Got copper or miners? watch out

Copper, silver, and gold quite often move together, especially during the big moves.

Impending massive slide

And this is currently very helpful.

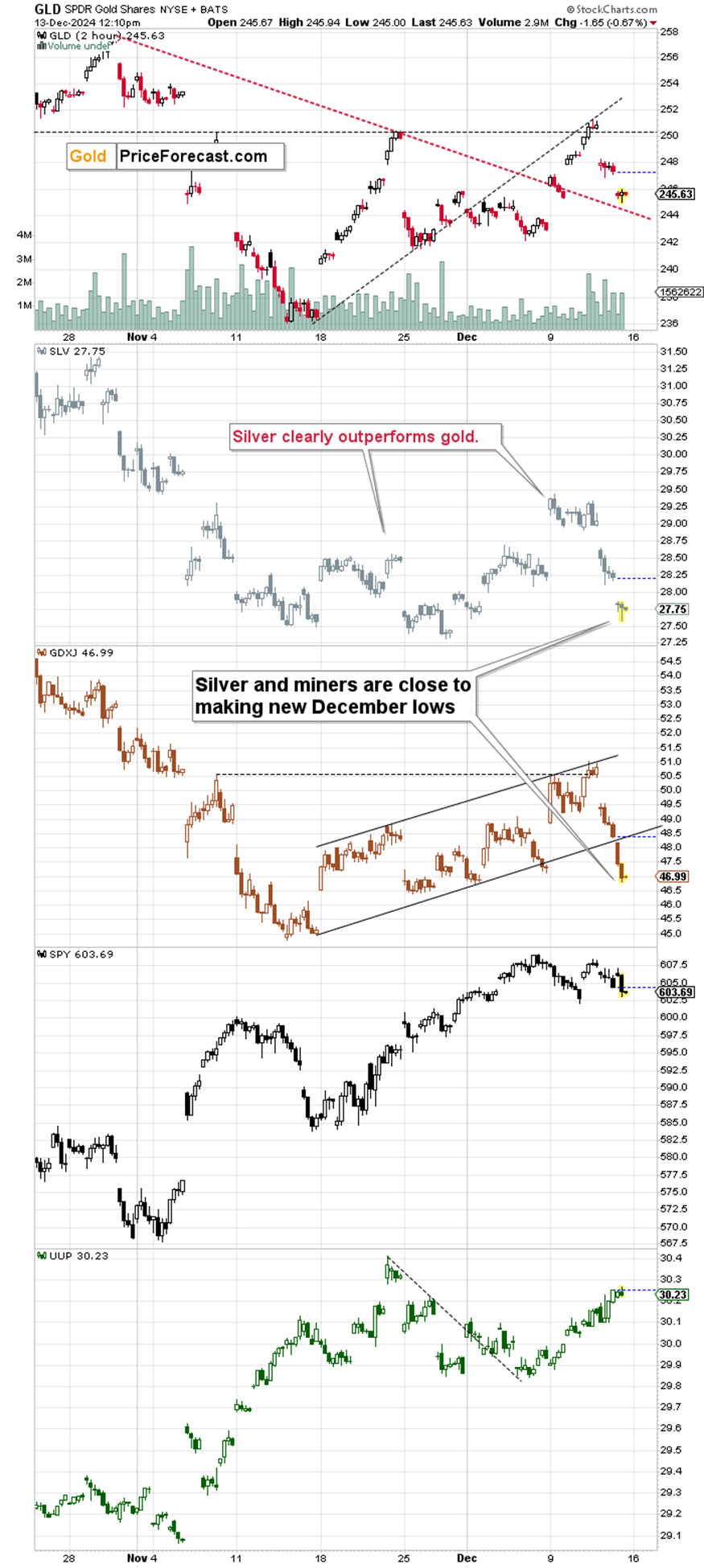

Given gold’s recent decline and a much bigger decline in silver and mining stocks, one might wonder whether miners’ and silver’s weakness are telling the truth about the precious metals market’s outlook, or if it’s gold that’s been holding up relatively well.

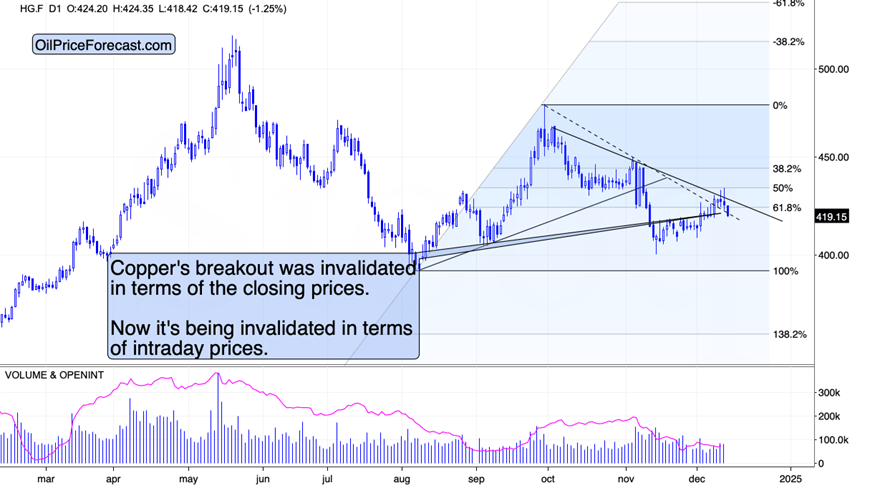

This is where looking at copper might be useful. This extra detail might make one or the other scenario more likely.

Let’s check the PMs first.

The GDXJ is down substantially, below our entry orders for the current short position (we had opened a long position in miners between Nov 14 and we took profits on Nov 21; we then entered a short position in the miners Nov 22 with GDXJ above $48) and the size of this quick decline is already bigger than what we saw in the previous weeks. That’s already a sign that this is more than just a correction – the same goes for the breakdown below the rising support line.

Silver is close to its recent lows as well.

Meanwhile, gold is above its declining support line as well as its December low (let alone its November low).

What can copper tell us here?

Copper recently invalidated its breakout above the declining resistance line. It’s done so in terms of the daily closes, which was already a bearish sign… But today we see something new. We see an invalidation also in intraday terms, which serves as an additional bearish confirmation.

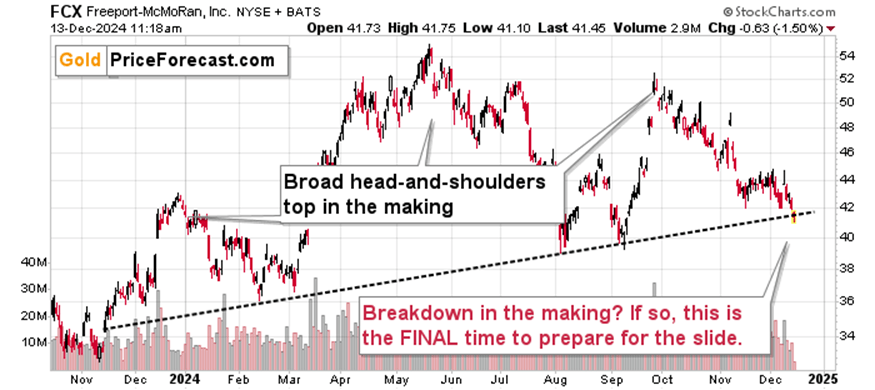

Besides, FCX, the copper and gold stock (that we’ve been shorting as well) already moved below its previous December and November lows.

FCX’s relative weakness compared to the prices of copper and gold indicates that they are all likely to move lower.

And given today’s move below the rising support line, which is also the neck level of the head-and-shoulders pattern, it seems that we’re on a verge of a massive slide.

Since sizes of the declines that follow this pattern tend to be similar to the sizes of the head, it seems that we can see a decline to $30 or lower relatively soon – in the following weeks.

Short-term Gold rally unlikely

A confirmation of the breakdown would increase the odds for this scenario even further, but even the relative weakness of FCX and invalidation of the breakout in copper make this large move lower likely.

This, in turn, makes a move lower in the precious metals market even more likely.

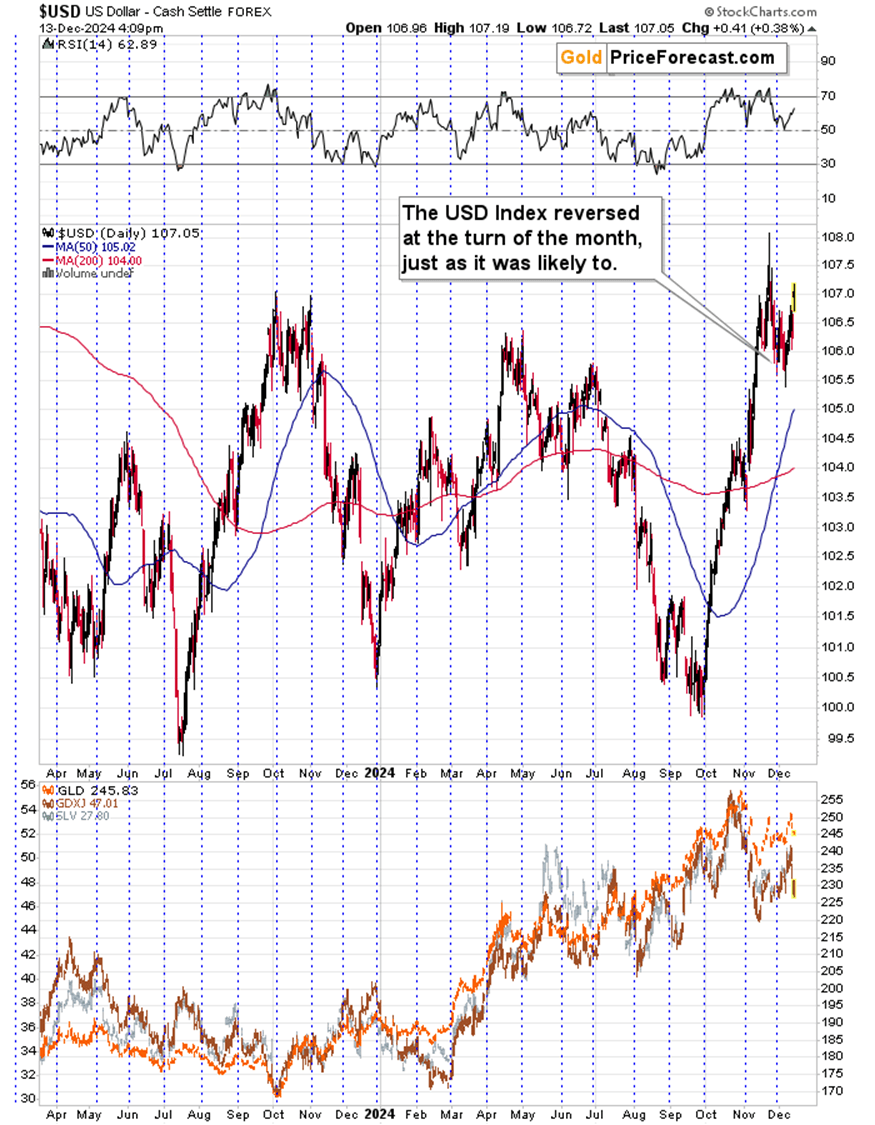

Besides, the USD Index is moving higher once again, which is a bearish factor for commodities and precious metals.

Yes, the USDX is once again above its 2023 highs. And since the correction was quite visible and managed to take RSI back to 50, it seems that another powerful upswing can start, especially that…

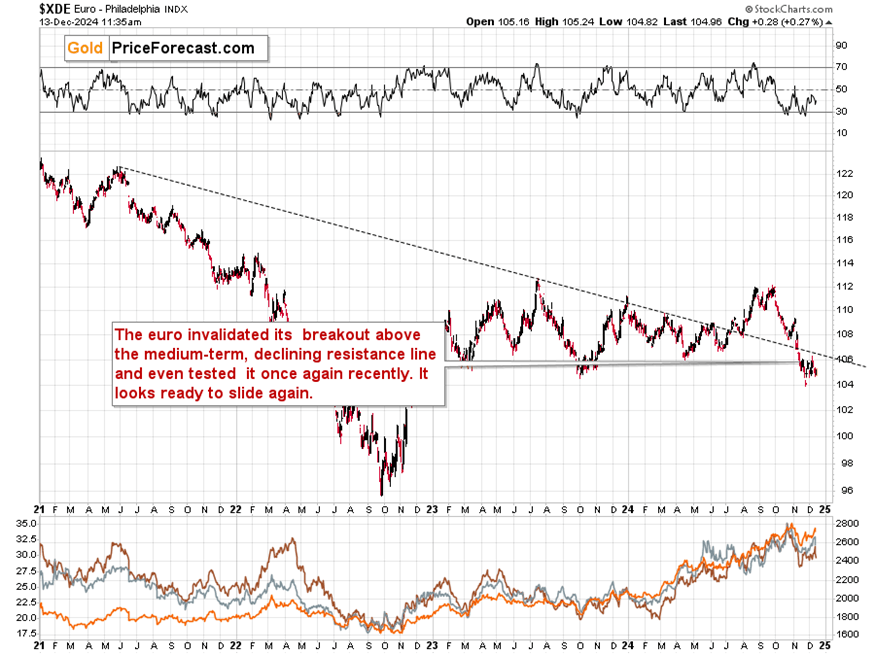

The USD Index’s biggest component – the EUR/USD pair invalidated its medium-term breakout and it even tried to break out once again – and failed.

This means that another round of declines is likely just around the corner. This is yet another reason to expect lower precious metals and – especially – mining stock values in the following weeks. Now, don’t get me wrong. Gold has merits as an investment, especially for insurance purposes, and especially if you allow it to earn interest, but for trading purposes, I don’t think that betting on its near-term rally is a good idea.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any