Hawkish realization, finally

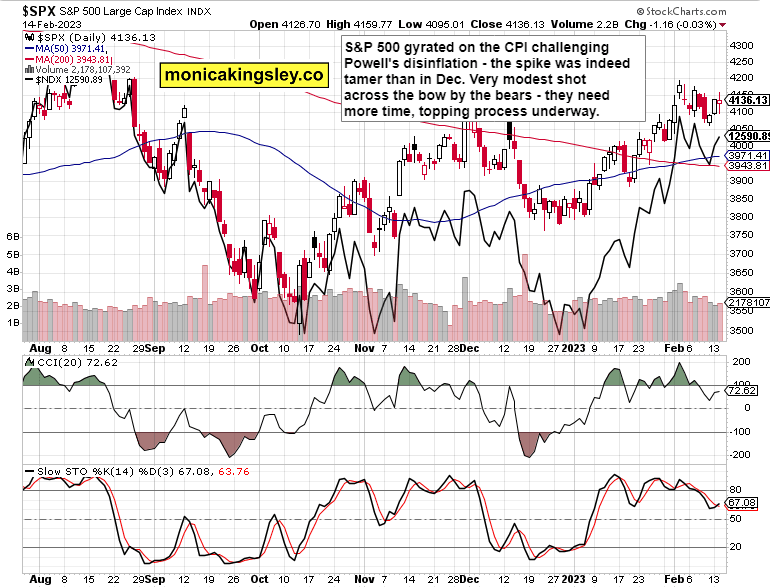

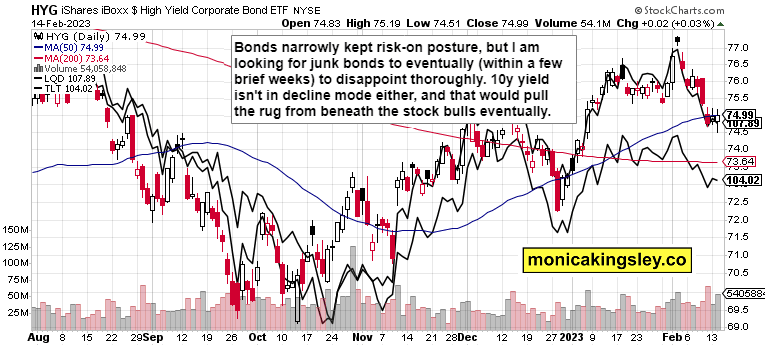

S&P 500 did manage with a spike, even on CPI slightly above expectations My 4,187 resistance wasn‘t though overcome, not even temporarily – the appreciation of Fed having to remain (more) hawkish (than earlier and mistakenly anticipated by the markets) in its fight especially against services inflation, took its toll. Yet the bears were twice rejected at my 4,128 level, HYG had a hard time closing positive, and market breadth was unconvincing.

This all points to selling into strength, and risk-off ready to progressively raise its head in the weeks ahead, which is in line with the USD relief rally as late 2023 rate cuts idea is melting away just as much as disinflation and soft landing. The Fed has no choice but to remain as stubborn as can be, even if 2-year yield would peak in several months (that‘s summer). Services inflation is simply much tougher to beat than goods one, and that sends a clear message as regards rising unemployment in the months to come. Recession fears would be on full display by then.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer), but the analyses (whether short or long format, depending on market action) over email are the bedrock. So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

4,128 followed by 4,093 are the supports to watch – given USD relief rally continuation in plain sight, stocks would suffer just as real assets (those to a generally larger extent). Rise in yields would be countered by approaching recession, temporarily. Topping process in stocks well underway.

Credit markets

Bonds are still resisting the hawkish Fed – but I’m looking for risk-off posture to win in the not too distant future (consequences for paper assets of course too). Tomorrow’s PPI data will help illustrate the point of sticky inflation, and of more inflation in the pipeline to hit CPI still. Just imagine what yesterday’s figure would have been without a calculation change and revisions...

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.