Gold’s $3,000 breakout: Inevitable or stalling?

Gold is once again at the center of financial markets, flirting with record highs and capturing investor attention as it edges closer to the elusive $3,000 per ounce mark. A mix of economic uncertainty, geopolitical tensions, and shifting monetary policies has fueled its rally, but the question remains: is this the beginning of a historic breakout or just another speculative frenzy?

A safe-haven surge amid global uncertainty

The demand for gold has surged as investors seek refuge from growing uncertainties. The weakening U.S. dollar has provided a major tailwind, making the metal more attractive to global buyers. Additionally, trade tensions have resurfaced, with former U.S. President Donald Trump’s latest tariff threats adding fuel to the fire. The mere mention of new duties on critical imports such as semiconductors, automobiles, and pharmaceuticals has heightened fears of a prolonged trade war, pushing investors toward gold’s safety.

Further bolstering the rally are strong inflows into gold-backed exchange-traded funds (ETFs), signaling that institutional investors are reinforcing their positions. This wave of capital suggests that gold’s appeal extends beyond short-term traders and into the realm of long-term strategic allocation. The psychological significance of $3,000 per ounce has now entered mainstream market discussions, with many viewing it as a natural extension of gold’s upward trajectory. But while sentiment remains strong, the looming presence of the Federal Reserve’s monetary policy decisions casts a shadow over the bullish case.

Despite the strong demand, gold faces a critical test as the Federal Reserve continues to weigh its next move on interest rates. Market participants have largely priced in a rate cut by September, but if inflation remains stubbornly high, the central bank could push back any policy easing further into the year. Given that gold is a non-yielding asset, a prolonged period of high interest rates could make it less attractive compared to yield-bearing alternatives such as bonds and savings accounts.

Investors are keeping a close eye on the upcoming Personal Consumption Expenditures (PCE) report, the Fed’s preferred inflation gauge. Should inflation print higher than expected, the narrative could shift quickly, strengthening the dollar and dampening gold’s momentum. On the other hand, a softer inflation reading could fuel further speculation that rate cuts are imminent, providing gold with the final push it needs to decisively break past $3,000.

Technical outlook: Will Gold sustain the rally or stall below $3,000?

The market is at a crossroads, and gold’s next move hinges on a delicate balance of macroeconomic forces. While fundamental drivers such as safe-haven demand and dollar weakness remain intact, traders must be mindful of shifting monetary policies that could pose obstacles to sustained gains. If history is any indication, gold has a tendency to test key psychological levels multiple times before breaking through, meaning volatility will likely persist in the coming weeks.

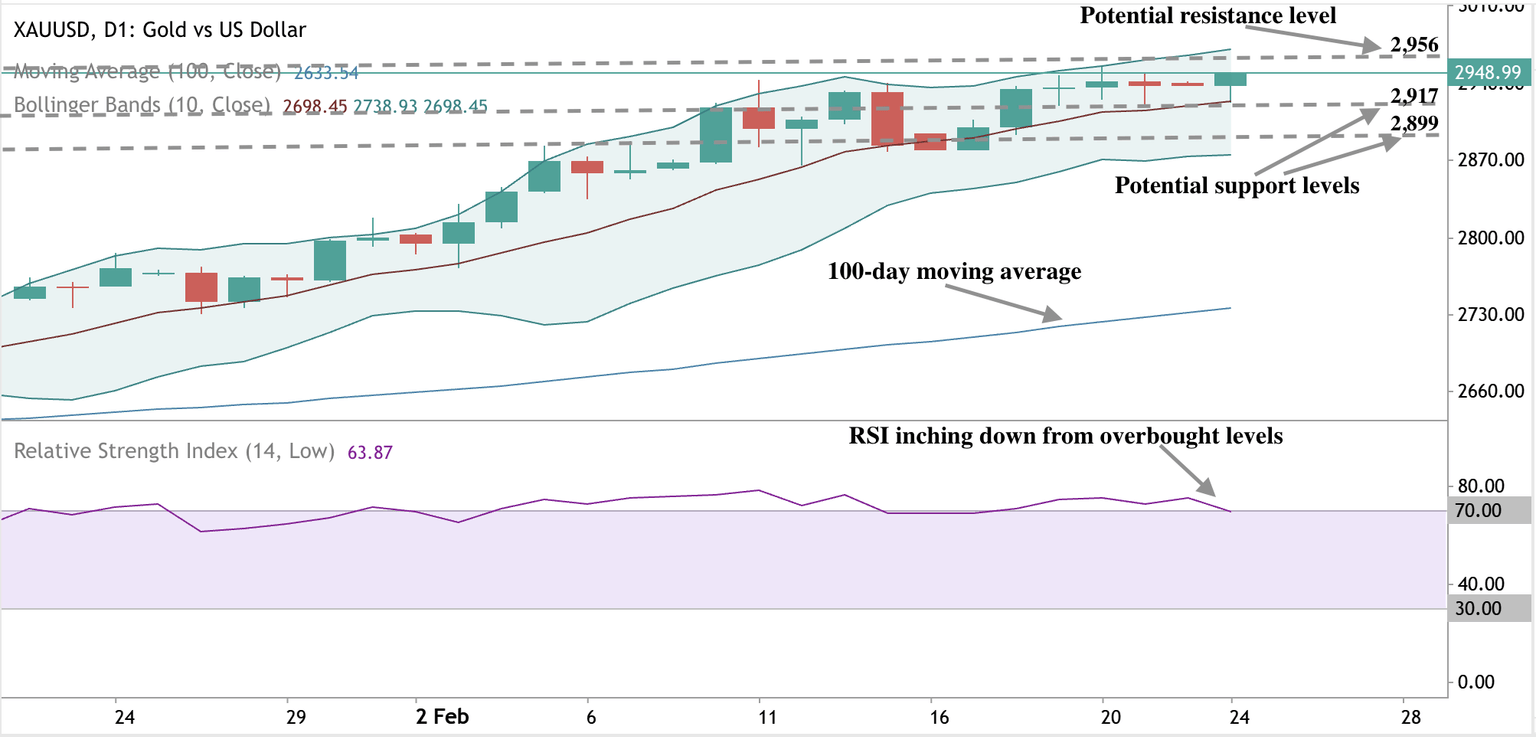

At the time of writing, the yellow metal is testing highs of $2,945, with a bullish bias clearly evident. Though there are signs of exhaustion, prices remain elevated above the moving average. The bearish narrative is supported by the fact that prices are inching closer to the upper bollinger bands, which is a sign of overbought conditions, with RSI also pointing downwards from overbought levels. Key levels to watch will be $2,956 and the $3,000 target on the upside, on the downside $2,917 and $2,899.

Source: Deriv MT5

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.