-

Yen down more than 6% against US dollar this year already.

-

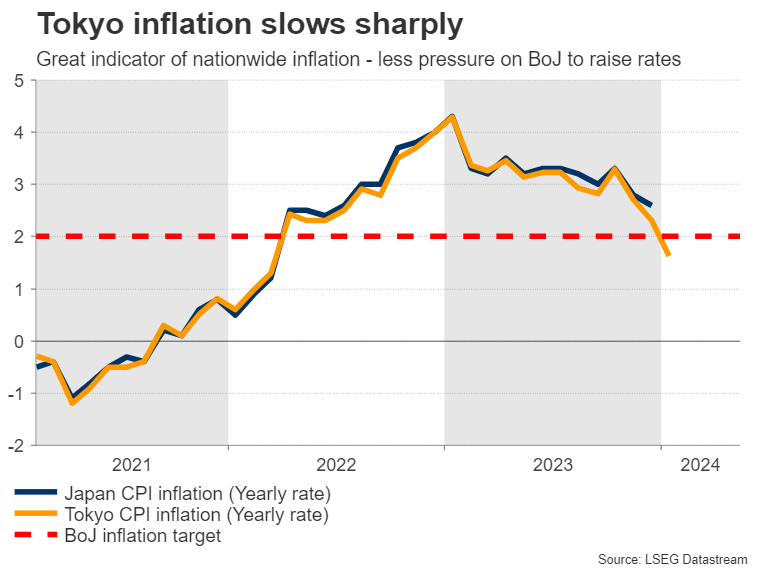

Traders less confident Japan will raise rates, as inflation slows.

-

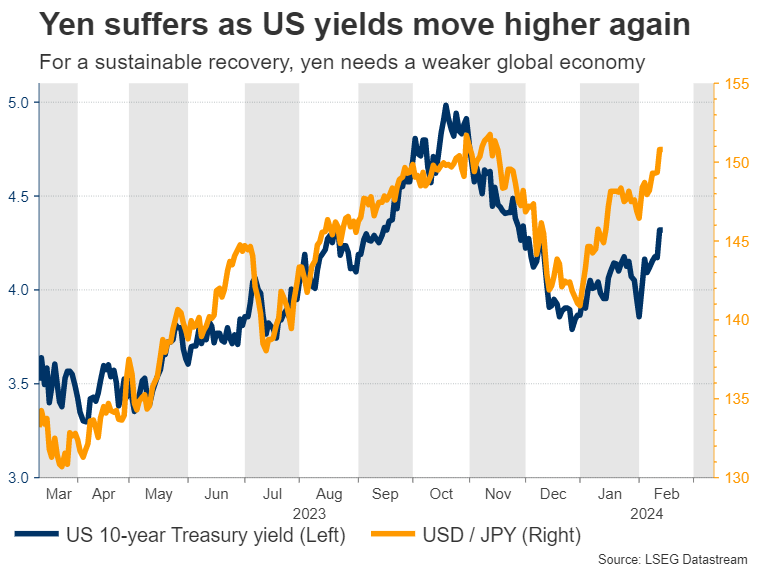

For the yen to recover, global economy needs to weaken.

Yen feels the blues

Another year, another meltdown for the Japanese currency. A combination of worsening economic data and some cautious messages by the Bank of Japan (BoJ) have raised doubts about whether a cycle of rate increases lies ahead, inflicting heavy damage on the yen.

Specifically, inflation and wage growth have slowed sharply. Inflation in Tokyo fell to an annual rate of just 1.6% in January, foreshadowing a similar cooldown on a nationwide level. Similarly, wage growth has stalled and household spending is contracting, both indications of even softer inflationary pressures ahead.

Reflecting the weaker economic data pulse, some senior BoJ officials have downplayed the prospect of raising interest rates significantly. Deputy Governor Uchida signaled that even if the central bank raises rates out of negative territory, it’s still difficult to imagine a scenario where it would continue raising them rapidly.

In other words, there is a clear risk the BoJ won’t embark on a proper rate hike cycle, but is instead looking at a one-off increase out of negative rates.

Is FX intervention imminent?

Amplifying the yen’s problems has been the strength in the dollar. Incoming data has painted a picture of a resilient US economy, forcing traders to unwind bets of rapid-fire Fed rate cuts, which has boosted the dollar. This helps explain why the yen has lost over 6% against the dollar this year, but only 3.5% against the euro.

With the yen sinking towards multi-decade lows again, Japanese authorities have resumed their verbal warnings, reminding investors that another round of FX intervention to defend the currency is still an option.

That said, Tokyo has not used language that would suggest intervention is imminent, such as describing FX moves as “disorderly” or “one-sided”. This is a tell that actual intervention is still some distance away.

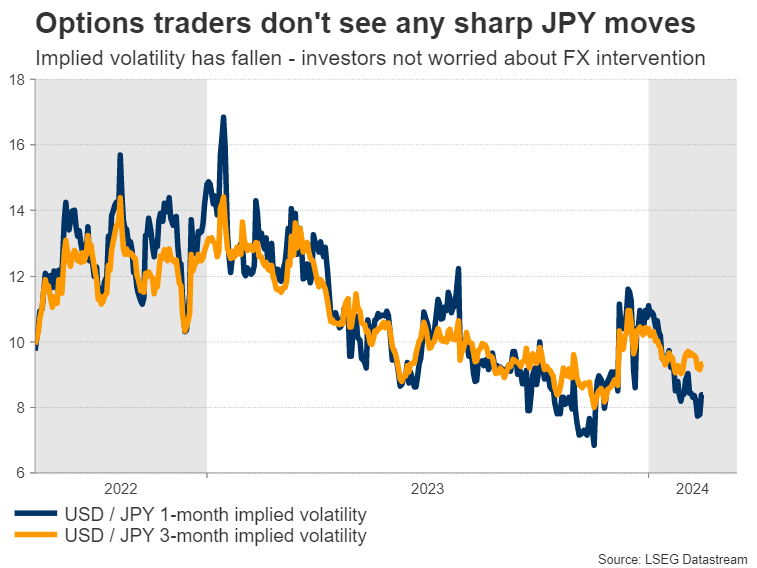

Options traders share this view, as implied volatility in short-dated USD/JPY options has declined substantially this year. Therefore, big players are not hedging so much against any massive yen moves.

That said, this calculation could change if the yen slices below the 152.00 region against the dollar, which is where Tokyo intervened back in 2022. This could be the line in the sand for Japanese authorities. Of course, even an intervention may not be enough to trigger a trend reversal in the yen, if nothing changes on the macro front.

What does the Yen need to heal?

Admittedly, there isn’t much on the horizon that can turn the tide. With the threat of FX intervention still low and the Japanese economy losing momentum, this is a setup that favors a continuation of the yen’s downtrend.

Over the next couple of months, a lot will ride on the outcome of the spring wage negotiations. This event could single-handedly decide whether the Bank of Japan will raise rates, as policymakers consider wage growth an early indicator of how inflation will evolve.

Markets currently assign a 75% probability for the BoJ to raise rates out of negative territory by April. Encouraging signs around the wage negotiations could give the BoJ enough cover to raise rates, but even in this case, it’s doubtful that this would mark the beginning of a lasting recovery in the yen as there is little appetite for any tightening beyond that.

For the yen to mount a sustainable rally, the global economy needs to weaken enough for foreign central banks to slash rates with brute force. That would help yield differentials narrow back in the yen’s favor, even without much help from the Bank of Japan.

That’s bound to happen eventually, but it could take some time. In the United States for instance, the economy does not seem to be slowing down and inflation continues to burn hot, a combination that could prevent the Fed from touching the rate-cut button for several more months.

In conclusion, the yen’s recent collapse reflects a deterioration in Japanese economic data, coupled with a ‘higher for longer’ outlook for US interest rates that has turbocharged the dollar. It is questionable whether FX intervention or a one-off rate increase by the BoJ would be enough to stop the bleeding and spark a full-blown trend reversal.

Instead, what the yen needs is a sharp slowdown in the global economy that forces foreign central banks to slash rates rapidly, which might be a story for the second half of this year.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD looks to retest 1.0900

EUR/USD surged to multi-day highs in response to further selling pressure on the Greenback and news that the EU could be planning measures to alleviate Trump’s tariffs.

GBP/USD flirts with tops near 1.2970 ahead of Trump's tariffs

GBP/USD is accelerating, challenging weekly highs near 1.2970 as a renewed, sharp drop in the Greenback sets the stage for the US 'reciprocal tariffs' announcement on "Liberation Day" at 20:00 GMT.

Gold looks consolidative near $3,120 ahead of Trump's “Liberation Day”

Gold is regaining momentum, climbing above $3,120 after a slight pullback from Tuesday’s near-record high of $3,150. Retreating US yields are bolstering XAU/USD, ahead of President Trump's official announcement of the reciprocal tariff measures later this Wednesday.

Grayscale launches Bitcoin options ETF with a focus on income generation

In a press release on Wednesday, Grayscale announced the launch of Bitcoin options-based ETFs, the Grayscale Bitcoin Covered Call ETF (BTCC) and Grayscale Bitcoin Premium Income ETF (BPI).

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.