Head over heels

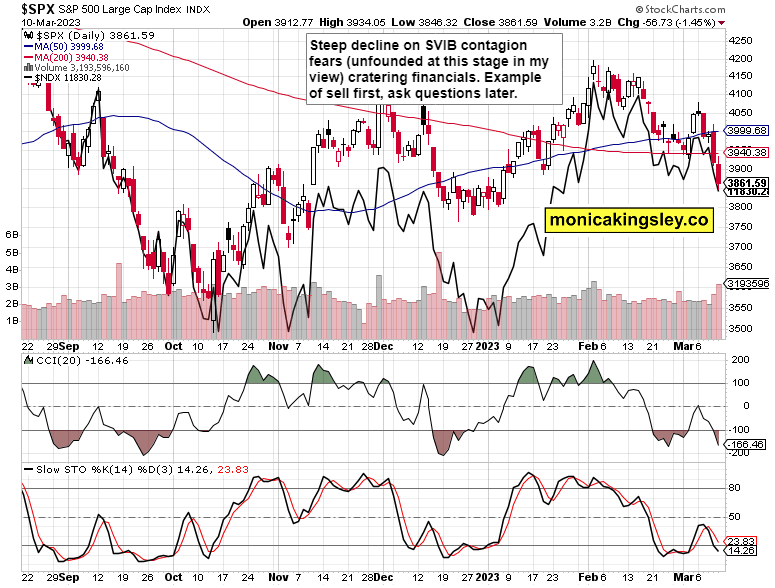

S&P 500 gave up the two opening rebounds as the SVIB meeting FDIC – and the contagion fears – hit, forcing a very sharp reversal in short-term yields, with 25bp Mar rate hike now being the base scenario. The bank run fears are overdone (unfounded) and should result in dialing back the hammering in my view, with the real problem being old fashioned deposit outflows as risk-free rate of return (in CDs, T-Bills and money market funds that ultimately park reserves at the Fed whenever short-dated Treasuries are in short supply), and no other problems are immediately palpable as the zombification and crowding out of productive investments by rates too low for too long, would be only painfully and slowly unwound.

To be clear, deposits outflow is unprecedented on a year on year basis, presenting serious challenges for the banking system. The 2.5% deposit outflow figure translates into contraction of bank assets (forced sales to pay depositors), the key among which is Treasuries. That‘s one less buyer when the Fed and foreigners are stepping back, giving rise to the ultimate assumption that the Fed would be forced to act as a buyer of last resort (this helps explain the first swallow, powerful gold rally Friday outshining silver and miners).

The Fed and Treasury‘s solution? Open discount window, new emergency lending facility, new funding program. While this isn‘t bailing out shareholders, it‘s about making sure (also uninsured) depositors are kept whole. It‘s likely this will further concentrate the banking sector – it‘s not about recapitalizing banks, but about them not having to recognize losses stemming from rates going up on their now underwater Treasuries (bought when rates were essentially zero).

These steps do manage to pevent contagion fears that I was clear on the weekend that they weren‘t on the table in the first place (that was before the Signature Bank). Importantly, this is no bail-in, and even though there could – and down the road would if the Fed persists in rate raising – be more causualties showing up months down the road.

The current moves are in effect similar to the Fed in Sep 2019 ensuring enough dollars in the US banking system during the repo crisis. Perhaps even the S/L crisis of 1989 – this is about providing enough liquidity to the system to ride out the storm caused by the fastest rate raising cycle since the mid 1990s. It‘s a bet on the Fed getting some kind of a better grip on inflation just in time before the costs of yesterday‘s moves start accruing. It buys short-term time, but spreads the pain long-term. It also raises justified question marks over the Fed‘s tightening (rate raising and balance sheet shrinking) – and that‘s what gold and silver are reflecting with their 1.2%, resp. 1.7% premarket upswings (at the moment of writing these lines), with the dollar pointing unsurprisingly lower. That‘s precisely the kind of real assets‘ reaction when these recognize that the long-term costs recognition has been kicked down the road as the proverbial can.

There are both similarities and dissimilarities to the 2008 environment, the chief of which is headline sensitivity, and the high propensity to buy the rumor sell the news reactions, to be manifested increasingly more down the road. S&P 500 got right to the target I announced still on Sunday. Very happy it‘s working out for you so well!

Meanwhile, LEIs are still falling, savings rate has turned south, unemployment claims are slowly picking up, and earnings recession with its outlook hasn‘t been properly discounted by the markets – making me to keep betting on a mild recession, probably starting in Q3 2023 after all. Then, look for serious cracks in the job market and earnings to manifest, rendering any discussion whether we‘re entering a / in recession, moot. Credit card usage going up, is another hallmark of approaching recession, by the way.

All of this makes for a dicey stock market environment with little upside potential, but at the same time bears can‘t count with outsized gains, because any retreat in inflation (hello, Tue CPI) would be positive for stocks. The bar with 6% YoY expected is arguably set too low, and even if my figure of 6.6% isn‘t reached by 0.2 or 0.3%, it won‘t probably trigger any S&P 500 fireworks to speak of.

I hope you checked the hyperlinks presented above for full picture as to my analytical take and expectations with reasoning.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer), but the analyses (whether short or long format, depending on market action) over email are the bedrock.

So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

3,915 is the „point of control“, and it would be conquered eventually before the downswing continues in earnest. So will the 3,945 – 3,958 zone be tested (just happened in premarket) – the upside remains limited and even if the coming around 2 months would be a trading range as slowing inflation and calls for Fed pivot (even interpreting yesterday‘s policy moves as in effect one) take hold, the poor fundamental outlook would eventually prevail in 2H 2023.

Credit markets

The risk-off turn in credit markets continued on steroids, and is likely to be somewhat dialed back right next as markets realize there is no contagion to be afraid of right now.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.