Great profitable runs

S&P 500 pause goes on, and bonds support more of it to come. Tech keeps thus far the high ground gained, but the value is showing signs of very short-term weakness – and yields haven‘t retreated yesterday really. The correct view of the stock market action is one of the micro rotations unfolding in a weakening environment – one increasingly fraught with downside risks.

To be clear, I‘m not looking for a sizable correction, but a very modest one both in time and price. It‘s a question of time, and I think it would be driven by tech weakness as the sector has reached lofty levels. It‘ll go higher over time still, but this is the time for value and small caps in the medium term.

The dollar though isn‘t putting much pressure on the stock, commodity, or precious metals prices at the moment – such were my yesterday‘s words:

(…) when the dollar starts rolling over to the downside (I‘m looking at the early Dec debt ceiling drama to trigger it off), emerging markets would love that. And commodities with precious metals too, of course – sensing the upcoming greenback weakness has been part and parcel of the gold and silver resilience of late. Precious metals are only getting started, but the greatest fireworks would come early spring 2022 when the Fed‘s failure to act on inflation becomes broadly acknowledged.

For now, they‘re still getting away with the transitory talking points and chalking it down to supply chain issues. As if these could solve the balance sheet expansion or fresh (most probably again short-dated) Treasuries issuance (come Dec) – the Fed is also way behind other central banks in raising rates. Canada, Mexico and many others have already moved while UK and Australia are signalling readiness – the U.S. central bank is joined by ECB in hesitating.

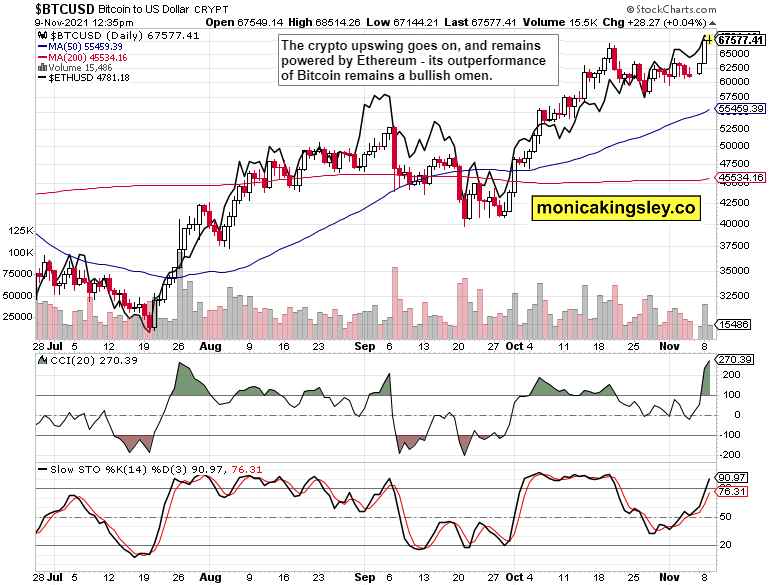

And that‘s what precious metals would be increasingly sniffing out. Commodities are joining in the post-taper celebrations, and my prior Tuesday‘s market assessments are coming to fruition one by one. Oil is swinging higher and hasn‘t topped, copper is coming back to life, and cryptos aren‘t in a waiting mood either.

Let‘s move right into the charts.

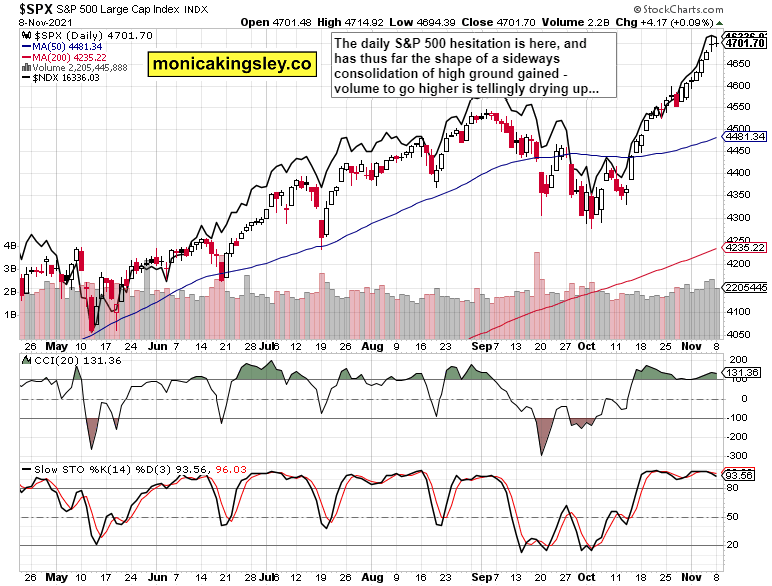

S&P 500 and Nasdaq outlook

S&P 500 pause is here, and all that‘s missing is emboldened bears. They may or may not arrive given that VIX keeps looking lazy these days – either way, the risks to the downside are persisting for a couple of days at least still.

Credit markets

HYG strength evaporated, but it‘s on a short-term basis only. The broader credit market weakness would get reversed, but it‘s my view that quality debt instruments would be lagging.

Gold, silver and miners

Gold and silver continue reversing the pre-taper weakness – the upswing goes on, but is likely to temporarily pause as the miners‘ daily weakness foretells. Still, I‘m looking for more gains with every dip being bought.

Crude oil

Crude oil bulls continue having the upper hand, no matter the relative momentary stumble in maintaining gains – the energy sector hasn‘t peaked by a long shot.

Copper

Copper is participating in the commodities upswing – not too hot, not too cold. Just right, and it‘s a question of time when the red metal would start visibly outperforming the CRB Index again.

Bitcoin and Ethereum

Bitcoin and Ethereum consolidation has indeed come to an end, and both leading (by volume traded) cryptos are primed for further gains.

Summary

S&P 500 breather remains a question of time, but shouldn‘t reach far on the downside – the bears are having an opportunity to strike as credit markets have weakened, and there isn‘t enough short-term will in tech to go higher still. The very short-term picture in stocks is mixed, but downside risks are growing. The dollar is already weakening, much to the liking of commodities and precious metals – there is still enough liquidity in the markets as any taper can be easily offset by withdrawing repo money sitting on the Fed‘s balance sheet.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.