Has USD/CAD started a new bullish cycle? [Video]

![Has USD/CAD started a new bullish cycle? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDCAD/canadian-money-2706551_XtraLarge.jpg)

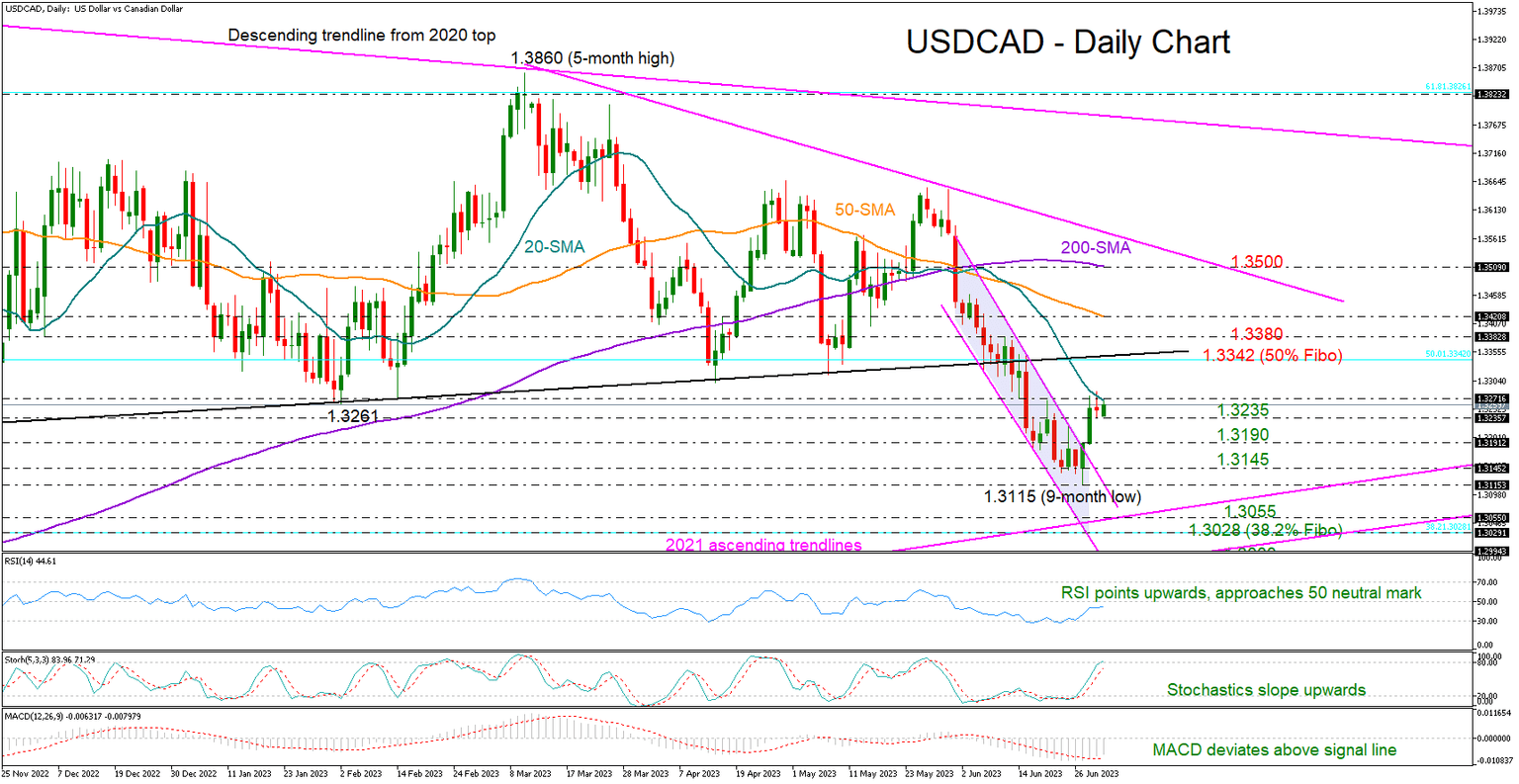

USDCAD rose quickly above the tight bearish channel, but soon stopped around February's lows and near its 20-day SMA on Thursday.

The pair is set to close the month down by 2.3%, marking its worst monthly performance since 2021. That said, the recent bullish channel breakout continues to look promising as both the RSI and MACD are showing a convincing improvement, indicating an encouraging start to July.

If the 20-day SMA at 1.3270 gives way, the price may advance straight to the broken, almost- flat support trendline from November 2022 seen at 1.3350. The 50% Fibonacci retracement of the 1.4667-1.2006 downtrend is adding extra importance to this region. Therefore, a successful move higher and above the nearby resistance of 1.3380 might add extra impetus to the price, bringing the 50-day SMA at 1.3420 next into view. Should the latter prove fragile, the recovery could pick up steam towards the 200-day SMA at 1.3500.

Alternatively, the price could slide to retest Thursday’s low of 1.3235. A continuation lower could examine the 1.3190 constraining zone ahead of June’s floor of 1.3145. Another failure here might threaten a downtrend extension towards the 1.3055-1.3000 zone, which encapsulates two key ascending trendlines from the 2021 lows and the 38.2% Fibonacci level.

In brief, USDCAD is expected to preserve its recovery mood, but traders might wisely wait for a close above the 20-day MA before they drive the pair higher.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.