Got those Fed blues? FOMC preview

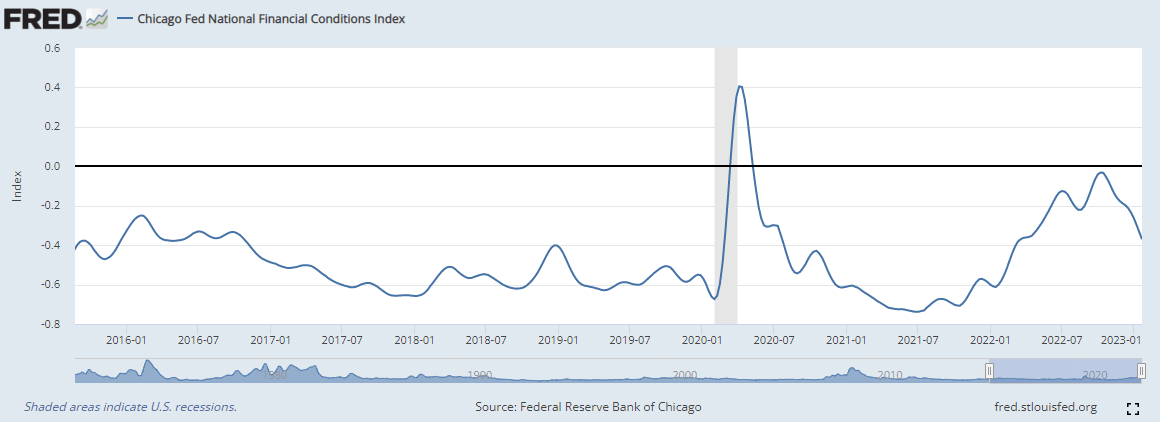

Ain’t nothing but the Fed today as investors focus on the FOMC interest rate decision. The Fed is all but certain to raise rates by 25bps but the complacency we see sets up for a volatility-driven event if Powell pushes back hard – and why not? There is no reason for the Fed to signal a pause – financial conditions have loosened considerably, inflation remains high, the labour market tight and commodity-linked inflation could be rearing its head again. However, as we have seen countless times, the market is willing to take a dovish read to just about anything the Fed says. Full preview below.

The sharp moves of the last two days on Wall Street indicate we are in the kind of market that will chop both bulls and bears, with the S&P 50 jumping almost 1.5% yesterday after a similar move to the downside on Monday. BNP Paribas says the decline in volatility has pumped systematic buying flows that have driven the rally – worth considering that stocks are up not because ‘investors’ are turning decidedly more bullish of late but the decline in volatility (VIX still sub-20) has triggered algos to buy...what happens when the volatility returns?

On Wall Street Dow closed up 1.1% at 34,086, the Nasdaq Composite added 1.7% to 11,585 and the S&P 500 rose 1.46% to 4,077. Whilst we have seen the market rally strongly in January – the S&P 500 +6.2%, the Nasdaq +10.7%, the indices are yet to break above the Nov/Dec peaks. Breadth is there but conviction seems to be lacking and the market is now a lot less cheap than it was a month ago and earnings are about to become a headwind. Still see the ‘oversold’ speculative tech doing well with ARKK up 31% this year, with Tesla up another 4% to leave it up 60% YTD in what has been a staggering rally for the stock over the last month.

We are seeing a sideways chop in Europe too, with the FTSE 100 rejecting 7,700 yesterday to trade up towards 7,800 today; but it broadly remains within the range of the last fortnight as investors search for more direction. Continued drift higher from the lows last week could see the FTSE take a look at the Jan 23rd high at 7,811.

Data – China Caixin Manufacturing PMI contracted for the sixth month in a row, declining to 49.2. EU inflation due at 10am GMT, seen at 9.0% from 9.2% prior, with core declining to 5.1% from 5.2%. US ADP employment data ahead of Friday’s nonfarm payrolls plus we have the JOLTS job openings and ISM manufacturing PMI to look forward to.

Earnings aplenty on Wall Street. Caterpillar – solid quarter being treated badly due to bottom line miss – unfavourable currency impacts and ongoing inflation pressures weighing on margins. General Motors – big beat, guiding strong on adjusted EPS, not going to match Tesla on price cuts. AMD beat expectations but guided for a 10% decline in sales in the current quarter.

Snap – tough read for the social media space (META, PINS) - shares plunged almost 15% in the after-hours market after it warned revenues could decline by as much as 10% in the first quarter of 2023. Still updating ad model following the iOS update. Revenues in the prior quarter were steady at $1.3bn, the slowest pace of growth since 2017. Meta Platforms reports this evening after the closing bell and it could be tough – EPS seen –40% at $2.20 and net income –43%. Expect a continued hit from shrinking advertising revenue and higher costs.

In FX, USDJPY continues to sit at 130, EURUSD is firmer towards 1.0890 and GBPUSD has held steady above 1.23 this morning after taking a 1.22 handle at one stage yesterday. Lots of sideways chop until the Fed and BoE/ECB shake out today and tomorrow. Watch for significant moves around the meetings, particularly in GBPUSD, EURUSD and EURGBP.

FOMC preview: One and done?

Or 25bps with more to come? Or will the FOMC surprise with a 50bps hike and say it’s not for budging?

It’s Fed Day on Wednesday and an expected rate hike but a lot less certainty around whether the FOMC has any more plans to raise rates. Markets see a roughly 99% chance the Fed goes for another hike and roughly 84% likelihood it follows this with another 25bps hike in March. Beyond that the outlook is much less clear – only a one in three chance of another 25bps in May as markets bet that the Fed is close to the top. The meeting and press conference will be crucial as Jay Powell either pushes back against the dovish market pricing or instead leans into the narrative that inflation has peaked and a pause is warranted.

The Fed raised rates by 425bps last year with an aggressive series of hikes. Now markets think it’s ready to slow right down with a 25bps hike on Wednesday, taking the target range to 4.5-4.75%. Slowing but not stopping seems to be the message – officials have been consistent in saying there is more work to do.

Fed governor Waller’s comments from Nov ring out still: “We're at a point we can start thinking maybe of going to a slower pace … we're not softening...Quit paying attention to the pace and start paying attention to where the endpoint is going to be. Until we get inflation down, that endpoint is still a ways out there.”

But the market thinks otherwise – futures point to the market thinking the Fed will stop between 4.75-5.0%, in other words one more 25bps in March after 25bps on Wednesday. Markets are also pricing in cuts later this year. But Fed officials, by way of the dot plot, think the terminal rate will be some way above 5% and stay there for all of 2023. I think even they are underestimating the scale of the problem and a 6% level is eminently possible. Ultimately, I think on Wednesday they will prefer to slow to 25bps but this is not the same as a stop and pivot – my belief is the market is mispricing the terminal rate and misjudging how long the Fed will keep them there before it cuts.

TLDR: 25bps and more to come, raising the market expectations for the terminal rate, which ought to hit risk assets and boost the USD. In short the message should be that ‘inflation not tamed, we won’t stop until it is’. The market though might still take a dovish read.

Economic growth is stumbling

US GDP expanded by more than expected in the final quarter of last year, however this might be the last positive print for a while as there are clear signs of deceleration at the start of 2023. Final sales to consumers rose just 0.2% in the fourth quarter and fixed investment declined 6.7%. January PMIs are in contraction territory. There are signs that the Fed’s hikes are starting to have an impact, albeit the labour market remains tight, partly for structural reasons.

The question is to what extent the Fed will be guided by a contracting economy if inflation remains too high. So far, the Fed has made it clear it will fight inflation come what may and I don’t think this is about to change – it can and will look through soft economic data until inflation is tamed. The labour market is different, of course, since the Fed has a dual mandate. This remains in fairly good shape and although some leading indicators within the labour market suggest it could be rolling over, it remains structurally tight.

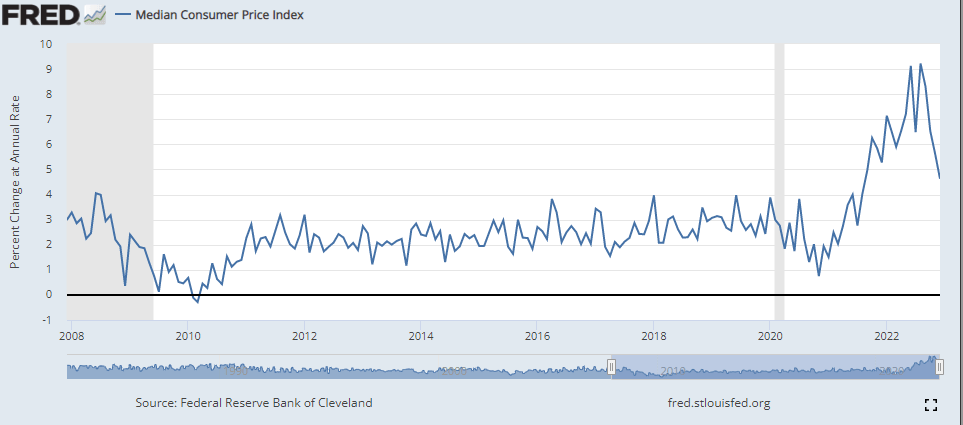

Inflation has been rolling over, but it’s stickier

Inflation has shown clear signs of cooling. PCE inflation has fallen from 6.3% in September last year to 5.0%, whilst core PCE inflation has declined to 4.4% from 5.2% over the same period. The thinking is that disinflation allows the Fed to slow down and signal that a final 25bps in March could be its last for now. However, slowing is not the same as coming down to target and the Fed is saying to the market that it won’t pivot soon. The setup seems to allow the Fed to slow and check the rear-view mirror. Looking forward, there are signs that inflation is broadening and become embedded to a degree that will force the Fed to push on further. Commodity inflation may be rearing its head again.

Moreover, PMI data on prices will worry the Fed. As per Chris Williamson at S&P Global - The rate of input cost inflation accelerated into the new year, linked in part to upward wage pressures, which could encourage a further aggressive tightening of Fed policy despite rising recession risks.

Minutes from the last Federal Open Market Committee meeting show most members reckon they should start slowing the pace of rate hikes soon. This was not a significant surprise, if indeed it’s surprising at all. Mostly we knew that the Fed was wanting to take its foot off the gas a bit as we round the corner of the year into 2023 to allow time to take a look in the rear-view mirror to see if the economy was catching up with the breakneck pace of hikes.

Disinflation but prices are still rising

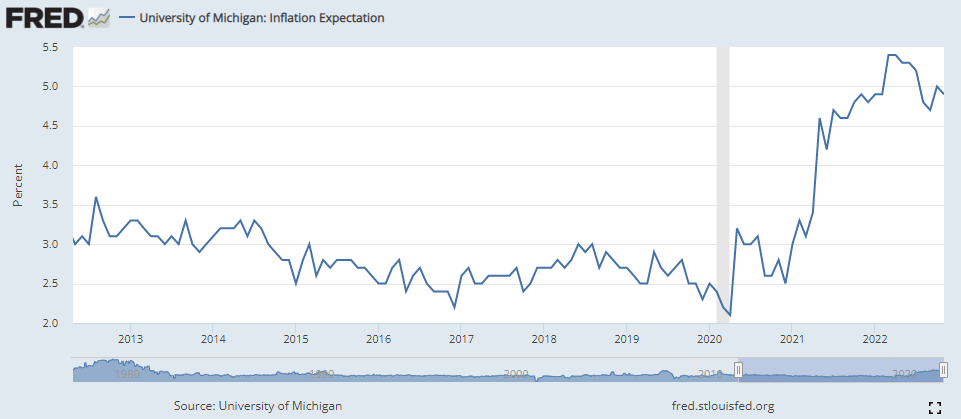

Consumer inflation expectations have fallen, but remain elevated

Dovish risks

One of the reasons I think the Fed sticks to a hawkish line is the market interpretation remains so dovish – pricing in cuts this year when the dot plots don’t suggest this at all. The Fed does not want to see further loosening in financial conditions – not yet

QT – will the Fed signal boost quantitative tightening?

In short, no. The Fed could actively start selling bonds but this would cause significant disruption in the market. I think the Fed is quite happy with QT chugging along in the background without too many ructions or tantrums. Any talk about juicing QT would spark significant volatility in rates. So we await with interest any talk about this since the Fed must surely be annoyed that long-end rates remain so persistently low, running counter to its hiking. The 10yr remains stubbornly at 3.5% and a nod to doing something with QT might push this rate up, so it could be an option for the Fed to try to get the market closer to where it’s thinking.

FX – we've seen the dollar roll over as the focus shifted from the Fed to the ECB and Bank of Japan. The Fed is seen being pretty well near the top of the cycle, whilst the ECB is trying to catch up and the BoJ is yet to join the party. That’s been a headwind for the dollar in recent months but a more persistently hawkish Fed can act as a tailwind this year.

Author

Neil Wilson

Markets.com

Neil is the chief market analyst for Markets.com, covering a broad range of topics across FX, equities and commodities. He joined in 2018 after two years working as senior market analyst for ETX Capital.