The Bank's own survey of businesses suggests price pressures continue to fade. We still expect a hike at the September meeting but recent comments from Bank of England officials suggest that could be the last increase in this tightening cycle.

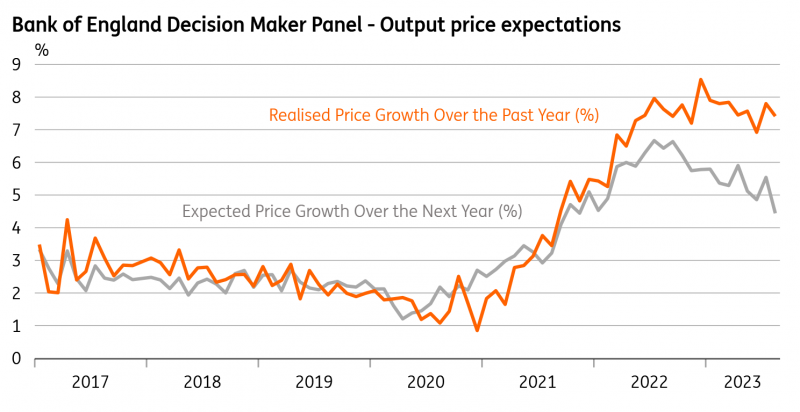

Corporate price expectations are continuing to fall

With two weeks to go until the next Bank of England rate decision, there’s a growing sense that the rate hike cycle is reaching its peak. That story has been offered further ammunition by the latest Decision Maker Panel from the BoE, which surveys chief financial officers (CFOs) on a range of topics and continues to point towards lower inflation. Here are some of the main numbers:

-

Expected price growth over the next year is seen at 4.4% (or 4.9% if you average the last three readings), the lowest since November 2021.

-

Expected annual wage growth is at 5.1% on a three-month moving average, down from 5.2% last month and 6% last December.

-

CPI inflation is expected to be at 4.9% over the next year and 3.2% over three years, and both have tracked the fall in actual inflation lower over recent months.

-

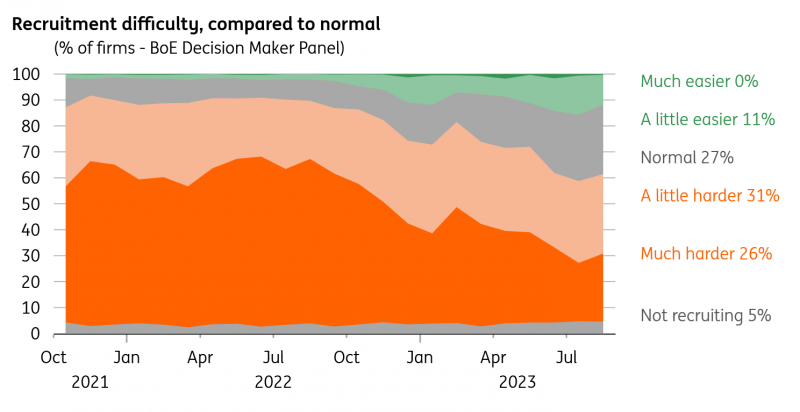

The proportion of firms finding it “much harder” to recruit sits at 26%, up fractionally on July but down from a peak of 66% last summer.

On the face of it, this all provides further ammunition for the Bank of England doves and echoes what we’ve been seeing in other surveys too.

In the past, the Bank of England has put a lot of emphasis on the Decision Maker survey, but more recently, the Bank has been visibly wary about putting too much weight on survey data while actual data on inflation and wage growth continues to come in hot.

Policymakers are also acutely aware that firms have been saying one thing about expected price increases, but when it comes down to it appear to end up moving more aggressively. 'Realised’ price growth has been consistently higher than 'expected', according to this survey, as the chart below demonstrates.

'Expected' price growth has consistently undershot 'realised'

Source: Bank of England

Further rate hikes mainly hinge on services inflation and wage growth

The English central bank has made it abundantly clear that the next decision will hinge on three variables – services inflation (due the day before the next meeting), private sector wage growth and the vacancy/unemployment ratio (both due on Tuesday). And the picture is likely to be mixed.

Private sector wage growth currently stands at 8.2% and is likely to stay there when we get fresh data next week. But there’s an outside risk that we see this nudge slightly lower, on the basis that separate data from firms' payrolls indicated that median pay actually fell in level terms during August. This data is released a month ahead of the more traditional average weekly earnings numbers. We’d expect that to be coupled with a further modest rise in unemployment, as well as a renewed fall in vacancies. The ratio of unfilled job openings to the number of workers unemployed is rapidly approaching pre-Covid levels.

Meanwhile services inflation, currently 7.4% and next due on 20 September, may well inch up by a tenth of a percentage point and mark another cycle high. But we expect this to be the peak and we expect a pullback through the remainder of the year as lower gas prices begin to leave their mark.

Recruitment difficulties are easing

Source: Bank of England

The bottom line is that the Bank is likely to hike rates by 25 basis points again in two week’s time, but our base case is that this is the last hike in this tightening cycle. Governor Andrew Bailey's indication that we're near the top of the tightening cycle came wrapped with several caveats. But it fits into a broader communication exercise from the Bank that appears to be laying the ground for a pause.

Chief Economist Huw Pill's reference to a "table mountain" profile for rates gave a further indication that the Bank is now more concerned about how long rates stay elevated rather than how high they peak. References to policy now being "restrictive" in the August policy statement pointed in this direction too.

A November hike is possible, but assuming we're right about the direction of the dataflow and on the basis of recent BoE comments, we think a pause is still more likely at that meeting.

Read the original analysis: Good news for the Bank of England as corporate price expectations fall further

Content disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/content-disclaimer/

Recommended Content

Editors’ Picks

EUR/USD stays vulnerable near 1.0600 ahead of US inflation data

EUR/USD remains under pressure near 1.0600 in European trading on Wednesday. The pair faces headwinds from the recent US Dollar upsurge, Germany's political instability and a cautiou market mood, as traders look to US CPI data and Fedspeak for fresh directives.

GBP/USD trades with caution near 1.2750, awaits BoE Mann, US CPI

GBP/USD trades with caution near 1.2750 in the European session on Wednesday, holding its losing streak. Traders turn risk-averse and refrain from placing fresh bets on the pair ahead of BoE policymaker Mann's speech and US CPI data.

Gold price trims a part of modest recovery, focus remains on US CPI

Gold price (XAU/USD) trims a part of modest intraday recovery gains, albeit it manages to hold above the $2,600 mark heading into the European session on Wednesday. Traders now look forward to the crucial US consumer inflation figures for a fresh impetus.

US CPI data preview: Inflation expected to rebound for first time in seven months

The US Consumer Price Index is set to rise 2.6% YoY in October, faster than September’s 2.4% increase. Annual core CPI inflation is expected to remain at 3.3% in October. The inflation data could significantly impact the market’s pricing of the Fed’s interest rate outlook and the US Dollar value.

Five fundamentals: Fallout from the US election, inflation, and a timely speech from Powell stand out Premium

What a week – the US election lived up to their hype, at least when it comes to market volatility. There is no time to rest, with politics, geopolitics, and economic data promising more volatility ahead.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.