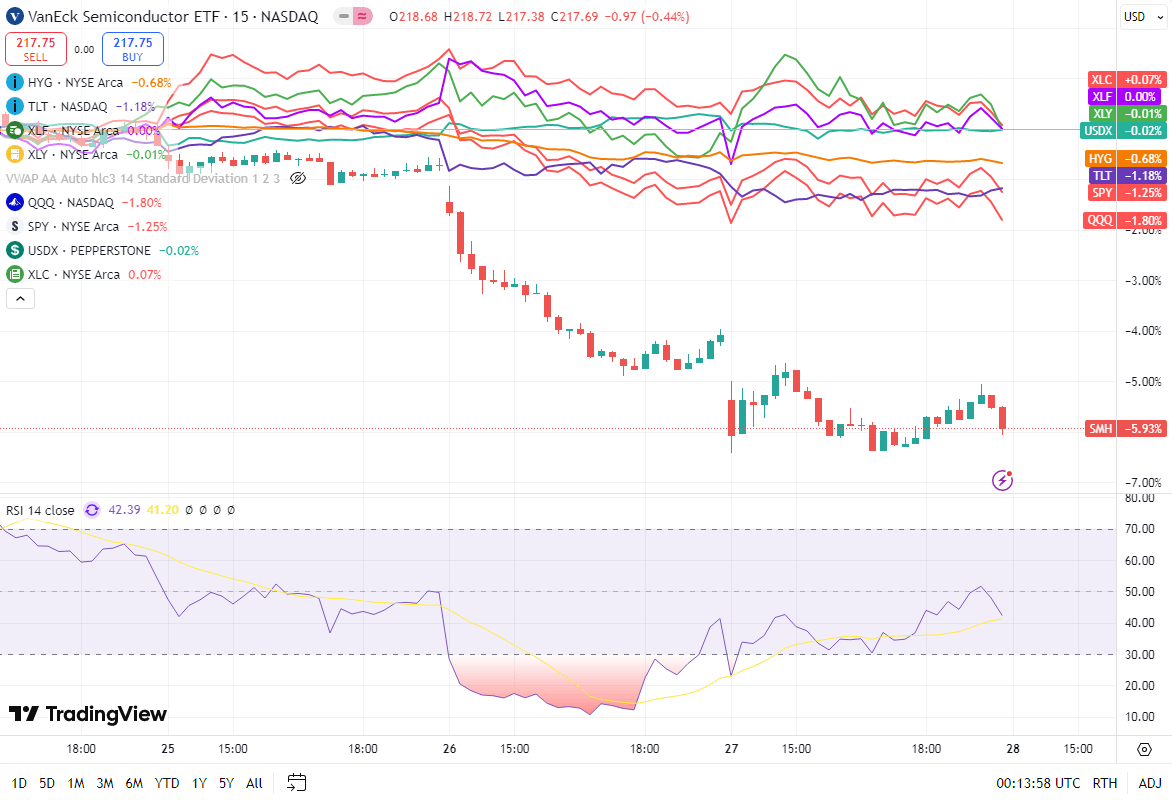

Heavy testing of Sunday’s gap

S&P 500 buyers didn‘t allow a drop to 5,715 yesterday – financials, staples and discretionaries had still a fine day, balancing out talked semiconductors and utilities weakness as the AI trade is being dialed back, in trouble (check MSFT), covered alongside much else in yesterday‘s first video, and contrasted with TSLA bullish call made 6 days ago and S&P 500 late session turns in the second video.

Today‘s setup before core PCE (forget not revised UoM consumer sentiment) together with volatility, options and weekly ES perspectives, I covered in latest long video – make sure you‘re subscribed to the channel with notifications on! Deep dive into conflicting signs, providing a way how to play it with swing trading clients willing to try out a tight stop-loss long. Intraday ones have plenty to get inspired from such as pessimistic clues from yesterday‘s close – did such fears get validated on higher than expected core PCE?

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.