-

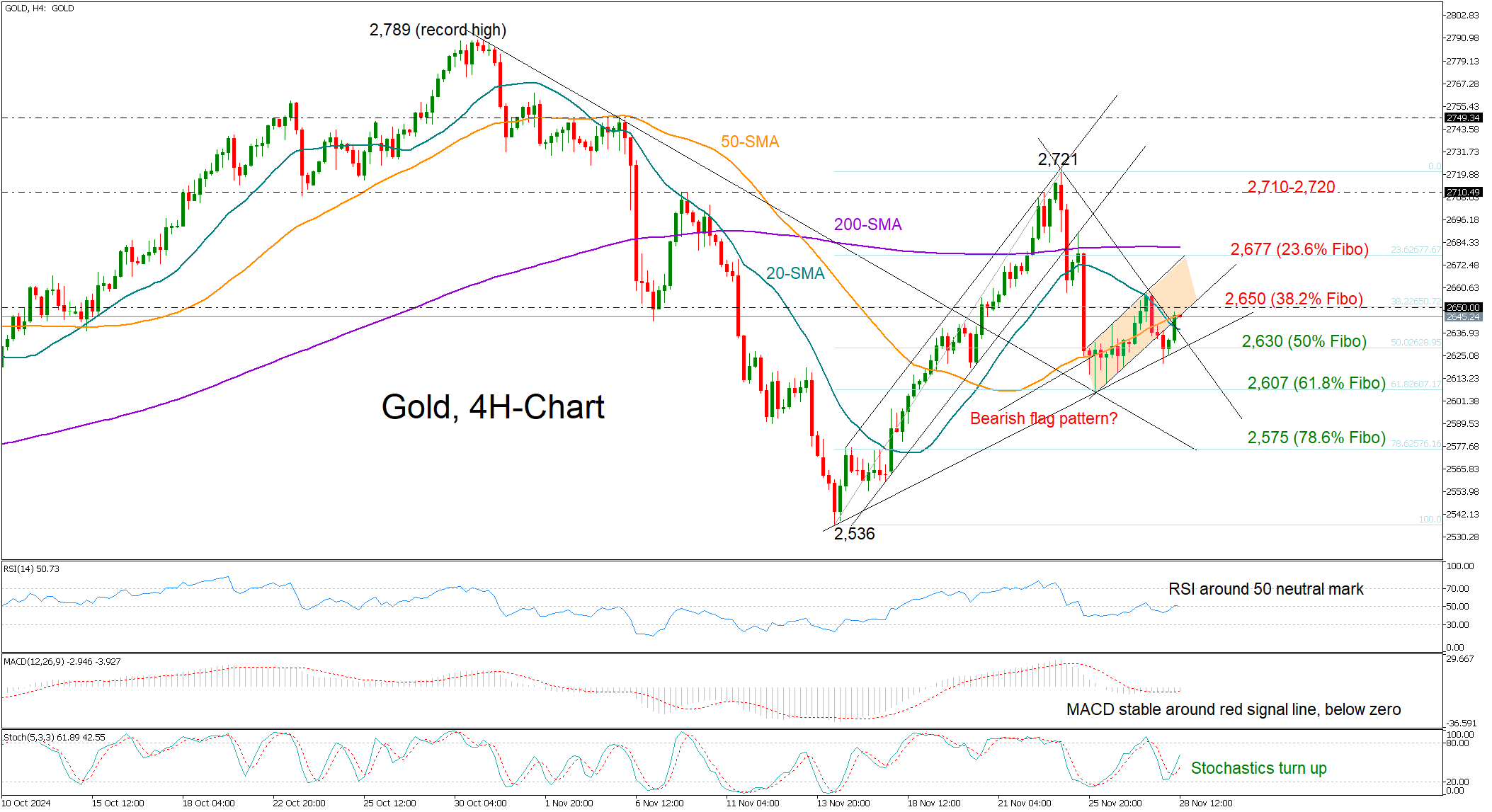

Gold stages a rebound in short-term timeframe.

-

Upturn is not convincing; bulls need to overcome $2,650.

Gold has been showing some signs of life over the past couple of hours but don’t get too excited just yet. Despite the upturn in the price, this is not convincing enough to say the bulls are back in charge.

The precious metal dipped below an upward-sloping channel on the four-hour chart, and while it’s trying to recover, there's a chance this is just part of a bearish flag pattern—meaning a continuation lower is still a real possibility.

The 20- and 50-period simple moving average (SMA), which have been somewhat restrictive lately, are again under examination, with the 38.2% Fibonacci retracement of the previous upleg being in sight as well at $2,650. If the price fails to jump above this border, it could flip back to the 50% Fibonacci of $2,630 and then toward the 61.8% Fibonacci of $2,607. Additional declines from there could cause a sharper decline to the 78.6% Fibonacci of $2,575.

On the flip side, the RSI is trying to climb back above the neutral 50 mark, and the stochastic oscillator is showing signs of a potential positive shift. These could point to some bullish momentum lingering in the market. If gold can break above the $2,650 threshold, it could make its way to the 200-period SMA and the 23.6% Fibonacci of $2,677. From there, it could even target the $2,710-$2,720 resistance zone.

In brief, while gold has made a bit of a recovery, it’s not out of the woods yet. Buyers will need to see a clear and sustained move above $2,650 before getting fully convinced that the upside is back on track. Until then, the downside risks are still very much in play.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0550 after soft German inflation data

EUR/USD trades in negative territory slightly below 1.0550 on Thursday. Soft inflation data from Germany makes it difficult for the Euro to gather strength, causing the pair to stretch lower. US markets will remain closed in observance of the Thanksgiving Day holiday.

GBP/USD trades below 1.2700 on modest USD recovery

GBP/USD stays under modest bearish pressure and fluctuates below 1.2700 on Thursday. The US Dollar corrects higher following Wednesday's sharp decline, not allowing the pair to gain traction. The market action is likely to remain subdued in the American session.

Gold clings to small daily gains near $2,650

Gold (XAU/USD) reverses an intraday dip to the $2,620 area and trades near $2,650 on Thursday, albeit it lacks bullish conviction. Investors remain concerned that US President-elect Donald Trump's tariff plans will impact the global economic outlook.

Fantom bulls eye yearly high as BTC rebounds

Fantom (FTM) continued its rally and rallied 8% until Thursday, trading above $1.09 after 43% gains in the previous week. Like FTM, most altcoins have continued the rally as Bitcoin (BTC) recovers from its recent pullback this week.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.