Hawkish or not

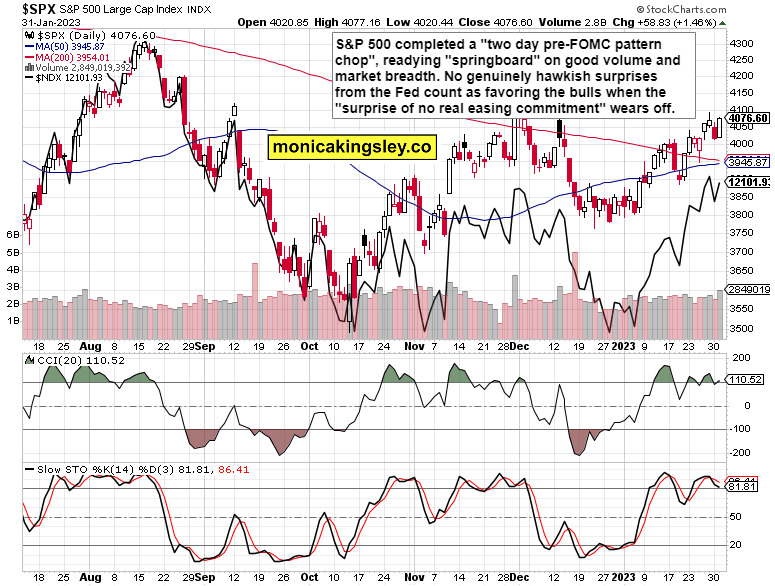

S&P 500 perfomed to the bulls‘ liking most definitely as is apparent from today‘s rich chart section. While I‘m looking for an eventual bullish resolution to today‘s FOMC, my medium-term view is of no smoothest sailing ahead for the bulls – still grinding higher, and also my daily intermarket observation confirms that.

Follow my Twitter feed for live coverage well before the Fed die is cast today!

Reiterating that the „springboard“ lives on, let me quote from yesterday‘s key analysis:

(…) Markets had been running on the best case scenario where nothing could go wrong – Fed pivoting, soft landing, inflation down, job market resilience, credit quality, consumer strong and earnings (with revenue, margins and guidance) not suffering. It isn‘t turning out that way, and will increasingly less turn out so.

In such an environment, tomorrow‘s FOMC merely not showing dovish face while reiterating prior positions, is to be perceived as hawkish even if it doesn‘t turn more hawkish than it was already.

This is what provides for all the „selling before the news“ unfolding – a tad deeper than the „springboard“ setup.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer), but the analyses (whether short or long format, depending on market action) over email are the bedrock.

So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

S&P 500 has first 4,063, then higher rather than lower 4,040s a key support – likely to hold in the FOMC aftermath. See captions for detailed fundamental / narrative reaction outlook.

Credit markets

Nice daily risk-on reversal in bonds – volume is leaning optimistic, and bonds don‘t look expecting a Fed curveball. The same for USD.

Crude Oil

Crude oil is relatively struggling, and my prior thoughts about this 2023 laggard being good enough just as part of a wider commodities long portfolio, remain true. $82.50 remains the key „point of control“ to beat, and then there‘s the tough $86 – 88 zone. Long road ahead.

Copper

Copper reversed nicely, but pay attention to the levels given in the chart. If the hawkish takeaway from FOMC prevails, real assets (high beta – think copper, silver) would be really hurt in the aftermath.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.